As practitioners at Techtide Solutions, we calibrate our view of “top” through outcomes, not logos. The market’s urgency is plain: end‑user spending on information security is projected to reach $213 billion in 2025, which frames both buyer expectations and vendor behavior in the year ahead. We’ve blended field lessons with deep research to help you separate durable capability from marketing static.

Toplist: 20 top cybersecurity companies to watch

Every budget cycle forces the same trade-offs: consolidate tools to cut complexity, or double down on best-of-breed to outpace attackers. From our perch at Techtide Solutions, we’ve learned that the only sensible answer is “both, when the platform is right.” Identity is converging with endpoint, network, and data security, accelerated by GenAI and tougher regulation. Consequently, a small set of vendors stands out. They execute reliably, ship roadmaps that anticipate two or three refreshes, and build ecosystems that deliver outcomes, not dashboards. We highlight where independent analysts, testing labs, and market data corroborate the signal. Our lens is the pragmatic CISO buying in Q4 2025 and planning for 2026.

Methodologically, we favored platforms that prove efficacy beyond slideware through independent evaluations or customer proof. We prioritized integration and automation that cut operational drag. Finally, we looked for alignment to identity first and data aware patterns that are winning in the field. We’ve also added our blunt views on ideal fit, because vendor excellence does not guarantee organizational fit. If you want an unbiased shortlist tailored to your budget, architecture and regulatory envelope, we’re happy to build it together.

1. Palo Alto Networks

Founded in 2005 and based in Santa Clara, Palo Alto Networks leads network, cloud, and SOC security. The company employs over 14,000 people worldwide. Meanwhile, its platform strategy with Prisma, Cortex, and Strata, plus identity led controls, has accelerated recently. Consequently, its installed base spans global enterprises and governments. We see them as the bellwether for consolidation done right.

Recent recognitions include being the only ‘leader’ on single-vendor SASE in Gartner’s inaugural analysis and continued recognition in the 2025 Gartner Magic Quadrant for SASE Platforms, which together underscore strength across both security and networking. Those placements matter because SASE/SSE buying increasingly substitutes multiple point products with one policy fabric.

Services and proof. Cortex now provides a maturing managed detection and response overlay. Incident response lineage remains strong across complex engagements. Field playbooks land steadily and cut dwell time in real environments. Clients saw faster value by linking Prisma Access and Prisma Cloud policies. Risky developer workflows were curtailed without hunting for integration glue.

Ideal fit. Global enterprises and upper mid market firms can consolidate overlapping firewall, SWG, ZTNA, and cloud security spend. Organizations prioritize AI assisted SOC workflows and aggressive retirement of legacy VPN and MPLS. Buyers comfortable with strategic platform lock in simplify operations and strengthen policy consistency.

2. Fortinet

Fortinet sits at the intersection of networking and security, with about thirteen to fifteen thousand employees. Founded in 2000 and headquartered in Sunnyvale, California. Its ASIC powered FortiOS fabric and unusually complete edge to cloud portfolio make it a frequent shortlister. Buyers choose it when cost per site and branch performance matter.

Fortinet continues to be prominent in the 2024 Gartner Magic Quadrant for SD-WAN and features among vendors in the 2025 Gartner Magic Quadrant for SASE Platforms, which validates the long-term bet on converged networking-security. These external views reinforce what we’ve seen in production: the platform’s consistency at scale in distributed networks.

Related Posts

- Top 30 App Development Companies In Spain 2026

- Top 30 Mobile App Development Companies in France to Consider

- Top 30 Outsourcing Software Development Companies in Vietnam: Comparison, Vendors, and How to Choose

- Top 30 Cybersecurity Companies In Vietnam For 2025

- Top 30 custom application development companies in 2025: research-based shortlist and buyer’s guide

Services and proof: a rapidly evolving managed SASE footprint, strong branch survivability patterns, and pragmatic migration runbooks from appliance-centric sites to unified, cloud-managed enforcement. We’ve seen lean IT teams deploy zero-touch branches reliably and later layer in SSE controls without re-architecting.

Ideal fit: retailers, logistics, manufacturing and multi-site healthcare where operational continuity and link diversity matter; organizations that prefer integrated networking and security under one operating system; buyers optimizing total cost of ownership across thousands of edges.

3. TechTide Solutions

We are a software development and security engineering firm. Moreover, we modernize application estates and embed security into delivery pipelines. Since the late 2010s, our distributed team has been anchored in North America and Europe. Our sweet spot is where product engineering, platform SRE and security architecture collide: we build, we integrate, and we operationalize.

At this time, we don’t have third-party awards we can credibly cite. Instead, we focus on outcomes and referenceable delivery, not trophies. If you want rigor, ask for customer references and we’ll align them to your use case, environment, and risk profile.

Services and proof. We deliver cloud native security architecture and security by design for microservices. Additionally, SBOM and software supply chain controls are standard. Moreover, data protection patterns and automated compliance as code round out the approach. In practice, we ship secure service meshes with workload identity. Meanwhile, teams retire brittle VPN islands using ZTNA. Finally, developer guardrails cut critical misconfigurations by orders of magnitude without slowing delivery.

Ideal fit: product-centric companies and digital business units that need hands-on security engineering, not slideware. Likewise, teams moving from lift-and-shift to cloud-native. Finally, CISOs who want guardrails in CI/CD, tamper-evident build systems, and pragmatic zero-trust patterns that developers embrace.

4. Bitdefender

Bitdefender focuses on endpoint, extended detection and response, and cloud workload protection, with approximately 2,000–3,000 employees, founded in 2001, and headquartered in Bucharest, Romania, with global operations. The company’s research bench is well regarded, and its GravityZone platform is common in both SMB and enterprise fleets.

Independent labs recognized Bitdefender’s consistency, including a Top-Rated Product in the 2024 AV-Comparatives Summary Report and 6 awards in the AV‑TEST Awards 2024. We watch these because they correlate with day-to-day operational friction—false positives down, resilience up.

Services and proof: effective MDR for resource‑constrained SOCs and straightforward hardening guidance that developers and IT can implement without ceremony. In mergers and carve‑outs, we’ve seen Bitdefender stabilize heterogenous fleets quickly, then expand into cloud and container coverage with minimal agent sprawl.

Ideal fit: organizations needing strong prevention with low noise and practical MDR escalation paths. Companies consolidating consumer and SMB EPP into enterprise grade controls. Buyers who value independent lab performance and clean rollouts over flashy UI.

5. Cisco

Cisco delivers security across secure networking, cloud security, and observability. It employs about 80,000 people, founded in 1984, headquartered in San Jose, California. After the Splunk acquisition, Cisco is fusing telemetry with response. Its network footprint anchors policy and enforcement at the edge.

We track Cisco’s positions in the 2024 Gartner Magic Quadrant for SD-WAN and the 2025 Gartner Magic Quadrant for Observability Platforms, reflecting traction on both transport and telemetry. That duality is practical: many incidents are solved faster when network truth and application truth share a console.

Services and proof: secure connectivity rollouts that combine SD‑WAN, identity-aware segmentation, and cloud-delivered inspection; SOC modernization strategies that pair Splunk with threat intel and playbooks to reduce MTTD/MTTR. We’ve seen material gains when ThousandEyes data enriches incident context for distributed apps.

Ideal fit: enterprises consolidating secure networking, observability, and SOC correlation with one vendor. Buyers modernizing WAN under a zero trust model. Teams that want pragmatic controls embedded in the network they already operate.

6. CrowdStrike

CrowdStrike is best known for Falcon endpoint and its broader XDR and identity defense portfolio, founded in 2011, headquartered in Austin/Sunnyvale with ~7,000–10,000 employees. As customers blend EPP, identity threat detection and SaaS telemetry, CrowdStrike’s cloud-native approach remains a market-setter.

For breadth, we note inclusion in the 2025 Gartner Magic Quadrant for Endpoint Protection Platforms and the 2025 Gartner Magic Quadrant for Security Information and Event Management, signaling a platform play beyond endpoints. Those recognitions align with what we see: endpoint-led programs evolving into data- and identity-aware detection footprints.

Services and proof: polished MDR, retainer-grade IR, and threat hunting that productizes quickly. Practically, customers succeed when they exploit Falcon’s data fabric to power response automation (for example, revoking risky tokens and isolating devices based on live identity risk signals).

Ideal fit: security teams prioritizing best-in-class endpoint with extensible XDR; cloud-native orgs hungry for API-first workflows; buyers who want to start with EDR excellence and expand into identity and data controls without platform sprawl.

7. IBM

IBM operates a vast portfolio—consulting, software and infrastructure—with security woven through data, automation and observability, founded in 1911, with well over 250,000 employees and headquarters in Armonk, New York. The recent focus has been on AI-assisted operations and unifying telemetry to reduce toil.

IBM appears among vendors in the 2025 Gartner Magic Quadrant for Observability Platforms and the 2025 Gartner Magic Quadrant for Process Mining Platforms, which together signal investment in the analytics routes that shorten incident lifecycles. That focus matters: resilience is increasingly an analytics and automation problem.

Services and proof: deep bench in consulting and managed security, with runbooks for complex regulated environments and hybrid mainframe-cloud estates. We’ve seen IBM’s strengths shine when organizations need to thread together AI governance, data security and SOC workflows under one strategy.

Ideal fit: global enterprises with intricate compliance and legacy gravity; buyers seeking a partner that blends advisory, integration and managed security; teams leaning on AI/automation to tame noisy, heterogeneous environments.

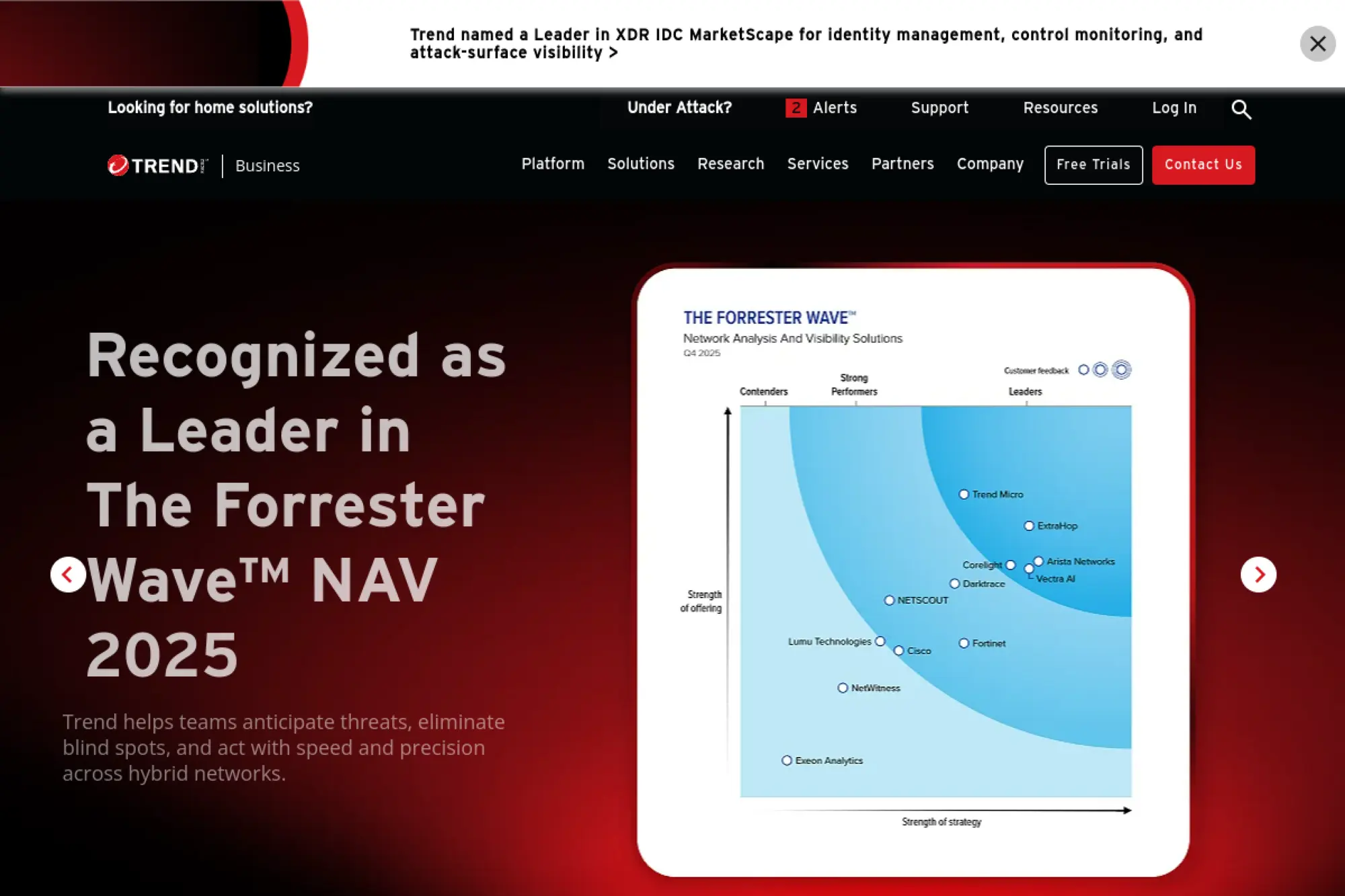

8. Trend Micro

Trend Micro focuses on enterprise cybersecurity and platformized prevention/detection across endpoints, cloud and networks, founded in 1988, with about 7,000 employees and headquarters in Tokyo, Japan. Vision One has become the fulcrum for its prevention-first, XDR-driven design.

Trend Micro marked an industry milestone with 20 consecutive Leader recognitions in Gartner’s EPP Magic Quadrant, underlining durable strength in prevention and platform progression. We view this longevity as a proxy for operational predictability in large fleets.

Services and proof: a mature Zero Day Initiative pipeline feeding protections, practical managed XDR, and steady container/server security for lift‑and‑shift workloads. We’ve used Trend to stabilize environments quickly and then elevate to cross-domain detections without multiplying agents.

Ideal fit: organizations prioritizing endpoint stability and managed XDR; heavily virtualized or hybrid workloads needing consistent policy; buyers wanting a prevention‑first posture that still scales to XDR without cognitive overload.

9. Tenable

Tenable, creator of Nessus, has evolved into exposure management across IT, cloud, OT and identity, founded in 2002, headquartered in Columbia, Maryland, with ~2,000 employees. The company’s visibility-first approach is resonating as risk moves from CVE tallies to exploitability and business context.

Analysts recognized Tenable as a Leader in the Q3 2025 Forrester Wave for Unified Vulnerability Management, reflecting strength in strategy and coverage. For risk owners, “book of record” credibility matters—it’s the ledger operations will actually remediate against.

Services and proof: blueprints to fuse vulnerability intel with identity and cloud context, practical connectors into ticketing and CI/CD, and maturing attack path analytics. In our fieldwork, security and platform teams both engage because the insights route cleanly into sprint backlogs and change windows.

Ideal fit: enterprises that need to rationalize fragmented scanning tools into one exposure management fabric; organizations pushing risk-based SLAs; buyers seeking to align remediation to business impact rather than CVSS dogma.

10. KnowBe4

KnowBe4 is synonymous with security awareness training and, increasingly, human risk management and email security adjuncts, founded in 2010 and headquartered in Clearwater, Florida, with ~1,500–2,000 employees. Its value lies in measurable risk reduction in the hardest control surface: people.

KnowBe4’s market traction is reflected in G2’s user-driven rankings, including #1 positions in two cybersecurity categories in G2’s Winter 2025 Grid Reports. While peer-review accolades are not the whole story, they correlate well with deployment success and content resonance.

Services and proof: deep content library tuned to role and region, phishing simulations that don’t insult users’ intelligence, and reporting that security leaders can surface to boards without translation. In practice, we measure uplift by reduced risky clicks and faster reporting, not just training completions.

Ideal fit: organizations ready to move from “train and pray” to risk-based human defense; firms with distributed workforces and compliance mandates; buyers who want culture change backed by metrics and iterative campaigns.

11. Darktrace

Darktrace builds self-learning AI for anomaly detection across network, cloud and SaaS edges, founded in 2013 in Cambridge, U.K., with ~2,000 employees. Its core proposition is continuously modeling “normal” to surface attacker intent quickly in environments where static policy lags reality.

Darktrace appears among vendors in the 2025 Gartner Magic Quadrant for Network Detection and Response, a category we increasingly deploy alongside EDR/XDR in east‑west heavy networks. Independent placement matters for buyers skeptical of pure black-box claims.

Services and proof: fast time-to-signal on lateral movement and data exfiltration patterns, with autonomous response that SOCs can meter up as confidence grows. We’ve seen its strength in high-entropy, IoT/OT‑adjacent networks where log coverage is inherently patchy.

Ideal fit: organizations with complex internal traffic (R&D, healthcare, manufacturing) where baselining beats signature reliance; teams augmenting EDR with NDR to close blind spots; buyers willing to pilot, tune and then automate incrementally.

12. Check Point

Check Point is a veteran in network, cloud and endpoint protection, founded in 1993 in Tel Aviv and now a global company with ~6,000 employees. The Harmony line and CloudGuard show a measured evolution toward unified, cloud-smart controls without abandoning deep network chops.

Check Point is covered in the 2025 Gartner Magic Quadrant for Hybrid Mesh Firewall, a space reflecting how firewalling now spans appliance, virtual and cloud-native form factors. We pay attention to this because management-plane unification is where operations win or lose.

Services and proof: consistent gateway performance, practical thread-through between on‑prem and cloud controls, and endpoint that’s good enough for many fleets. We’ve migrated customers to consolidated policy layers that reduced rule creep and audit fatigue.

Ideal fit: enterprises standardizing on predictable firewall behavior across hybrid estates; buyers who want one policy fabric for east‑west and north‑south. Teams with tight compliance rhythms that value mature change control.

13. Sophos

Sophos delivers endpoint, firewall and MDR services oriented to mid‑market simplicity, founded in 1985 in the U.K., with ~3,500–4,000 employees. Its Intercept X and managed services are often the “works out of the box” answer when internal teams are stretched.

Sophos earned certification in AV‑Comparatives’ enterprise testing, receiving an Approved Business Security Product Award for 2024, which we interpret as signal for balanced protection and usability in day‑to‑day operations. Buyers should value evidence that avoids configuration heroics.

Services and proof: crisp MDR engagements, controlled handoffs to in‑house teams, and admin consoles that don’t require weeks of training. We’ve watched overstretched IT groups regain weekends by offloading triage and maintaining tight response SLAs.

Ideal fit: midmarket IT and security teams consolidating endpoint, firewall, and MDR. Franchises and multisite businesses with small onsite IT. Buyers who prefer predictable operations and vendor help over DIY tuning.

14. Zscaler

Zscaler pioneered cloud-delivered security for users and workloads, founded in 2007, headquartered in San Jose, with ~6,000–7,000 employees. As customers move from castle‑and‑moat to identity‑centric access, Zscaler’s inline and API controls provide a credible “default on” perimeter for modern work.

We track Zscaler’s continued recognition in the 2025 Gartner Magic Quadrant for Security Service Edge and among vendors in the 2025 Gartner Magic Quadrant for SASE Platforms. For buyers, this translates into confidence that internet, private app and SaaS access can share policy and telemetry.

Services and proof: deep SSL inspection at scale, strong data protection add‑ons, and pragmatic migration from VPN to ZTNA that doesn’t strand privileged workflows. Our best outcomes paired Zscaler with rigorous identity hygiene and device posture for true zero trust.

Ideal fit: distributed workforces, M&A‑heavy organizations rationalizing overlapping networks, and buyers seeking to reduce attack surface by removing implicit network trust wholesale.

15. OneTrust

OneTrust focuses on privacy, data governance, third‑party risk and responsible AI, founded in 2016 and headquartered in Atlanta with ~2,000+ employees. While not a “pure security” vendor, they increasingly shape the guardrails that security, data and AI programs must operate within.

Recognition includes being named a Leader in the IDC MarketScape for data privacy compliance, as reported in “Worldwide Data Privacy Compliance Software 2023 Vendor Assessment”, and ongoing momentum summarized in independent coverage. In practice, that leadership helps CISOs align privacy, data loss prevention and AI governance.

Services and proof: data mapping at enterprise scale, consent and preference management wired into marketing stacks, and third‑party risk workflows that actually move procurement. We’ve used OneTrust to turn regulatory chores into searchable, re‑usable knowledge assets that also feed security policy.

Ideal fit: firms with complex data estates and expanding AI initiatives. Organizations under privacy regimes across multiple jurisdictions. Buyers who want compliance to pay dividends across security, product, and customer trust.

16. Rapid7

Rapid7 offers detection and response, cloud security and vulnerability management with a strong practitioner ethos, founded in 2000 in Boston with ~2,000 employees. Its strength is in unifying detection across logs, endpoints and cloud with approachable workflows.

Rapid7 is included among vendors in the 2025 Gartner Magic Quadrant for Security Information and Event Management. We see the SIEM space reshaping around “security data lakes” and managed detection, and Rapid7’s approach resonates with teams wanting acceleration without heavy administrative burden.

Services and proof: managed detection that scales with you, decent cloud posture tooling, and vulnerability management that ties into action rather than reports. Our customers appreciated Rapid7’s opinionated defaults that favor responders over report writers.

Ideal fit: teams that need to uplevel detection quickly without hiring 24×7; organizations refactoring SIEM around cloud native pipelines; buyers who value vendor led runbooks and coaching alongside product.

17. Proofpoint

Proofpoint specializes in people‑centric security across email, cloud collaboration and insider risk, founded in 2002, headquartered in Sunnyvale, with ~4,000 employees. As social engineering becomes the dominant initial access vector, their stack moves the needle where it counts.

Proofpoint was recognized in the 2024 Gartner Magic Quadrant for Email Security Platforms, reflecting strength in detection, behavioral AI and policy controls for high‑risk users. We value this category because email remains the most abused control plane in breaches.

Services and proof: advanced threat protection paired with adaptive DLP, VIP and supplier risk protections, and tight incident ties into user coaching. In real deployments, Proofpoint’s “explainable detections” helped drive behavior change, not just quarantines.

Ideal fit: enterprises targeted by BEC, supplier impersonation and insider data loss; buyers who want email and collaboration controls to inform human risk scoring; teams aligning security awareness with actual threat exposure.

18. Broadcom

Broadcom’s Symantec division delivers enterprise-grade endpoint, web and data security with deep roots in large, regulated environments. Broadcom, founded in 1991 and headquartered in San Jose, now spans semiconductors and infrastructure software with tens of thousands of employees and a formidable global footprint.

Symantec appears among vendors in the 2025 Gartner Magic Quadrant for Endpoint Protection Platforms, indicating continued relevance in endpoint protection for large, complex fleets. For conservative buyers, that presence signals roadmap durability and support discipline.

Services and proof: strong device control, DLP and email security lineage, plus stable global support. We’ve seen Symantec’s strength in high‑assurance environments where change windows are scarce and audit trails must be pristine.

Ideal fit: large enterprises with entrenched Symantec estates seeking modernization without rip and replace. Buyers that prioritize rigorous DLP and policy governance. Teams working under stringent regulatory oversight.

Ideal fit: large enterprises with entrenched Symantec estates seeking modernization without rip and replace. Buyers who prioritize rigorous DLP and policy governance. Teams operating under stringent regulatory oversight.

19. Trellix

Trellix emerged from the McAfee Enterprise and FireEye union, focused on living‑security XDR across endpoint, network and cloud. Headquartered in San Jose with several thousand employees, the company blends legacy depth with a more open, analytics‑forward stance.

Trellix is featured among vendors in the 2025 Gartner Magic Quadrant for Network Detection and Response, reinforcing the relevance of network‑level detection alongside endpoint telemetry. In practice, we’ve seen NDR add decisive context for sophisticated lateral movement.

Services and proof: enterprise‑proven endpoint agents, maturing XDR correlation, and useful integrations to accelerate containment. Customers with FireEye heritage particularly benefit from smoother data continuity and playbook reuse.

Ideal fit: enterprises wanting network‑savvy XDR that respects installed tools; buyers aiming to elevate incident context without ripping SIEM; teams that value both human‑led hunting and machine‑led correlation.

20. Okta

Okta is a pure‑play identity provider spanning workforce, customer identity and a growing PAM footprint, founded in 2009 and headquartered in San Francisco with ~6,000 employees. With identity now the new perimeter, Okta’s role in zero‑trust programs is central.

Okta is among the vendors in the 2024 Gartner Magic Quadrant for Access Management, reflecting its standing in workforce and CIAM patterns. For buyers rationalizing legacy IAM or adopting passkeys and phishing‑resistant flows, independent placement provides useful assurance.

Services and proof: strong ecosystem connectors, adaptive MFA, device‑signal integrations, and a roadmap that acknowledges the blending of workforce, machine and app identities. Our best outcomes come when identity policy is the first decision in any new app or network change.

Ideal fit: organizations driving identity‑first security, SaaS‑heavy environments ready to jettison brittle VPN patterns, and buyers who want to unify workforce and customer identity governance while preparing for AI agent identities.

Curious which two or three platforms will meaningfully shrink your attack surface next year without derailing delivery? Tell us your top three constraints—budget, skills and compliance—and we’ll pressure‑test a shortlist with you before you renew anything.

What defines the top cybersecurity companies in 2025

Before features and price, we look for companies that consistently turn chaos into clarity. Adoption signals matter: 63% of organizations worldwide have implemented a zero‑trust strategy, and those implementations expose strengths and gaps across identity, endpoint, network, and data controls. From our vantage point, leaders in 2025 translate this architecture into measurable resilience and human‑centric workflows.

1. Service quality and threat response time benchmarks

We prize vendors that shorten the messy middle between detection and containment. That means intuitive triage, precise correlation across identity, endpoint, and network telemetry, and clean handoffs into ticketing and chat. In practice, we see top platforms make investigation paths obvious, not arduous—graph‑first timelines, artifact detonation that “just works,” and scripted containment that respects change‑control boundaries. Our internal playbooks now assume that the vendor can quarantine, snapshot, and restore while preserving chain‑of‑custody without duct‑tape scripts.

2. Product satisfaction and low false positive rates

False positives burn analyst cycles and erode trust. We scrutinize how vendors curate training data, de‑bias models, and expose tunable policies. Leaders let us instrument outcomes—what was suppressed, what was escalated, and why—so we can coach rules without suppressing real attacks. In customer environments, the best tools reduce alert storms by fusing identity risk, data sensitivity, and network context into a single conviction score that analysts believe.

3. Breadth across NGFW EDR XDR IoT security SD‑WAN SASE and Zero Trust

Breadth is valuable only if it collapses integration cost. We look for shared policy, shared identity, and shared telemetry across firewall, endpoint, and edge, with APIs that don’t fight back. The strongest vendors stitch user‑to‑app segmentation with device posture and egress control, so remote access, branch connectivity, and cloud workloads operate under the same guardrails. In our due diligence, we favor platformization with escape hatches—wide coverage, open standards, and a clear path to swap components when needs evolve.

4. Endpoint security and incident response leadership

On endpoints, prevention plus rapid, remote surgical response is table stakes. We examine kernel‑safe instrumentation, tamper resistance, and stability under pressure. Elite tools capture volatile evidence in the background while giving responders the levers they need: live shell, memory artifacts, selective kill and repair, and sensitive file restores that don’t trample business processes. Our clients reward vendors that handle “bad day” operations with as little friction as routine patching.

5. Network and perimeter security modernization

Perimeter controls now sit closer to identities and applications than to physical walls. Leading NGFW and cloud proxies expose identity‑aware policies, DNS and TLS inspection that respects privacy and compliance, and direct peering into major SaaS backbones. We test for graceful fail‑opens, resilient client connectors, and performance on real networks—not just lab demos. When a vendor’s anycast edge and private backbone translate into cleaner user experience, adoption follows.

6. Identity and access management capabilities

Identity is the control plane that everything else rides on. Best‑in‑class IAM blends strong authentication with risk‑based continuous session evaluation, modern protocols, and rich signals from endpoints and networks. We look for identity threat detection that spots abuse of service principals and automation tokens, plus admin workflows that resist human error. Clean integrations with HRIS, ticketing, and directory services often determine whether zero trust lives on a slide or in production.

7. Email security and human risk mitigation

People remain the front door. Leaders combine behavioral models for business email compromise with brand and supplier impersonation defenses, and then close the loop with teachable moments inside the inbox. We’ve seen the strongest results when email controls and identity share context, so a dubious mail plus risky sign‑in equals an immediate session step‑up rather than a post‑incident lesson.

8. Vulnerability and exposure management maturity

Exposure beats counts. We prioritize vendors that merge asset discovery, software bills of materials, exploit intelligence, and compensating controls into one risk picture. The winners make it simple to answer: what really matters this week, and which control—patch, isolate, or monitor—buys down the most risk with the least disruption. Bonus points for tight links between code scanning, container registries, and runtime enforcement to keep dev and ops in lockstep.

9. AI‑driven threat detection and autonomous response

AI should elevate analysts, not surprise them. We evaluate how models are grounded in your data, what guardrails prevent hallucinations, and how autonomous actions are reviewed and reversed. The best offerings formalize an “analyst copilot” that drafts narratives, correlates alerts, and proposes next steps, then graduates to narrow, reversible automation where the risk is low and the toil is high.

10. Compliance privacy and data governance solutions

Controls are only durable when data handling is trustworthy. Platforms that unify data classification, policy, and lineage across cloud and SaaS make audits faster and breaches smaller. We favor vendors that let privacy, security, and engineering collaborate with the same labels and the same enforcement plane so policies travel with the data wherever it goes.

11. Market capitalization and financial durability snapshots

Durability shows up in steady execution: recurring revenue that isn’t single‑product‑dependent, healthy margins without starving R&D, and risk management that learns from public incidents. We’ve grown wary of vendors whose roadmaps balloon faster than their ability to support customers. A smaller, well‑supported footprint usually beats a sprawling promise that arrives half‑built.

12. Multi‑product platforms versus specialist vendors

There’s no universal right answer. Platforms minimize integration drag and vendor management, but specialists can raise the bar in hard problems like firmware control, industrial networks, or abuse‑resistant identity. Our pattern: anchor on a platform that’s open enough to welcome specialists where they truly differentiate, then enforce high‑trust interfaces between them. Governance lives in the seams.

Category highlights and market leaders among top cybersecurity companies

Funding tides shape roadmaps and consolidation. A data snapshot from CB Insights shows how a single cloud‑security mega‑round of $1B can reorder attention across categories, with practical implications for partner ecosystems and M&A plays. We translate those capital flows into buying guidance below, grounded in deployments we’ve built, broken, and rebuilt alongside our clients.

1. Application and data security leaders BlackBerry Cisco Cloudflare CrowdStrike Dynatrace Fortinet Google IBM Microsoft Varonis

We see defensible strength where runtime visibility meets data‑aware policy. Microsoft and Google translate platform gravity into pragmatic guardrails for code, data, and cloud workloads. Meanwhile, CrowdStrike and Dynatrace earn trust by linking runtime behavior to developer feedback loops. Finally, Varonis anchors data governance that both security and privacy teams accept. Cloudflare and Fortinet bring edge‑native controls that enforce least‑privilege paths into apps without driving users through brittle chokepoints. BlackBerry and IBM still matter in regulated and embedded contexts where firmware trust and device fleets dominate the risk budget. Our bias: pick the vendor whose data model matches how your apps are actually built, not how the brochure imagines them.

2. End‑user and perimeter security leaders Cisco Cloudflare CrowdStrike Fortinet SentinelOne Verizon Zscaler Akamai

At the edge, performance and policy converge. Cisco and Fortinet deliver integrated branch and data center control. Meanwhile, Zscaler and Cloudflare simplify direct to app access for users. Akamai’s edge heritage shows up when traffic turns spiky. Similarly, CrowdStrike and SentinelOne bring endpoint muscle that meshes with cloud proxies. Finally, Verizon’s managed offerings matter when global reach and service guarantees beat DIY. In rollouts we’ve led, the happiest adopters treat the edge as an identity‑aware fabric rather than a pile of boxes.

3. Market cap leaders in 2025 Palo Alto Networks CrowdStrike Cloudflare Fortinet Zscaler

Public‑market darlings tend to be platform builders with credible adjacencies. In practice, that means faster feature cadence, deeper partner ecosystems, and a steadier bench of field engineers. We advise buyers to leverage that scale for support and roadmap influence, while insisting on reference architectures that keep you portable.

4. Identity and privileged access Okta CyberArk

First, Okta’s center of gravity is user identity at cloud scale. Meanwhile, CyberArk excels when machine and admin identities need vaulting, isolation, and just in time access. Next, our reference designs start with clean, low friction access for the many. Finally, for the few with elevated power, we minimize blast radius and enforce isolation. Identity threat detection belongs alongside both.

5. Vulnerability and exposure management Tenable Rapid7

Tenable’s asset‑centric view and Rapid7’s detection‑response heritage both push toward exposure‑aware prioritization. The win for customers is fewer “highs” that aren’t, and faster, automated fixes where controls, not patches, buy down risk. Tie these to code and container registries and you turn noisy lists into an engineering backlog teams can finish.

6. Email security and human risk Proofpoint KnowBe4

Proofpoint’s strength is depth of detection and forensics; KnowBe4 helps bend human behavior toward safer defaults. We get the best results when simulations, training, and real‑time protections inform one another, and when risky events trigger identity step‑ups instead of only awareness nudges.

7. AI‑driven detection and response Darktrace

Darktrace’s autonomous detection resonates where unlabeled, fast‑changing environments make signature‑heavy approaches brittle. Our guidance: treat autonomous actions as reversible automation, feed them the cleanest telemetry you can, and require transparent reasoning so analysts can debug the machine when it gets clever and wrong.

8. Endpoint and EDR standouts CrowdStrike Sophos Bitdefender

CrowdStrike remains a benchmark for fast, confident response. Meanwhile, Sophos wins hearts with admin friendly workflows across midmarket fleets. Finally, Bitdefender’s detection depth and performance efficiency stand out in VDI and resource sensitive environments. We lean on rigorous pilot bake‑offs that include stress tests during patch cycles and software rollouts—not just clean‑room tests.

9. Integrated network security Cisco Fortinet

Both bring consolidated policy planes, hardware acceleration where it counts, and credible paths into cloud‑delivered security. The practical question isn’t which logo to buy, but which model—appliance, virtual, or service—fits your topology, skills, and procurement tempo. We often blend site‑level control with cloud‑proxied access to keep complexity from re‑entering through the side door.

10. Privacy compliance and GRC platforms OneTrust

OneTrust’s value shows when privacy, security, legal, and data teams need one vocabulary for policies, data maps, and proofs. Marry it with automated discovery and labeling, and audits become predictable exercises rather than fire drills. We’ve watched programs grow up quickly once evidence collection and policy enforcement ride the same rails.

How TechTide Solutions helps you build custom cybersecurity solutions

Budgets are moving toward security outcomes, not shelfware. In a recent global survey, 57% of respondents anticipate increasing their budget for cybersecurity, and those funds are flowing to architecture, integration, and automation. Our role is to translate that investment into resilient software and systems that fit your business—not the other way around.

1. Custom secure software development aligned to your industry

We build with security by default: memory‑safe languages where possible, policy‑as‑code baked into CI, and secrets that never touch developer laptops. In regulated industries, we codify approvals and evidence so compliance becomes a side effect of delivery. Our reference patterns—event streaming for auditability, least‑privilege microservices, and resilient data pipelines—are lifted from live production, not from whiteboards.

2. Security architecture and integrations with top cybersecurity companies

We treat platforms as composable parts. Whether you anchor on Cisco, Fortinet, Microsoft, Palo Alto Networks, CrowdStrike, or Zscaler, we glue identities, endpoints, and edges into one policy fabric and one data lake you can actually query. Our opinionated integrations avoid brittle one‑off scripts in favor of supported APIs, event bridges, and IaC modules that survive upgrades.

3. Automation monitoring and response workflows tailored to customer needs

Automation should remove toil and amplify judgment. We implement detection pipelines that fuse identity risk, data sensitivity, and network paths into actions analysts trust—quarantine when confidence is high, enrich when it isn’t, and always leave a clear audit trail. The result is fewer swivel‑chair moments and more time spent neutralizing what matters.

Conclusion: choosing from the top cybersecurity companies in 2025

Strategy now puts security at the center of growth; in a recent survey, 85% of CEOs say cybersecurity is critical for business growth, which mirrors what we hear in boardrooms: enable transformation, but do it safely. The shortlist you build should reflect your architecture, risk appetite, and operating model—platform where it simplifies, specialize where it truly differentiates, and automate the connective tissue so teams can move faster.

If you want a pragmatic way to narrow options, we’ll facilitate a vendor‑agnostic design session to map your identity, endpoint, network, and data control planes to concrete platform choices and automation paths. Would you like us to draft that agenda and candidate lineup tailored to your environment?