How to choose the best mobile app development companies in france

France’s mobile opportunity is not abstract; global consumer app spending climbed to $171 billion in 2023, and French users mirror that momentum in download behavior and in‑app engagement. From our seat at TechTide Solutions, we see buyers thriving when they select partners with measured delivery habits, clear value hypotheses, and a bias for lifecycle impact rather than launch‑day theater.

1. Experience and project portfolio

Proven delivery beats promises. A seasoned French partner should show live apps across multiple stores and categories. Gallery reels tell stories, yet repositories and case notes reveal durable practice. We ask for code walk‑throughs, not only glossy screens. Demonstrations of offline sync, accessibility, and graceful failure paths signal mature engineering craft. When a team explains how it handled certificate pinning or network flakiness in the field, we listen harder. That fluency matters when your users ride a subway tunnel or cross a rural valley.

Domain adjacency also counts. Mobility projects inform logistics features. Retail loyalty logic enriches fintech rewards. We value adjacent muscles that map to your roadmap. In practice, we invite portfolio reviews organized by problem pattern rather than industry label. Security step‑ups, data migrations, and growth experiments are patterns that recur. A vendor that talks openly about mistakes and remediations earns trust. That candor often predicts calmer incident response and faster time to recovery.

2. Technology proficiency and agile methodologies

Method is a multiplier. Agile is more than rituals; it is a learning system that reduces waste and compresses discovery. We prefer partners who cleanly separate outcomes from outputs. Roadmaps focus on user jobs, not features. Healthy teams practice trunk‑based development, maintain forward‑leaning test suites, and keep release cadences short. Strong squads also automate baseline compliance checks for privacy and security. That automation frees minds for product learning, not only sprint chores.

Tooling choices reveal posture. Safe defaults for secrets management and observability show up early. Partner teams that favor typed APIs, predictable state management, and contract tests catch integration surprises before they reach users. We probe for explicit architectural decision records. Those notes clarify trade‑offs and help future teams avoid historical loops. We also look for experimentation rhythms that treat feature flags as assets rather than temporary hacks.

3. Customer reviews and testimonials

Words from peers cut through marketing fog. We weigh longitudinal references more than one‑off praise. A client who stayed through a pivot has perspective you can use. Ask what the vendor pushed back on, and why. Healthy friction is a sign of a thinking partner. We also seek context on the sponsor model. The best vendors tune updates for engineers, product managers, and finance stakeholders, each with its own need for detail and cadence.

We read between lines in public testimonials. Praise that mentions “kept us honest” or “challenged our brief” is meaningful. Praise that celebrates responsiveness during crunches also matters. A balanced picture includes bumps and how the team absorbed them. When reviews highlight co‑located workshops or bilingual facilitation, we note gains in alignment and speed. Cultural fluency is not a bonus; it is often the hidden accelerator.

4. Transparency in budget and timelines

Opacity multiplies risk. We prefer partners that present ranges, not single‑point guesses. Clear assumptions help everyone recalibrate when reality shifts. A vendor that shares burn rates, productivity bands, and risks up front is setting the table for better governance. We also ask for change‑control shapes that protect momentum without hiding scope churn. Simple yardsticks, such as cycle time and escaped defect ratios, keep the conversation objective.

Budget clarity should coexist with outcome flexibility. Discovery can shrink or expand scope, and the framework must adapt. We treat cost drivers as levers. Design depth, offline breadth, or analytics granularity can slide. Skilled partners explain those levers without defensiveness. That helps sponsors defend choices during board or procurement reviews.

Related Posts

- Top 30 App Development Companies In Spain 2026

- Top 30 Outsourcing Software Development Companies in Vietnam: Comparison, Vendors, and How to Choose

- Top 30 Cybersecurity Companies In Vietnam For 2025

- Top 30 custom application development companies in 2025: research-based shortlist and buyer’s guide

- Top 30 App Development in Singapore Companies and Services to Hire in 2025

5. Post‑project communication and support

Launch is a midpoint. We favor vendors who offer calm on‑call playbooks, not ad hoc pings. We look for post‑release rituals that include error budget reviews and retention curves. Support teams should speak the same design language as product squads. When new devices appear or OS policies change, continuity matters. Partners that curate SDK upgrades and deprecation calendars spare your staff a world of pain.

We also ask about knowledge transfer. Good partners give you traceable decisions, dependency maps, and architecture notes. They leave behind dashboards that sponsors actually understand. A lighter vendor handover reduces vendor lock‑in and improves your hiring runway. That freedom is its own insurance policy.

6. Strategic focus and result orientation

Mobile success compounds when teams chase a north‑star metric, not a backlog. We push for hypotheses and testable bets. Growth loops around onboarding, activation, and referral perform best when wired for quick learning. A vendor’s strategy chops show in early instrumentation choices. Models beat anecdotes; segmentation beats averages. A results‑first culture turns research notes into backlog reshapes, not slide decks. That discipline separates the good from the truly effective.

Quick Comparison of mobile app development companies in france

Procurement teams want benchmarks. For a France‑anchored lens, the local app economy shows healthy monetization through advertising, which generated 2.4 billion U.S. dollars in 2022, while in‑app spending continued to mature. We see selection speed improve when buyers shortlist by fit, not fame, then validate through scoped discovery sprints.

| Company/Service | Best for | From price | Trial/Free | Key limits |

|---|---|---|---|---|

| BAM (Paris) | Product‑led native apps with swift delivery | Custom | No | Focus on mobile; broader enterprise scope needs partners |

| OCTO Technology | Complex architectures and transformation guidance | Custom | No | Enterprise processes can slow smaller teams |

| Zenika | Secure builds and open‑source craftsmanship | Custom | No | Specialist squads may require multi‑vendor orchestration |

| SFEIR | Cloud‑ready mobile with modern UI | Custom | No | Product strategy depth varies by squad |

| Niji | Design‑to‑delivery across retail and telecom | Custom | No | Regional focus may limit niche stacks |

| Clever Age | Commerce‑centric apps with omnichannel flows | Custom | No | Legacy integrations can extend timelines |

| VISEO | Analytics‑aware enterprise mobility | Custom | No | Stakeholder alignment needed for pace |

| Capgemini | Global scale and regulated environments | Custom | No | Large‑program governance overhead |

| Sopra Steria | Public sector and mission‑critical apps | Custom | No | Change control can feel heavy |

| Devoteam | Cloud‑native mobile on leading platforms | Custom | No | Specialty platforms may drive vendor ties |

To round out a thirty‑strong longlist, we often consider these additional contenders for France‑centric or France‑served work:

- Accenture Song France

- AKQA Paris

- Valtech

- SQLI

- Smile

- Inetum

- onepoint

- Pentalog

- CGI France

- Orange Business

- Wavestone

- Alten

- Akkodis

- SII

- Devialet Studio Apps

- Ineat

- Netguru France

- Mobelite

- Backelite Alumni Network

- Theodo

We pick by match quality, not logo sheen. The right partner for a regulated bank may not fit a marketplace that pivots weekly. That is normal and healthy.

Top 30 mobile app development companies in france

France’s mobile ecosystem is thriving—from the public-sector scale of health passes and mobility apps to the precision engineering behind fintech, e‑commerce, and industrial IoT. As Techtide Solutions, we’ve spent the last decade partnering with product leaders across Europe.

What matters most to French buyers, in our experience, is a blend of stringent data protection, robust UX for multilingual audiences, and delivery models that combine in‑country proximity with nearshore scale. Below we profile thirty companies active in France’s market. For each, we outline focus areas, team size (estimates), years in operation, and headquarters.

Where public recognition exists, we include independent award links; and where public case studies are available, we point to proof without adding links. Our goal isn’t to crown a single winner but to help you shortlist by fit: regulated versus consumer product, native versus cross‑platform strategy, and the engagement model that matches your operational tempo. If you need help pressure‑testing a shortlist against budget, roadmap risk, or compliance constraints, we’re happy to share our discovery framework.

1. App Design

App Design focuses on native and cross‑platform mobile development, plus web and custom software. The team operates as a boutique studio with an estimated headcount under 50, with roughly 15+ years in operation, and is headquartered in Madrid while serving EU clients including France via a French‑language practice. Their positioning suits founders who want a fast, design‑first build that still respects maintainability.

In delivery, we see App Design favor pragmatic technology stacks (Swift/Kotlin, React Native, Flutter) and straightforward CI/CD for modestly complex apps. They tend to bring UX and scope control together—a good fit for MVPs that need measurable conversion paths and early analytics instrumentation rather than heavyweight data platforms.

Ideal Fit: Early‑stage startups and SMEs in retail, services, media, or education that value cost transparency and iterative milestones. Expect tighter squads, frequent demos, and willingness to pivot the backlog when market feedback arrives.

2. Lunabee Studio

Lunabee Studio specializes in premium consumer‑grade iOS and Android products, accessibility, and secure UX. We’d estimate a 30–50 person team, ~15 years in operation, headquartered in the Auvergne‑Rhône‑Alpes region of France. The studio is known for crafting polished mobile experiences and for its roots as a product team (e.g., password manager heritage), which shows in its emphasis on performance and store‑readiness.

On the proof side, Lunabee’s engineering culture is battle‑hardened by large‑scale public usage—building the official French COVID app (TousAntiCovid) with sustained mass adoption is a notable credential. When we evaluate their code maturity, we see care for accessibility (TalkBack/VoiceOver), crash‑free sessions, and predictable release trains that survive high download spikes.

Ideal Fit: Enterprises and public bodies that need consumer‑scale reliability and accessibility, plus startups where app store features and localization can materially move acquisition. Engagements tend to be product‑team‑like, not “outsourced,” which suits buyers who want a thinking partner, not just ticket‑takers.

3. TechTide Solutions

We focus on full‑stack mobile (native and Flutter), web, and platform modernization. Our team counts ~150+ engineers and designers, ~10+ years in operation, with leadership and delivery hubs in Ho Chi Minh City and distributed EU coverage for France‑friendly time zones. We’re often asked to fix stalled mobile initiatives or to compress time‑to‑market for regulated workflows.

Services & proof center on native Swift/Kotlin builds, Flutter for multi‑brand portfolios, and hardened CI/CD (Fastlane/Bitrise/GitHub Actions) tied to telemetry (Crashlytics, Sentry, Datadog). We’ve helped companies convert legacy mobile backends to event‑driven designs, trim cold starts, and pass tougher privacy reviews without over‑engineering. Our portfolio includes wallet flows, field‑service apps, and fitness/health UX that must stand up under real‑world usage patterns.

Ideal Fit: Product owners who want measurable outcomes—crash‑free rates, startup times, engagement cohorts—more than shiny prototypes. We suit mid‑market and enterprise teams that prefer a co‑delivery model with internal developers and want our help with roadmap decisiveness and technical debt pay‑down.

4. GoodBarber

GoodBarber is a France‑born no‑code app and PWA platform. Think builder, not custom agency: a mid‑sized product team (estimated 50–100) operating since 2011 and headquartered in Ajaccio, Corsica. For many French SMEs and municipalities, GoodBarber reduces the lift needed to ship store‑ready apps with e‑commerce or content features.

In our experience, GoodBarber is best when speed and cost predictability outrank bespoke complexity. We’ve seen French retailers and local media get a first‑class app presence with reliable plugin ecosystems and hosted infrastructure, then add targeted customizations via APIs when they outgrow templates.

Ideal Fit: Local commerce, media, festivals, tourism bodies, and associations that want a vendor‑supported builder (push, payments, catalog, CMS) translated to French norms. If you need novel device capabilities or hard real‑time behaviors, a custom stack may serve you better; otherwise, this platform can be a launch accelerator.

5. Pentalog

Pentalog is a long‑standing European engineering group with strong French roots and nearshore scale. We estimate ~1,300 professionals, ~30 years in operation, with French headquarters presence around Paris/Orléans and global delivery in EU/LatAm/Asia. Since 2023, it’s part of a larger digital group, which added reach for France‑based clients needing multi‑disciplinary squads.

Their services span native and cross‑platform apps, embedded, data, and growth engineering. Publicly referenced client work includes large French and global brands in adtech, research, travel, and security. We’ve seen Pentalog deliver when buyers need stable multi‑team governance, product ops, and capacity ramp‑up without losing cadence.

Ideal Fit: Scale‑ups and enterprises seeking managed velocity—multiple pods, quality at volume, and product + talent channels under one umbrella. Particularly solid for organizations that value French‑speaking leadership while operating across time zones.

6. Fidesio

Fidesio is a Paris‑based digital agency delivering sites, e‑commerce, and mobile apps. Historically a 10–49 person team with ~15–20 years in operation, it has supported French SMEs and institutions on custom Symfony/JS and PWA projects, adding mobile interfaces where the journey demands it.

In our view, Fidesio is at its best when projects blend UX storytelling with pragmatic engineering—e.g., brand sites evolving into transactional experiences, or intranet workflows moving into mobile form factors. Their practice emphasizes research‑driven UX and sober infrastructure choices, which French buyers often prefer for long‑term maintainability.

Ideal Fit: B2B and mid‑market brands with a content‑to‑conversion arc, and public/para‑public actors who need Paris‑based account management and steady, iterative output rather than flash‑in‑the‑pan campaigns.

7. Elinext

Elinext is a multinational custom software firm with a Paris office and EU delivery centers. We estimate 700+ employees, ~27+ years in operation, and a headquarters presence in the EU with global reach. In France, they support healthcare, finance, logistics, and industrial clients with mobile stacks ranging from native Swift/Kotlin to Flutter and React Native.

Top 15 Business Intelligence Consulting Companies 2025.

Public case references include work for global manufacturers, healthcare organizations, and consumer brands; in France we’ve seen them handle mobile companions to MES/ERP and field‑ops workflows where offline, BLE, and device driver nuances matter. Their technical breadth helps when a mobile app must sit cleanly within larger data and legacy environments.

Ideal Fit: Mid‑to‑large companies with enterprise integration constraints—security review cycles, audit trails, role‑based access—that need a vendor comfortable navigating MES/CRM/ERP boundaries as much as app‑store polish.

8. Innowise Group

Innowise Group is an international engineering partner with EU headquarters and a Paris presence. We estimate 2,000–2,500 engineers, ~18 years in operation, headquartered in Warsaw with multiple EU offices, including Paris for local touchpoints. Their mobile bench is deep across native and Flutter, with strong QA automation habits and GDPR‑first delivery for European buyers.

Top 15 Business Intelligence Consulting Companies 2025.

Public work spans banking, e‑learning, media streaming, and telemedicine apps with measurable outcomes (rating lifts, subscription upticks, HIPAA/GDPR diligence). When we evaluate staffing for French clients, we see a useful balance of senior ICs and mid‑levels that keeps throughput high without threatening knowledge continuity.

Ideal Fit: Product owners who want Paris‑time collaboration yet need flexible squads—augment your internal mobile team with specialists or commission a turnkey build with integrated DevOps and testing at enterprise standards.

9. Managed Code

Managed Code is a boutique studio in Pau, France, working at the intersection of design, product, and generative AI with mobile builds in native and cross‑platform. The team size sits under 50, with ~4–5 years in operation and a southwestern France base that still serves national accounts.

We see a strong emphasis on UI/UX craft, quick MVP turnarounds, and use of AI‑assisted features (LLM integrations) where mobile UX can benefit from on‑device inference and privacy‑conscious prompt architectures. This is handy for French buyers experimenting with AI while respecting data‑handling norms.

Ideal Fit: Startups and product divisions exploring new interactions (voice, chat, AI copilots) and needing a small, responsive partner who can ship prototypes, validate in TestFlight/internal tracks, and then harden the code into production.

10. Agillia

Agillia is a Lyon‑based digital engineering agency with a Paris footprint, delivering e‑commerce, custom Symfony, and PWA/mobile projects. We estimate a 20–50 person team, ~20+ years in operation. Their core is business‑platform engineering—sites, portals, and apps wired into ERP/CRM and payment stacks.

When mobile is the front door to a broader e‑commerce or B2B portal, we’ve seen Agillia pair solid UX with APIs that don’t buckle under catalog complexity or agent workflows. They’re pragmatic integrators who know where to push for “native” versus what to keep as responsive or PWA for simplicity and cost of ownership.

Ideal Fit: SMEs and mid‑market brands connecting storefronts, logistics, and CRM in France, with the need to ship a coherent mobile experience quickly—without rebuilding everything from scratch.

11. Appinventiv

Appinventiv is a global mobile and product engineering firm with European client coverage, including France. We estimate 1,600+ employees, ~10 years in operation, and a distributed network of offices across APAC, EU, and North America. In France, we’ve encountered them on consumer apps, marketplace builds, and enterprise mobility projects requiring large squads.

Publicly referenced clients include global brands across QSR, retail, and sports. The delivery model emphasizes discovery‑to‑post‑launch continuity, with specialized groups for analytics, growth, and SRE supporting mobile post‑release realities. If you need velocity with governance, they can spin up multi‑disciplinary teams quickly.

Ideal Fit: Corporates and scale‑ups with ambitious growth targets and the capacity to absorb a large external team. Good match when your roadmap needs both mobile feature factories and downstream optimization (experimentation, performance budgets, monetization).

12. MindInventory

MindInventory provides mobile, web, and AI‑assisted product builds with EU‑friendly service coverage. We estimate ~250+ specialists, ~14 years in operation, with delivery to French clients coordinated through localized engagement. Technically, they balance native and cross‑platform choices and are comfortable with payments, maps, and chat features that are typical for French consumer apps.

In practice, we’ve seen them succeed on MVPs that demand polished UI flows and a path to rapid scale—Firebase/Amplitude‑instrumented releases, React Native or Flutter for multi‑brand portfolios, plus backend pragmatism to keep complexity in check until product‑market fit is validated.

Ideal Fit: Founders and product leads seeking predictable sprints, a clear bench for scale, and a partner willing to assist with analytics discipline and ASO/ASO‑adjacent hygiene post‑launch.

13. Concetto Labs

Concetto Labs is a mobile and web development firm active in the French market through nearshore delivery. We estimate 100–250 professionals, ~9 years in operation, with core strength in cross‑platform frameworks (Flutter/React Native) and rapid MVP into scale‑up transitions.

We’ve seen them do well on product backlogs that blend customer‑facing apps and internal ops tools—inventory, booking, CRM connectors—where cost predictability, open communication, and reversible architectural decisions matter more than deep platform specialization.

Ideal Fit: Budget‑sensitive startups and SMEs who need a reliable, hands‑on team to transform Figma + PRDs into shippable iOS/Android binaries with sensible QA and rollout gates.

14. Fusion Informatics

Fusion Informatics operates as a long‑tenured custom software partner with mobile at the core. We estimate ~200–500 staff, ~20+ years in operation, and a track record spanning fintech, logistics, and retail. For French buyers, their value is in enterprise discipline—documentation, compliance, and post‑launch support.

We’ve seen this model work when the app is only one pillar of a broader platform—APIs, partner integrations, analytics, and data pipelines. Their teams have the patience to bring stakeholders along and harden the release cycle without losing momentum.

Ideal Fit: Mid‑market to enterprise, especially when procurement wants repeatable process artifacts (test plans, traceability, security checklists) alongside steady sprint throughput.

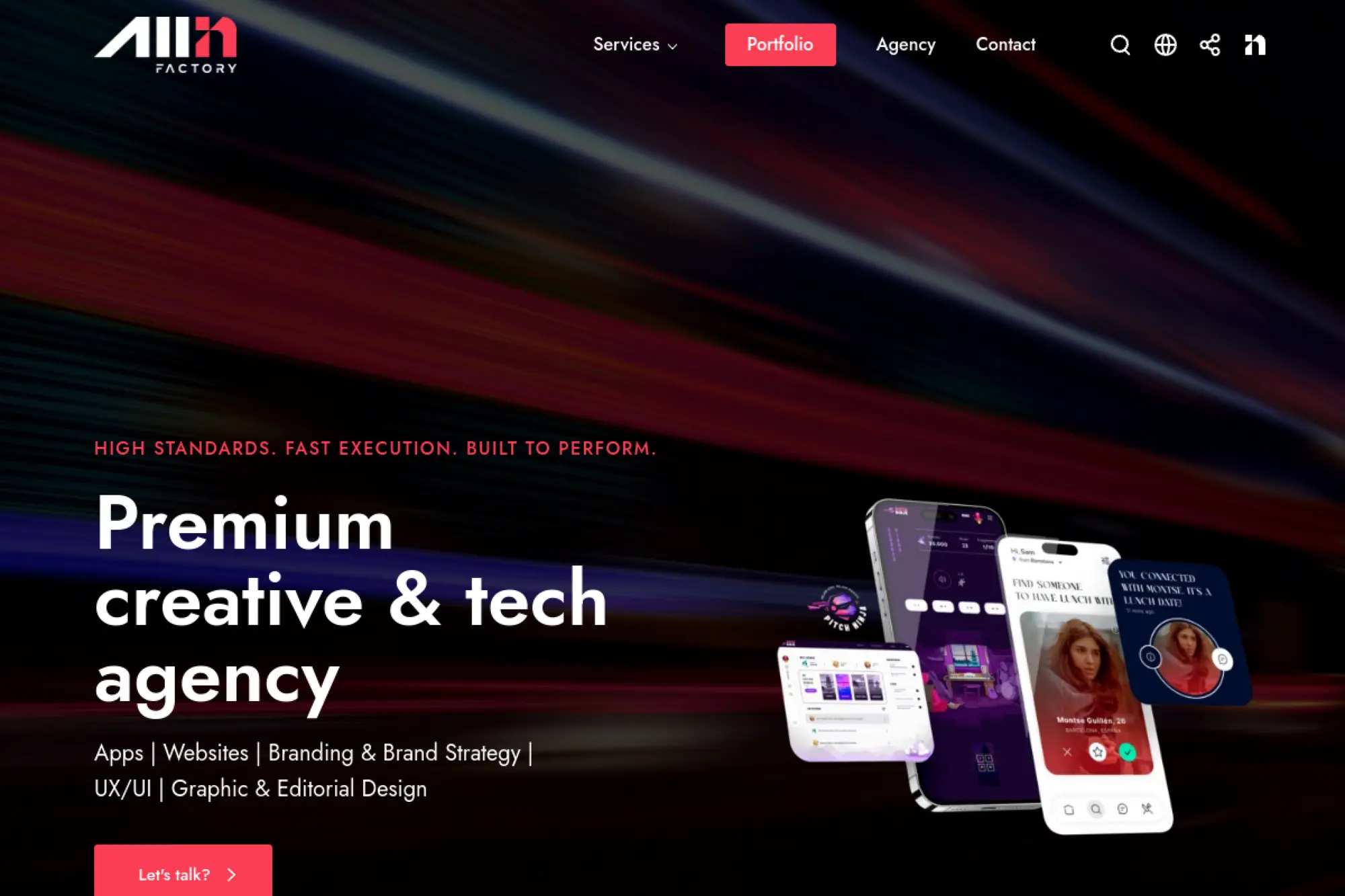

15. All‑In Factory

All‑In Factory is a premium creative‑plus‑tech agency with bases in Paris, Basel, and Barcelona. We estimate a 10–20 person core, ~7–10 years in operation. Their hallmark is brand‑led UX with serious engineering underneath, shipping mobile, web, and AI‑infused applications.

Public project references include European consumer brands and tech companies; the team highlights engagements with automotive and retail names as well as media and marketplaces. From our vantage point, they shine where look‑and‑feel must meet measurable app performance—i.e., no trade‑off between design excellence and responsiveness.

Ideal Fit: Ambitious brands and funded startups seeking “flagship‑grade” UX on iOS/Android with rapid creative cycles, clear PMF hypotheses, and marketing alignment from day one.

16. Serevia

Serevia is a France‑based digital engineering studio focused on custom web and mobile solutions. The team appears boutique (under 50), with recent years spent productizing an agile approach that favors durable codebases and sustainable operations.

We’ve encountered Serevia on projects where mobile is part of an internal transformation—streamlining legacy workflows into focused, secure apps with a service‑oriented backend and attention to change management for non‑technical users.

Ideal Fit: SMEs and ETIs digitizing core processes—quoting, inspections, approvals—who need a nimble partner to co‑design flows, implement, and then stay around for continuous improvement.

17. Adeliom

Adeliom is a Strasbourg‑born digital agency with offices in Aix‑Marseille and a Paris commercial presence. We estimate ~40 collaborators, ~15 years in operation, specializing in strategy, UX, and development of complex web and mobile systems for ETIs and large organizations.

Listed among the top mobile app agencies in Strasbourg (2025).

Public references span mobility, accessibility, and public‑sector adjacent projects; we’ve seen the team handle applications for transport and civic use‑cases where UX clarity, accessibility, and device diversity (kiosks/tablets/phones) are essential.

Ideal Fit: Organizations with multi‑persona journeys (citizens, employees, partners) and the need to integrate with existing IS while maintaining high UX quality and governance.

18. W3r.one

W3r.one is a French studio building web, mobile, and blockchain solutions. The team is lean (likely under 20) and has been operating for several years out of France with national client coverage. Their stack spans React Native, Swift/Objective‑C, and Android Java/Kotlin for mobile.

Public case work includes mobile for major travel and aviation brands as well as marketplaces and communities. From our vantage point, they’re effective when a POC must evolve into a production‑ready app without losing speed—especially where agencies bring them in as technical copilots.

Ideal Fit: Agencies and startups needing senior engineering “on the field” who can connect brand ambition to robust delivery, including security hardening, API design, and store compliance.

19. Galadrim

Galadrim is a French product engineering company delivering web, mobile, and AI‑driven solutions. We estimate ~130 employees, ~8 years in operation (founded in the late 2010s), headquartered in Paris with additional teams in Nantes and Lyon. They blend product strategy with full‑stack execution.

Public cases include safety and consumer applications, with shipping discipline that suits apps needing reliability, secure auth, and multi‑tenant patterns. We’ve seen them move comfortably between greenfield builds and modernization work.

Ideal Fit: Venture‑backed startups and mid‑market innovators who want product managers and engineers working as one team, with the ability to scale squads as traction grows.

20. ELEKS

ELEKS is a global software partner with European heritage and a France entity in Paris. We estimate 2,000+ employees, ~30+ years in operation, with headquarters established in the EU and a long track record across regulated industries. Their mobile practice integrates with data engineering, cloud, and cybersecurity functions.

Recognized in the Global Outsourcing 100 (2024).

Public clients include global financial institutions, cybersecurity vendors, and logistics leaders. For French buyers, we’ve seen ELEKS deliver when mobile apps are tied to bigger transformations—think payments integrations, customer identity, or predictive maintenance with IoT.

Ideal Fit: Enterprises with stringent procurement/compliance and multi‑vendor programs, looking for a partner who can deliver mobile and the adjacent platform capabilities under enterprise SLAs.

21. Exomind

Exomind is a French consulting and development company with offices in Boulogne‑Billancourt (Paris area) and Rennes. Team size looks like several dozen consultants and engineers, ~5–10 years in operation. They pair product consulting (PM/PO) with mobile and web delivery.

Public proof spans media, cloud, energy, and retail. We’ve seen Exomind handle consumer streaming, global retail internal apps, and cloud program delivery for large French tech firms—useful when your mobile backlog needs embedded PMs as much as developers.

Ideal Fit: Corporates and scale‑ups that want hybrid staffing: embedded product and engineering to reinforce internal squads while still owning the roadmap and IP.

22. TheCodingMachine

TheCodingMachine is a France‑grown engineering agency with offices in Paris and Lyon plus international branches. We estimate 100–200 staff, ~18+ years in operation. Their strengths are open‑source, robust architectures, and long‑living codebases, spanning web, mobile, and emerging tech.

Public proof includes hundreds of delivered projects and open‑source leadership. In mobile, we’ve seen them emphasize maintainable code, CI discipline, and data‑privacy alignment that French stakeholders expect—especially where apps must coexist with complex back‑office systems.

Ideal Fit: Buyers who prioritize technical stewardship and sustainable velocity over quick hacks—finance, industry, and B2B sectors that need traceability and a partner who can say “no” when it reduces future risk.

23. ALLOHOUSTON

ALLOHOUSTON is a Paris‑based digital transformation partner with a developer‑consultant model. Team size appears under 20, with recent years focused on building adaptive, evolving tools for real‑world operations. Their mobile work is usually one component in a bigger operating‑model shift.

We see them thrive when simplifying messy, spreadsheet‑driven processes into ergonomic apps that sit atop existing tools. The emphasis is on field usability and business continuity—important for French SMEs wary of big‑bang platform changes.

Ideal Fit: Leadership teams seeking pragmatic, incremental digitization—clear roadmaps, small wins compounding over quarters, and mobile UX grounded in day‑to‑day operations.

24. Loop

Loop is a French product company behind a mobile platform connecting musicians for collaboration. This is not an agency; it’s a product team applying mobile craft to a targeted community space. Team size is startup‑scale (under 20), with several years of iteration on iOS and likely cross‑platform technology.

From a buyer’s perspective, Loop demonstrates product‑market fit thinking: matchmaking logic, community moderation, and in‑app participation mechanics that keep sessions healthy. The pattern—shaping network effects and user‑generated content on mobile—is instructive for any consumer app play in France.

Ideal Fit: As a reference, it’s best for founders studying how to blend recommendation, chat, and content into a cohesive mobile experience while implementing safeguards and growth loops responsibly.

25. Wess Soft

Wess Soft is a Lyon‑based ESN/agency delivering custom mobile and web applications. We estimate ~12 people, ~10 years in operation. Their practice mixes Flutter/React Native with Symfony/JS backends, with a track record in education, industrial, and public‑interest use‑cases.

Listed among leading Android agencies in France (2025).

Publicly referenced projects include an interactive platform for an outdoor ads marketplace, a companion mobile app for rescue volunteers, and education administration tools. We like how they address real‑world constraints: geospatial data, offline resilience, and admin workflows that must be bulletproof.

Ideal Fit: SMEs, public‑interest orgs, and industry players that want a close‑knit team, direct access to engineers, and a delivery approach that respects the domain’s operational realities.

26. Definima

Definima is a Bordeaux‑area agency (Gradignan) with two decades of web and mobile experience. We estimate ~18 collaborators, ~20+ years in operation. They combine UX, custom development, e‑commerce, and integrations with ERP/CRM—often adding mobile for field use or consumer extensions.

Public work includes retail and education platforms and a “where to train” marketplace—useful references for French buyers who need multi‑tenant content, catalog depth, and mobile touchpoints that mirror web parity without duplicating complexity.

Ideal Fit: Regional and national SMEs seeking a steady partnership that can iterate across channels—site, portal, mobile—with a single team that understands their business rhythms.

27. Digital Unicorn

Digital Unicorn is a France‑based digital studio delivering web, mobile, and design with AI‑aware workflows. We estimate a boutique team (under 20), operating across France with bilingual (FR/EN) delivery. Their positioning is practical: UX/UI + engineering + SEO/activation to make apps and sites discoverable.

Recognized as an “Activateur France Num”.

Public references include on‑demand health delivery, marketplace rebuilds, and custom back‑office tools. We like their bias toward measurable outcomes—traffic, conversion, or process time saved—rather than features for features’ sake.

Ideal Fit: SMEs and growth‑stage startups wanting one team to own UX, app development, and discoverability. Good for founders who prefer a single point of accountability across build and early growth.

28. Makeo

Makeo operates as a boutique French product and engineering studio. The team appears small (under 20), with several years of hands‑on delivery for web and mobile builds. Their strength is compressing idea‑to‑MVP for founders and business units, with an emphasis on clear UX and sensible technical scaffolding.

We’ve seen partners like this succeed by using a “sharp chisel” approach—just enough backend, lean CI, real analytics, and release discipline—so buyers don’t drown in platform complexity before PMF.

Ideal Fit: Founders and intrapreneurs who need a pragmatic MVP with a viable path to v1.0, maintaining optionality for eventual in‑house teams to take over cleanly.

29. Kwantic

Kwantic is a Bordeaux‑based agency delivering websites, applications, and ERP/CRM integrations, with additional presence in Toulouse and Lille. We estimate a small team (under 20), ~5–7 years in operation. On mobile, they leverage React Native/Flutter when cross‑platform speed is the priority.

Public references include commerce and education builds—useful examples of how to translate catalog and learning flows into lightweight mobile interfaces without blowing up TCO. The advantage here is proximity and a team that spans UX to SEO to implementation.

Ideal Fit: Local and regional SMEs wanting one crew to cover UX, development, and integrations, and who value phone‑a‑friend proximity in Bordeaux/Toulouse/Lille for workshops and sustainment.

30. AGENCE QUANTUM

AGENCE QUANTUM appears as a Bordeaux‑based boutique studio, focused on custom web and mobile work with product sensibilities. Team size is likely under 10–20, with a focus on listening closely to business constraints and translating them into straightforward, usable mobile experiences.

Studios at this scale win by aligning founders and stakeholders early, shipping testable builds, and instrumenting usage from week one. That’s particularly relevant in France’s SME landscape where budgets are finite and ROI must show up within a quarter or two.

Ideal Fit: Entrepreneurs and local businesses who want senior attention from day one, simple pricing, and clean delivery without the overhead of a large vendor.

We’ve profiled a wide spectrum—from builders like GoodBarber to global players like ELEKS and product‑grade studios such as Lunabee—because “best” depends on context. If you share your target users, budget band, and the one KPI that matters most in the next two quarters, we’ll map a shortlist and a 4‑week pilot plan to de‑risk your choice. Ready to pressure‑test your mobile roadmap with us?

Core services offered by mobile app development companies in france

Service menus can blur, so we anchor on outcomes. Design maturity correlates with returns, as top‑quartile performers achieved 32 percentage points higher revenue growth, which tracks with what we observe when teams weave research into backlog.

1. Native iOS and Android app development

Native builds shine where performance, platform nuance, and deep hardware access matter. French mobility, retail, and banking use cases often need that extra polish. We look for teams that treat UIKit or SwiftUI, and Jetpack components, as living tools rather than doctrine. The right approach hinges on latency targets, device coverage, and roadmap clarity. Teams that blend platform patterns with brand taste deliver apps that feel at home to users.

2. Cross‑platform and hybrid app development

Cross‑platform stacks compress time to value when features outpace budgets. The French market rewards consistent feel across devices and channels. We probe how a vendor isolates platform‑specific code and abstracts navigation, state, and network layers. A tidy separation allows graceful native escapes where they matter. Success here also depends on good design tokens and accessible components that travel across platforms.

3. Mobile app UI/UX design

Great design reduces support tickets and increases conversion. We want designers who speak in states, not only screens. Empty states, loading states, and error states define the experience under stress. French users appreciate clarity and respectful defaults, especially around consent and data sharing. We also expect designers to join metrics reviews. Design choices should respond to real usage, not static mockups.

4. Product consulting and digital strategy

Strategy connects customer value to business value. In France, that thread runs through privacy expectations, cultural nuance, and channel preferences. A strong partner will help define a north‑star metric and the handful of inputs that drive it. That thinking surfaces trade‑offs early. We look for experiments that target activation, retention, and monetization without eroding trust. Good strategy is a conversation, not a decree.

5. Maintenance and continuous improvement

Upgrades never stop. OS releases, SDK changes, and policy updates keep teams on their toes. We prefer partners that practice routine dependency hygiene and library audits. Mobile teams should run canary releases and monitor crash clusters with alerting discipline. Continuous improvement also involves content updates and minor UX fixes that compound over time. Small improvements stack into large gains.

6. Testing and quality assurance

Quality starts at design and extends through deployment. We like test pyramids that balance unit, component, and device tests. Contract tests shield APIs from surprises. Exploratory testing still catches oddities that scripts miss. Teams who build test data factories learn faster and ship with lower stress. Accessibility tests are table stakes for public sector and retail in France.

7. API and backend integrations

Backend seams are where mobile experiences often fray. We expect strong partners to design stable contracts, embrace idempotency, and instrument latency budgets. Teams should plan for flaky networks and apply robust retry logic. For regulated clients, audit trails and consent records must be first‑class features. Mature vendors treat API versioning as a product, not a chore.

8. App Store and Google Play publishing and ASO

Publishing is a discipline. Metadata, screenshots, and descriptions should align with user intents and brand voice. French localization, including tone and formality, affects conversion. We also ask for clear release notes and staged rollouts. ASO experiments pair well with referral loops and lifecycle campaigns. Good partners debug store policy questions before they become blockers.

9. Enterprise mobile app development

Enterprise mobility brings identity, policy, and compliance to the foreground. We expect support for managed devices, secure storage, and offline access for field work. Vendors must respect DPO requirements and security sign‑offs. Effective teams write playbooks that map to internal support desks. Strong change management keeps staff informed and willing to adopt new flows.

10. PWA development

Progressive web apps fit retailers and content brands that seek reach without heavy installs. France’s connectivity profile still benefits from fast first loads and small bundles. We judge PWAs on perceived performance, caching plans, and resilience offline. A modern PWA should feel native enough for casual users while preserving low friction for discovery and sharing.

11. Startup MVP and prototyping

MVPs exist to invalidate false certainty. We prefer lean prototypes that target riskiest assumptions first. For consumer apps, that often means onboarding and first value moments. For B2B plays, it might mean admin ergonomics and data correctness. A vendor that embraces kill criteria saves founders from vanity builds. French founders benefit from a partner who knows the funding climate and procurement rhythms.

12. App modernization and re‑engineering

Legacy apps can learn new tricks. We map technical debt, then isolate modules and replace them in steps. Wrapper strategies keep business moving while internals evolve. Partners that stage modernization limit user disruption and avoid big‑bang risks. This work pairs well with observability upgrades and security hardening. The payoff is smoother releases and happier teams.

Tech stacks and frameworks used in france mobile app development

Stack choice is never neutral; it shapes hiring, performance, and maintainability. The French market has depth in both native and cross‑platform skills, and the device landscape is dense, with 74.5 million cellular mobile connections in early 2025, which reinforces a need for careful performance tuning and analytics discipline.

1. iOS development Swift SwiftUI Objective‑C

Swift and SwiftUI speed iteration, but UIKit still matters for nuanced layouts and older devices. We evaluate teams on migration strategies and interop fluency. Objective‑C expertise remains valuable for long‑lived codebases. Strong iOS squads favor modular architectures, stable DI, and predictable state patterns. They also invest in snapshot tests to keep UI regressions in check.

2. Android development Kotlin Java

Kotlin dominates new work, supported by Jetpack libraries and modern tooling. Java persists in legacy code that deserves steady care. The best Android engineers manage background work responsibly and respect power budgets. We listen for nuanced takes on Compose adoption. Balanced teams keep Compose and Views living side by side where needed.

3. Flutter

Flutter accelerates when teams need consistent pixel control across platforms. We look for thoughtful plugin strategies and a plan for native escapes. Strong Flutter squads keep business logic isolated from widgets and treat platform channels with care. Rendering speed is impressive, yet teams must watch bundle sizes and memory pressure on older devices.

4. React Native

React Native thrives when web and mobile share a design system and mindset. We ask how teams handle navigation complexity, gesture performance, and animations. Well‑kept modules, stable bridges, and careful state management produce smooth apps. TypeScript brings safety to shared code. Performance budgets keep teams honest about native components where it matters.

5. Ionic

Ionic can move fast in content‑heavy scenarios or internal tools. We check whether the partner relies on Capacitor with sensible plugin hygiene. Teams that use design tokens and caching smartly can deliver respectable experiences. It is not a fit for the most demanding interactions, yet it earns its keep for many business cases.

6. NativeScript

NativeScript offers access to native APIs with JavaScript or TypeScript. We see it used in niche cases where a web‑centric team wants native reach. Competent use demands attention to memory and bridge overhead. Partners that demonstrate clarity on debugging workflows and error reporting tend to succeed here.

7. Backend Node.js .NET PHP Laravel Python Ruby on Rails

Backend pragmatism wins. Node.js pairs well with mobile for shared contracts and tooling. .NET excels in regulated or Microsoft‑leaning shops. Laravel speeds product work when teams value batteries included. Python and Rails shine for rapid iteration and data‑heavy services. We care less about language and more about reliability patterns, caching strategies, and observability. Strong partners align API shape with mobile latency constraints.

8. Cloud solutions and DevOps

Cloud maturity shows in automation and guardrails. We value teams that treat infrastructure as code and use ephemeral environments for review. DevOps wins look like fast rollbacks, crisp metrics, and calm incident playbooks. Secrets should live in vaults, not source trees. FinOps awareness matters when analytics volumes spike after a feature win.

9. AI and machine learning

On‑device ML and server‑side models both enrich mobile. We ask vendors how they guard user privacy while personalizing experiences. Good partners test model impact against human baselines, not only theoretical gains. We also verify fallback paths when models misfire. AI features should degrade gracefully and remain explainable to users and regulators.

10. Blockchain

Blockchain shows up in identity, ticketing, and supply chain traceability. Mobile’s role is secure signing, wallet UX, and fraud control. French projects benefit from plain language around custody, fees, and recovery. A partner that pilots with closed groups reduces risk before wider release. Good wallet UX avoids jargon and keeps recovery humane.

11. Internet of Things IoT

IoT and mobile pair naturally in home, health, and industrial settings. Device enrollment, firmware updates, and offline behavior deserve early tests. We evaluate Bluetooth and Wi‑Fi pairing stories with real devices, not emulators. A strong partner invests in protocol understanding and resilience under interference. Simple status cues prevent support calls and returns.

12. AR and VR

Spatial experiences reward careful scoping. Retail try‑ons, training overlays, and guided maintenance are viable areas. We check tracking stability under diverse lighting and surfaces. Teams should plan for fatigue and accessibility. Clear exits back to familiar UI reduce friction for first‑time users. Analytics must capture session quality, not only clicks.

Industries and use cases served by mobile app development companies in france

Sector lenses shape scope, compliance, and growth loops. Funding tides also inform priorities, with global fintech investment falling to $33.7B in 2024, which has pushed product leaders to value efficiency gains and durable engagement over flashy features.

1. Healthcare and mHealth

Healthcare apps in France must dance with privacy and consent. Appointment booking, teleconsultation, and medication reminders thrive when trust is visible. We advocate transparent consent flows and clear data boundaries. Offline modes and careful caching help patients in low‑connectivity zones. Clinical integrations carry validation burdens, so we plan documentation from day zero.

2. Finance and banking fintech

Fintech apps win on clarity, speed, and safety. Strong partners deliver friction‑light onboarding and visible controls. Payment flows need crisp error handling and clear retry patterns. We also advocate for humane security, including context‑aware step‑ups and calm language. Behavioral analytics can drive savings nudges and card controls that users actually use. The French market rewards trust and transparent fees.

3. E‑commerce and retail

Retail apps succeed when discovery feels personal and fulfillment feels effortless. We prioritize fast product lists, reliable search, and smart re‑engagement. Store pickup and returns flow should feel simple. Loyalty mechanics work best when tied to real‑time stock and personalized rewards. Push notifications should respect quiet hours and add clear value with each message.

4. Education and e‑learning

Learning apps rely on bite‑size modules, spaced repetition, and strong progress cues. Offline support keeps commuters engaged. Parents and teachers need dashboards that clarify growth without shaming. Privacy expectations are high for minors, so defaults must be conservative. We like to pilot with small cohorts to refine tone and pacing.

5. On‑demand services and marketplaces

Marketplaces live or die on liquidity and trust. We design supply onboarding as carefully as demand funnels. Ratings, identity checks, and dispute paths deserve real attention. GPS accuracy and network variance challenge courier and driver flows. We prototype geolocation edge cases in dense urban cores and rural gaps alike.

6. Real estate and property tech

Property apps mix maps, imagery, and complex filters. We optimize for quick scannability and saved search alerts. Field agents benefit from offline note‑taking and document capture. Secure data rooms ease transactions. Good partners compress media without wrecking detail. Calendar, messaging, and e‑signature integrations accelerate deals.

7. Travel and hospitality

Travelers want confidence and options. We design itineraries that survive cancellations and reroutes. Tickets and passes must work offline. Loyalty logic should surface value without hoops. Real‑time alerts and simple claim paths reduce stress. Localized content elevates experience and helps vendors cross‑sell services ethically.

8. Social networking and communities

Communities thrive on safety tools and visible norms. We build moderation features that combine automated triage with human review. Onboarding should set tone and expectations. Content formats evolve fast; experimentation frameworks need to keep up. We protect attention with thoughtful defaults that respect user agency.

9. Fitness and wellness

Wellness apps succeed with habit scaffolding and humane nudges. Integrations with wearables bring context to workouts and sleep. Plans should adapt to changing goals and energy. Privacy is core when dealing with health metrics. We build clear data control surfaces so users remain in charge.

10. Automotive and mobility

Mobility apps rely on precise mapping and reliable telematics. We test in tunnels, parking garages, and dense cores to stress routing. For EV contexts, charging station data must refresh reliably. Car‑sharing flows benefit from fast identity checks and robust damage reporting. Safety cues must be clear and calm.

11. Telecom and connectivity

Telecom apps combine account care with network tools. SIM management, plan changes, and support chats should feel effortless. We value diagnostic wizards that shorten support calls. Push channels must be respectful and sparse. Visual clarity and error messaging reduce churn and build goodwill.

12. Gaming and entertainment

Entertainment lives on polish and performance. We design onboarding that highlights delight while keeping taps minimal. Social hooks work when consent is explicit and reversible. For streaming, adaptive bitrate logic and prefetching keep sessions smooth. For games, live ops and events benefit from stable analytics and low‑latency pipelines.

How TechTide Solutions helps you build custom mobile app solutions

Our approach blends disciplined research with adaptive delivery. We invest early in measurable hypotheses and error budgets. When appropriate, we harness coding copilots carefully, mindful that generative tools can reduce coding time by 35–45%, while quality still depends on strong reviews and clear architectures.

1. Discovery and requirements mapping tailored to your business goals

Discovery should shrink uncertainty, not decorate slides. We start with stakeholder goals and user pains. Jobs‑to‑be‑done workshops surface value and unblock scope. Lightweight prototypes then probe the riskiest assumptions. We map data flows early and design for privacy by default. That groundwork keeps rework low and sponsor trust high.

What you see in week one

We share a plain‑language problem statement, user archetypes, and a draft KPI tree. You also get a risk register and a technical strawman. These artifacts guide debates productively. They make trade‑offs explicit and future hires faster to onboard. Early clarity lowers stress later.

2. Agile development with iterative releases and transparent collaboration

Our squads deliver in tight loops. Short release cycles mean learning arrives quickly. We keep branches brief and automate checks where it counts. Feature flags allow safe experiments and smooth rollouts. Every iteration includes time for refactoring and test health. That discipline keeps velocity sustainable.

How we keep everyone aligned

We run concise demos and maintain a living changelog. Sponsors see the same metrics as engineers. We use shared dashboards for crash rates, latency, and activation. Decisions are recorded in small ADRs. Those notes outlive personnel changes and support audits or diligence requests.

3. Long‑term support optimization and scalable growth planning

We treat support as product work. Alerting balances sensitivity with sanity. We review error budgets and funnel health routinely. Growth work focuses on lifecycle messaging and respectful nudges. Our teams plan for platform changes and device waves. Playbooks document how we update SDKs, libraries, and policies with minimal friction.

When to reassess architecture

Scaling moments trigger structured reviews. We revisit service boundaries, caching, and queuing. We also verify privacy notices and consent logs. These checks keep your app resilient and compliant as demand compounds. The goal remains the same: stable releases and satisfied users.

Conclusion: choosing among the top mobile app development companies in france

Choosing a French mobile partner is less about the shiniest pitch and more about disciplined learning, calm delivery, and shared incentives. The same bodies of research we cite point to durable returns when teams align design, engineering, and product around measurable outcomes. That pattern holds across sectors and company sizes. We see success when buyers insist on clear metrics, transparent trade‑offs, and thoughtful lifecycle plans.

If you are weighing two or three finalists, consider a small, time‑boxed trial that tackles a risky slice of work. You will learn whether the team can listen, adapt, and ship without drama. We can design that trial with you, or simply help you score proposals with a neutral rubric. Would a brief discovery sprint help you de‑risk your shortlist before you commit?