We’re Techtide Solutions, and we’ve spent the last decade shipping software with teams that live and breathe design craft and delivery discipline. In 2025, what separates merely attractive interfaces from performance-driving product design is the ability to connect research, decisions, and code in a measurable loop. The overall technology context matters: worldwide IT spending is projected to reach $5.43 trillion in 2025, and design capability still correlates strongly with business performance; McKinsey found that top‑quartile design performers achieved 32 percentage points higher revenue growth compared to peers. That macro picture is our daily reminder: picking the right UX UI design company is a strategic decision, not a cosmetic one.

How to Choose UX UI Design Companies: The Criteria That Matter

Before scrolling portfolios, align on what the market rewards. McKinsey’s longitudinal study of 300 companies showed design leaders delivering 32 percentage points higher revenue growth over time, and those same organizations delivered 56 percentage points higher total returns to shareholders. We translate that into selection heuristics: prioritize partners who treat design as an operating system (how they work), not a department (who they hire).

1. Process and Collaboration Signals

Great agencies make their process legible. We look for frictionless rituals that fit engineering rhythms: weekly decision reviews with crisp artifacts (hypotheses, risks, and the next best action), shared design tokens, and a centralized backlog that traces each UI decision to a user insight or metric. You’ll feel it in the first workshop—do they ask questions that improve your problem framing, or do they jump to pixels? In our experience, the right partner pushes uncomfortable clarity (what are we not doing this sprint?), maintains a living research repository rather than one‑off reports, and demonstrates an “integration mindset”: design critiques involve product managers and tech leads, and designers attend sprint planning, not just showcases. Process is culture made visible; if the proposal phase is a maze, delivery won’t be better.

2. Portfolio Alignment With Your Industry and Problems

Ignore the industry labels; read the problems solved. In fintech, we assess whether the team handles flows with regulatory and risk implications (KYC loops, multi‑factor authentication, audit trails). In logistics, we want evidence they’ve designed for operational reality (offline modes, variable network quality, congested UIs that still maintain legibility under stress). If you run a marketplace, look for multi‑sided incentives balanced through UX (seller tooling quality tied to buyer trust signals). A credible partner will walk you through their decision tree: what they simplified, what they resisted, and which trade‑offs they chose. Ask for “before/after” problem statements, not just shiny UIs. The best portfolios tell you why they’re proud of the boring stuff: improved error recoveries, faster first‑time‑to‑value, and fewer support tickets on week two after release.

3. Depth of Services and Commitment to Research

Surface‑level research produces surface‑level design. We look for teams that pair generative research (diary studies, contextual inquiry) with evaluative cycles (unmoderated tests, benchmarked tasks, and analytics instrumentation). A mature partner will have a research ops playbook: recruitment, consent, data handling, and synthesis cadence, all codified. We also value “design forensics”—being able to read transactional, funnel, and support data to spot invisible friction (think microcopy, error states, and recovery paths). “We do research” is table stakes; “we stabilize insights into your roadmap and design system” is the differentiator. You want a partner who loves contradictions in findings and knows when to decide with imperfect information.

4. Proposal Quality, Clarity, and Flexibility

We read proposals like contracts with future reality. The keepers clearly define outcomes (not just deliverables), phase gates, dependencies, and risk triggers. They include a change‑management path, not just a “scope change” clause. Flexibility doesn’t mean ambiguity; it means a modular plan that can expand or contract without breaking. Look for explicit assumptions (“Availability: 3 user interviews per week from your side; Decision latency: next‑day on critical flows”) and clear definitions of “done” per artifact. A reliable proposal explains how discovery informs delivery, and how delivery feeds discovery again—because the map changes once you drive the road.

5. Verified Reviews and Proven Delivery

Third‑party reviews matter, but read between the stars. We favor stories describing how the partner handled failure modes: a missed test recruit, an unexpected API limitation, a stakeholder reversal. Track record also shows up in operational details: how they handled accessibility audits, how they shepherded a design system into engineering code (tokens, linting, CI checks), or how they migrated legacy UI patterns safely. Good agencies have clients who talk about them when they’re not in the room because they left the organization better equipped—not dependent.

6. Questions to Ask on Calls: What Design Process Do You Use

We expect a real answer, not a diagram. Ask them to narrate a project like a post‑mortem: “We started with X unknowns; in week two, discovery contradicted our initial hypothesis; we reframed Y; we cut Z because engineering constraints; we validated with A/B tests and logged success criteria in analytics.” Process should include how they name and retire risks. Probe handoff depth—do they deliver Figma files or coded components? Do they ship governance for your design system (naming, versioning, contribution model)? Processes that make decisions easy are more valuable than processes that make presentations pretty.

7. Questions to Ask on Calls: Do You Have Dedicated UX Researchers

Ask who does the research, who synthesizes, and how learning moves into design and engineering. We want to see researchers with their own backlog, not just designers moonlighting as researchers. Clarify tooling (recruitment panels, tagging strategy), ethics (consent, data retention), and how often they revisit assumptions. Great partners will ask for access to your support tickets and product analytics immediately; they know insights are already hiding in your house. Also ask them to show a “killed idea”—research that spared the team from building something seductive but wrong.

Related Posts

- Top 30 App Development Companies In Spain 2026

- Top 30 Mobile App Development Companies in France to Consider

- Top 30 Outsourcing Software Development Companies in Vietnam: Comparison, Vendors, and How to Choose

- Top 30 Cybersecurity Companies In Vietnam For 2025

- Top 30 custom application development companies in 2025: research-based shortlist and buyer’s guide

8. Questions to Ask on Calls: Can We Keep the Same Team Ongoing

Continuity compounds value. Team stability keeps implicit knowledge intact—edge cases, stakeholder preferences, integration quirks. If they can’t promise the same designers or researchers for at least the core sprints, ask how they codify context: onboarding docs, decision logs, and a shared glossary. We’ve seen projects drift when institutional memory leaves the project Slack. A strong agency will have a bench plan and a shadowing model so transitions don’t cost you momentum. If they rotate, they should rotate intentionally (e.g., swapping in a motion specialist for a specific milestone) rather than randomly.

9. Questions to Ask on Calls: How Can We Support Your Daily Work

High‑performing collaborations are reciprocal. Your speedy access to SMEs, legal, and engineering accelerates the team more than any design trick. Agree on a decision SLA, a single source of truth (product brief, roadmap, and Figma library linking to tickets), and a weekly user access window. Assign an internal “insights concierge” to unlock users and data. The right agency will be explicit about what they need from you to move fast without breaking context: timely feedback, quick API clarifications, and a shared definition of “fast enough to learn.”

10. Questions to Ask on Calls: Will Designers Work Full Time on Our Product

Focus matters. Part‑time allocations create context‑switching overhead that quietly taxes throughput and quality. When full‑time isn’t feasible, ask how they shield deep work time and how they synchronize with engineering sprints. We often propose a stable “trunk” (a full‑time lead) with flexible “branches” (specialists who surge for motion, 3D, or research). Ensure they protect slack for discovery; if every hour is scheduled for output, there’s no time to find out if you’re shipping the wrong thing faster.

11. Pricing Models and Regional Benchmarks — Fixed Price, Retainers, and Time & Materials

Match the model to uncertainty. Fixed price fits well‑understood scopes with low volatility and clear success criteria; you pay a premium for risk transfer. Retainers buy you a stable multidisciplinary unit—ideal when the goal is throughput on a moving roadmap. Time & Materials is best when discovery will reshape the work; it keeps options open while you de‑risk assumptions. We’ve found regional rate variations reflect more than labor cost: time zone overlap, language clarity in research, and sector expertise can dwarf hourly deltas. Our rule of thumb: price for outcomes (how quickly we can learn and stabilize value), not just hours. Ask for a pilot at small scope to validate velocity and fit before committing long term.

12. How to Measure Business Outcomes and UX ROI

UX earns its keep when it moves a metric you already track. We start by aligning on a single “north‑star” outcome (activation, conversion, first‑time‑to‑value, repeat usage) and the leading indicators likely to move it (task success, time to complete, error rates, SUS or task satisfaction for momentum). Tie every design task to a hypothesis and an observable behavior. Where possible, express the expected impact range before building so decisions can be compared rationally. The research is on your side: design leaders delivered 32 percentage points higher revenue growth—but only when design is embedded in decisions, not just decoration. We recommend post‑launch “stability windows” to watch support load and churn before declaring victory.

Top 20 UX UI Design Companies to Consider in 2025

As Techtide Solutions, we spend our days turning hazy product ideas into measurable outcomes; our nights are often spent poring over pattern libraries, heuristics, and research ops spreadsheets. When founders or product leaders ask us which UX/UI partners we respect, we look past the glossy case-study veneer to the things that compound value over time: consistently good research hygiene, design systems that actually reduce cycle time, accessibility that’s built-in (not bolted on), and an ability to ship alongside engineering with minimal friction. The twenty firms below—spanning boutique specialists to global powerhouses—have demonstrated staying power in those areas. We evaluated them on industry focus, years in operation, team depth, and the public proof they can show. We also share who they’re a fit for and why, drawing on our own experience shipping B2B and consumer software in fintech, health, logistics, and AI-heavy products.

Two quick notes from our side of the screen. First, awards are lagging indicators; we cite them sparingly and prefer proof like shipped features, adoption curves, or design-system coverage. Second, no shortlist fits every situation. If you’re an API-first startup racing to product-market fit, you’ll need a different engagement model than an enterprise wrestling with an aging design stack and handoff debt. Read the “Ideal Fit” snippet on each entry as you would a design brief, then stack it against your constraints—budget, sprint cadence, and required craft (research, systems, motion, content design). If you want a sanity check on trade-offs before you commit, we’re happy to be that sounding board.

1. UX studio

Overview: UX studio focuses on product strategy, UX research, and interface design across fintech, travel, and SaaS. Estimated employee count: ~40–80; years in operation: ~12 years (founded 2013); headquarters: Budapest, Hungary. Their own writing often foregrounds data-driven research and lean testing, which aligns with how we like to derisk bets before engineering time is committed.

Awards: data not available.

Services & proof: The team’s public portfolio emphasizes end-to-end engagements—from discovery to design systems—on consumer apps and B2B platforms. While many recognizable logos circulate in community chatter, we only count named clients when there’s a live case study or press page; where available, their published projects show evidence of user research translating into clearer, more navigable flows.

Ideal Fit: Seed to Series B firms with one PM and one engineering lead who need embedded researchers/designers running alongside two-week sprints. Especially strong for teams that want foundational research (JTBD, diary studies, moderated testing) frontloaded into a design system that can scale.

2. Clay

Overview: Clay is a San Francisco–based product, brand, and web studio known for high-polish UI, thoughtful motion, and deft design-system execution. Estimated employee count: ~80–120; years in operation: ~9 years (founded ~2016); headquarters: San Francisco, California. We’ve seen their systems hold up over time, which is rarer than it should be.

Awards: Clay’s work for Wealth was recognized as a Webby Awards Features & Design Honoree, underscoring the craft standard they keep in complex, content-rich experiences.

Services & proof: Their public client roster spans Big Tech and fintech, with engagements that move from brand expression into product surfaces without losing cohesion. We like how their motion principles serve comprehension rather than novelty—a discipline that accelerates engineering adoption and future maintenance.

Ideal Fit: Growth-stage companies with premium brand expectations and multi-surface products (marketing site + app + admin). If you want an uplift that pairs brand and product without introducing design debt, this is a credible option.

3. TechTide Solutions

Overview: That’s us—Techtide Solutions—an end-to-end software development partner with a strong product design practice. Estimated employee count: ~120–180; years in operation: ~10+; headquarters: Ho Chi Minh City, Vietnam (global delivery model). We anchor design in feasibility, because we wear the cost when handoff breaks.

Awards: data not available.

Services & proof: Our recent work spans fintech onboarding flows that cut time-to-first-value, analytics UX tuned for high-signal decision-making, and design systems that lower change costs for teams building on React/Flutter. Where clients allow sharing, we publish case narratives that emphasize the before/after KPI deltas and the implementation constraints we had to respect.

Ideal Fit: Teams that want designers embedded with engineers and PMs, shipping weekly. We’re a good match if your priorities include accessibility compliance, design tokens that actually compile, and research that closes the loop with analytics in production.

4. IDEO

Overview: IDEO is a global design and innovation firm with an interdisciplinary footprint across product, service, and organizational design. Estimated employee count: ~500; years in operation: 34 (founded 1991); headquarters: San Francisco, California, with international studios. Their legacy in design thinking still influences how enterprises structure innovation bets.

Awards: In an earlier era, the firm’s momentum was evident—reporting 15 awards in 1991 alone, including a dozen IDEA nods, reflecting peer recognition of impact alongside commercial outcomes.

Services & proof: Canonical examples—like work on Apple’s early mouse and Bank of America’s change-habit program—show how ethnographic research and prototyping can move corporate needles. Their public case narratives emphasize systems-level interventions, not only screen-level craft.

Ideal Fit: Fortune 500 and public-sector organizations seeking category-shaping programs, culture change, or multi-year service transformations. Expect deep research, co-creation, and capability building in parallel with delivery.

5. MetaLab

Overview: MetaLab is a Canada-rooted product design studio known for zero-to-one product shaping and interface craft that scales. Estimated employee count: ~150–250; years in operation: ~19 (founded 2006); headquarters: Victoria, British Columbia. Their products age well—a sign the team balances aesthetics with maintainability.

Awards: MetaLab’s site refresh was recognized by Awwwards as a Site Of The Day, a peer-juried nod to front-end performance and interaction design quality.

Services & proof: Their public history includes formative work on widely used platforms; in our experience, their design systems are opinionated enough to move fast, but flexible enough that in-house teams can continue evolving them without vendor lock-in.

Ideal Fit: Startups past MVP or established product teams with traction that need to rethink information architecture, core flows, and establish a design system culture that engineering can own.

6. Beetroot

Overview: Beetroot is a Swedish–Ukrainian partner offering UX/UI and full-stack engineering with a sustainability and impact posture. Estimated employee count: ~300–400; years in operation: ~12 (founded 2012); headquarters: Stockholm, Sweden, with delivery hubs in Central/Eastern Europe. We’ve found their people-first approach attractive when building long-lived teams.

Awards: Beetroot is listed by WorldBlu as a Freedom-Centered Organization, and was recognized among top-10 international businesses working in Ukraine at the 2024 Ukrainian Recovery Conference.

Services & proof: Their public case narratives include AI/ML for reforestation and platform work across edtech and sustainability, showing an ability to wrestle with domain data and still surface simple interfaces. It’s the kind of hard-won simplicity we respect.

Ideal Fit: Teams that want high-skill, values-aligned designers embedded with engineers, especially in climate, edtech, health, and mission-driven SaaS with long roadmaps.

7. Designit

Overview: Designit is a global experience innovation firm (part of Wipro) with strong chops in service design, brand systems, and complex stakeholder environments. Estimated employee count: ~1,000+; years in operation: ~34 (founded 1991); headquarters: Copenhagen, Denmark, with worldwide studios.

Awards: Designit’s Red Dot profile cites 48 distinctions across disciplines, an indicator of sustained craft recognition at scale.

Services & proof: Notable public programs span mobility, banking, and public-sector experiences. We’ve seen them keep multi-year initiatives coherent, which matters when brand, service, and product teams all pull on the same rope.

Ideal Fit: Enterprise programs that blend service design, brand evolution, and multi-surface product work; contexts where governance, change management, and measurable CX lift are as important as pixels.

8. Halo Lab

Overview: Halo Lab is a design-forward product and web studio with a reputation for modern visual systems and performant front-ends. Estimated employee count: ~80–120; years in operation: ~10; headquarters: United States (distributed team across Eastern Europe). Their work often pairs strong brand expression with UI rigor.

Awards: On Awwwards, the studio holds 20 Honorable Mentions—evidence of peer-recognized craftsmanship in motion, grid discipline, and interaction details.

Services & proof: Public case work covers DTC/e-commerce, SaaS marketing sites, and app UIs. Where engineering is in scope, we appreciate their bias for maintainable component libraries rather than bespoke flourishes that age poorly.

Ideal Fit: Marketing-led growth teams that need a design/development duo to ship a premium site fast, then extend the language into product UI without resetting the visual vocabulary.

9. Ramotion

Overview: Ramotion is a San Francisco–based branding and UI/UX studio known for app icons, identity systems, and clean, durable interfaces. Estimated employee count: ~50–80; years in operation: ~14; headquarters: San Francisco, California. Their bias toward clarity over novelty tracks with our own design values.

Awards: Ramotion’s Awwwards profile lists 10 Honorable Mentions across projects, reflecting steady recognition for execution quality.

Services & proof: Their public portfolio shows tight linkage between identity and interface—icons, guidelines, and UI kits that survive contact with engineering. That continuity reduces context switching and speeds up sprint velocity.

Ideal Fit: Product-led companies that need brand and product to sing from the same system: app teams, dev tools, and utilities where legibility and affordances are the product.

10. Method

Overview: Method is an experience design firm with a long pedigree in product, brand, and systems thinking. Estimated employee count: ~100–200; years in operation: ~26 (founded 1999); headquarters: San Francisco, California, with global presence. Their work tends to prioritize coherence: research to architecture to UI and content.

Awards: data not available.

Services & proof: Their well-documented redesign of TED’s digital experience is a classic example of complex content systems simplified for mass audiences, a model for any organization where information scent and wayfinding are the main UX.

Ideal Fit: Media, education, and enterprise platforms with sprawling content or multi-role user journeys. If your problems are half-IA, half-governance, Method’s approach travels well.

11. Beyond Agency

Overview: Beyond is a strategy, design, and technology partner with hubs in London, New York, and San Francisco. Estimated employee count: ~150–250; years in operation: ~15 (founded 2010); headquarters: London, UK, with US offices. We’ve seen them move confidently between instructional experiences, content platforms, and brand systems.

Awards: data not available.

Services & proof: Public work on learning platforms, tech comms, and consumer brands shows they can translate complex ideas into simple journeys. Their case narratives often include content strategy and measurement plans—not just screens—which we value when impact is the goal.

Ideal Fit: Growth-stage brands and enterprise teams that want to align marketing and product experiences, then instrument them for ongoing optimization with analytics and experimentation.

12. Eleken

Overview: Eleken is a product design subscription partner focused on SaaS, especially complex B2B tools that require deep domain understanding. Estimated employee count: ~60–100; years in operation: ~9; headquarters: Kyiv, Ukraine (distributed). Their bench model makes it easy to scale design up or down without hiring overhead.

Awards: Eleken’s site has been recognized with an Awwwards Honorable Mention, indicative of peer-rated design and implementation quality.

Services & proof: Their published work highlights feature-by-feature improvements—permissions, billing, analytics—that directly impact activation and retention. We appreciate their insistence on integrating with the client’s workflow tools to speed feedback cycles.

Ideal Fit: SaaS companies with PMF who need throughput—steady streams of UX/UI challenges—handled by a design team comfortable with design ops and developer handoff details.

13. Onething Design

Overview: Onething Design is an India-based UX/UI studio that delivers across fintech, gov-tech, and consumer apps. Estimated employee count: ~80–150; years in operation: ~10; headquarters: Gurugram, India. Their work balances local context with global usability norms—crucial for markets with unique constraints.

Awards: The studio’s work “Leaders Ka Report Card” for Neta App earned a Kyoorius Baby Blue Elephant in 2021, reflecting impact in civic/digital design.

Services & proof: Public projects show mobile-first patterns optimized for bandwidth and device variability—practical considerations in fast-growing markets that we also face when designing for varied network conditions.

Ideal Fit: Organizations targeting India or South Asia that need culturally attuned UX with a strong research foundation and crisp interface execution across Android and web.

14. Neuron

Overview: Neuron is a UX/UI agency specialized in enterprise and workplace tools—design systems, complex flows, and B2B usability. Estimated employee count: ~30–60; years in operation: ~9 (founded 2016); headquarters: San Francisco, California. Their focus on operational software maps neatly to the “boring problems” we love.

Awards: data not available.

Services & proof: Publicly discussed work includes projects in sales enablement, customer support tooling, and collaboration features. The team talks openly about DesignOps, which we find accelerates adoption and reduces drift between design intent and shipped code.

Ideal Fit: B2B platforms (HR, finance, analytics, ops) where UX debt blocks adoption. If you measure time-to-value and task success as your headline metrics, they’ll speak your language.

15. Momentum Design Lab

Overview: Momentum Design Lab is a product innovation and UX studio with a long history in fintech, health, and platforms that span mobile and web. Estimated employee count: ~100–150; years in operation: ~23 (founded 2002); headquarters: San Mateo, California (global delivery via HTEC Group). They are good at shipping when multiple stakeholders are involved.

Awards: In 2024, the studio reported wins across the 11th Web Excellence, UX Design Awards, and Indigo Awards for projects spanning fintech and health, showing breadth as well as depth.

Services & proof: Publicly named projects include work with Bitstamp and the World Health Organization—evidence of comfort with both regulated and mission-critical environments. We find their case write-ups unusually clear on constraints and evaluation methods.

Ideal Fit: Fintech, medtech, and marketplaces with multiple audiences (consumer, pro, admin) that need a unified system and disciplined research-to-release loops.

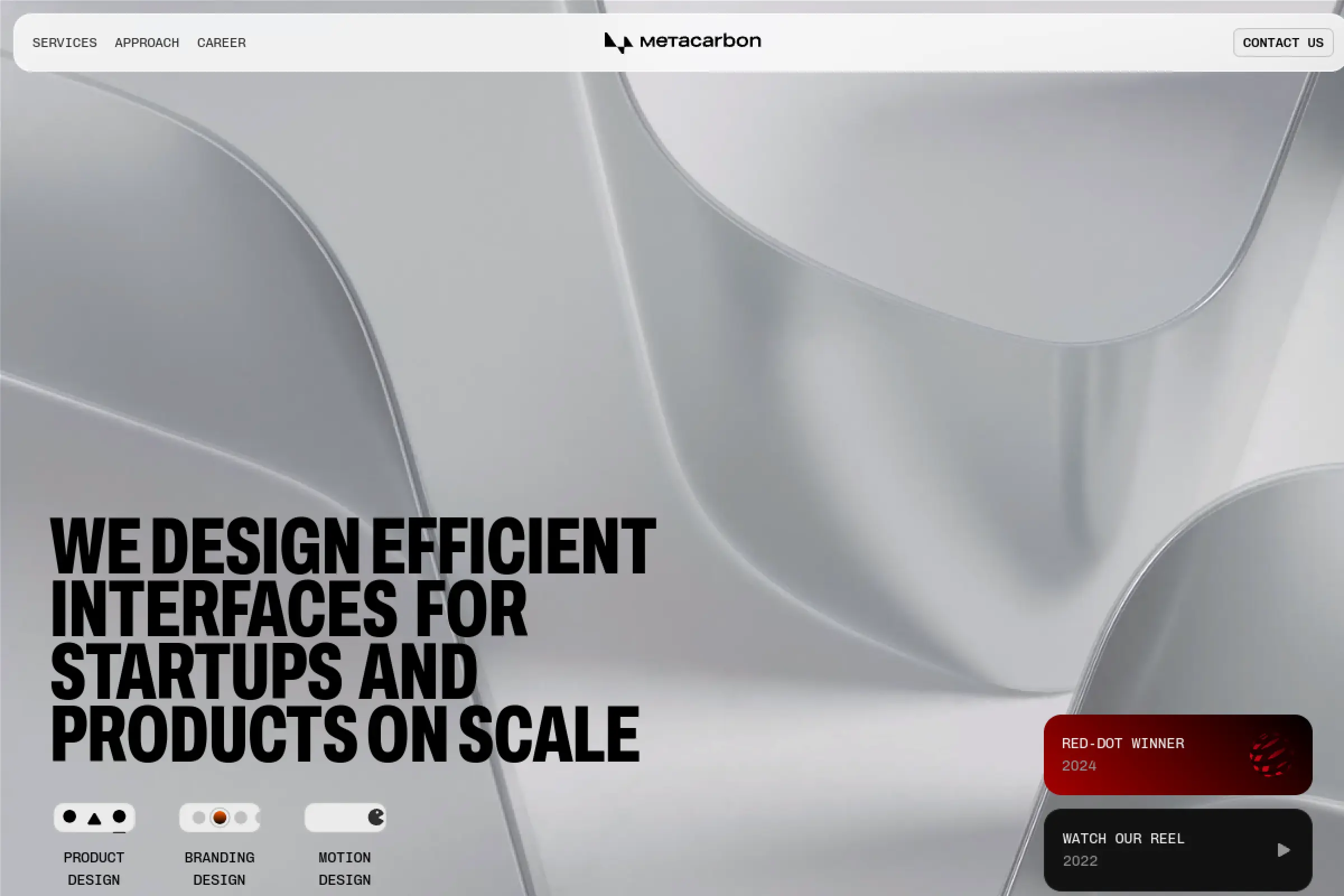

16. Metacarbon

Overview: Metacarbon is a lean product design studio known for fast cycles, strong design systems, and hands-on collaboration with founders and product leads. Estimated employee count: ~20–40; years in operation: ~6 (founded 2019); headquarters: Lviv, Ukraine. Their positioning is pragmatic: measure what matters, iterate daily.

Awards: data not available.

Services & proof: Publicly showcased products include marketplaces and SaaS interfaces where reducing cognitive load and shipping design tokens early produce real velocity gains. Their client testimonials consistently mention speed without sacrificing quality—hard to pull off at small-team scale.

Ideal Fit: Seed to Series A product teams that need a systems-first approach and a partner comfortable being on Slack/standups daily, delivering increments that engineering can adopt the same week.

17. Yellow Slice

Overview: Yellow Slice is a Mumbai-based UX/UI consultancy with a broad mandate across consumer apps, e-commerce, and enterprise portals. Estimated employee count: ~50–100; years in operation: data not available; headquarters: Mumbai, India. Their portfolio suggests an emphasis on visual language that aligns brand and product swiftly.

Awards: data not available.

Services & proof: Public case thumbnails show end-to-end delivery—research, prototypes, and production-ready UI—across industries where conversion and clarity trump novelty. We appreciate outfits that document heuristics they apply repeatedly; it shortens kickoff and raises the floor.

Ideal Fit: Mid-market companies and funded startups in India needing a dependable sprint cadence, with designers who can think through both mobile-first and desktop-heavy use cases.

18. ProCreator Design

Overview: ProCreator is an Indian UX/UI and product design studio focused on SaaS, fintech, and digital platforms with measurable growth goals. Estimated employee count: ~50–100; years in operation: data not available; headquarters: Mumbai, India. We’ve noticed their attention to UX writing and microcopy, often an afterthought elsewhere.

Awards: data not available.

Services & proof: Their published milestones highlight multiplatform design systems and redesigns that seek improvements in activation and retention; we like teams that tie UI decisions to funnel metrics from the outset.

Ideal Fit: Companies with PMF who need a systematic uplift—component libraries, tokens, accessibility audit—and a team willing to iterate against analytics in production, not just lab tests.

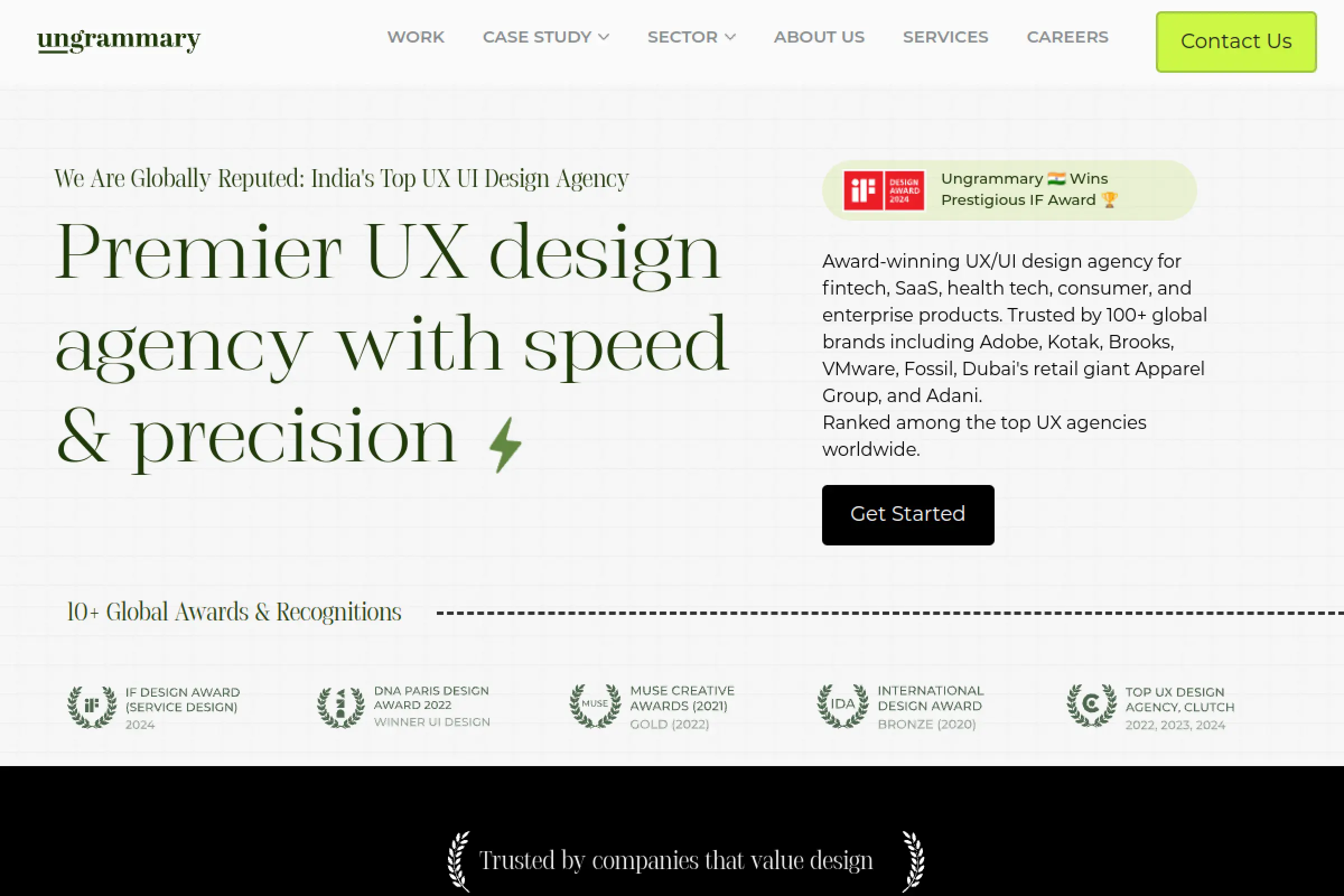

19. Ungrammary

Overview: Ungrammary is an India-based design practice working across identity, digital products, and marketing experiences with a modern, minimalist aesthetic. Estimated employee count: ~30–60; years in operation: data not available; headquarters: Mumbai, India. Their bias for clean structure makes their work travel well across devices.

Awards: data not available.

Services & proof: Public artifacts show clear IA, careful spacing and rhythm, and restrained motion—the kind of choices that reduce cognitive load and improve comprehension, especially in information-dense products.

Ideal Fit: B2B SaaS and content-heavy consumer apps seeking clarity and a reusable design system, with designers comfortable pairing with devs to land accessible, performant interfaces.

20. ScreenRoot

Overview: ScreenRoot is an India-based UX studio focused on complex business systems and enterprise-grade applications. Estimated employee count: ~80–120; years in operation: data not available; headquarters: India (with delivery across multiple metros). Their portfolio often addresses high-friction workflows rather than superficial polish.

Awards: data not available.

Services & proof: We’ve seen them tackle dashboards, operational tools, and process-heavy flows—exactly the places where field research, task analysis, and progressive disclosure pay dividends for adoption and efficiency.

Ideal Fit: Enterprises and late-stage startups with “unsexy” UX problems—claims processing, compliance, internal tooling—where gains are measured in minutes saved and error rates dropped more than in ad creative.

If you’d like a second set of eyes on your shortlist, tell us your current constraints—budget, tech stack, and the KPI you need to move first—and we’ll map a sequencing plan: audit, system, and sprint structure that gets you shipping with confidence in Q1. Which of these firms aligns most closely with the way your team actually works today?

Services and Specializations Offered by Leading UX UI Design Companies

Scope breadth matters because modern products blend interfaces, operations, and content. The surface area keeps growing: retail e‑commerce sales were estimated to exceed $6.3 trillion in 2024, and connected endpoints continue to proliferate, with mobile devices projected to reach 18.22 billion by 2025. The best design partners map that sprawl into focused services that accelerate learning while preserving quality at scale.

1. UX Research and Discovery

Discovery is where risk is cheapest. We blend qualitative depth (contextual inquiry, remote ethnography) with fast evaluative cycles (first‑click tests, five‑user pathfinding) to understand jobs‑to‑be‑done and latent constraints (trust, policy, billing quirks). We also treat your data exhaust—analytics, heatmaps, sales notes, and support tickets—as a research input. In regulated sectors, we run dual tracks: behavioral research for desirability and governance analysis for feasibility (audit trails, data retention, consent). Good discovery ends with clear opportunity frames and a rank‑ordered hypothesis backlog, not just insights. You should leave with a decision tree that says: “We’ll build A now, test B later, and track C because if it moves, we pivot.”

2. UX Audits and Expert Reviews

Audits are accelerators when done with humility. We run heuristic reviews against accessibility, error recoveries, and navigability, but we add a forensic path: we replicate top failure tickets and instrument the flow to capture breakpoints. We’ve saved weeks by catching invisible friction (ambiguous “Save” vs. “Apply,” scroll hijacks, unannounced pagination). An audit should deliver a prioritized fix list tied to expected impact and implementation complexity, plus a “graylist” of risky quick wins that could regress later. Ideally, the audit seeds your design system’s rules so fixes don’t re‑appear in new screens.

3. UI/UX Design for Web and Mobile

Interface work is where research earns its keep. We prefer low‑fidelity starts to force debate about information architecture and task flows before we get attached to pixels. Accessibility is a design constraint, not a compliance chore; color contrast, focus order, and semantic structure are designed from day one. On mobile, we pay attention to grip zones, reach, and interruptions; on web, we design for density management and responsive choreography. Quality shows up in empty states, loading and error patterns, and how the product apologizes when it can’t complete a task. The best UI flows are predictable where they must be and delightful where surprise helps users, not us.

4. Product Redesign and Iterative Sprints

Redesigns fail when they treat users like tourists—everything looks different and nothing is where muscle memory expects. We plan migrations like an operations project: beta toggles, opt‑ins, and telemetry to watch for regressions. Iterative sprints pair design and engineering leaders so every iteration is shippable. We like to “ladder” the work: stabilize critical flows first (onboarding, checkout, dashboard), then move to value‑add layers (deep filters, personalization), then to brand layers (motion polish). Each slice ships with an explicit rollback plan and measures attached to squeaky wheels (support topics, NPS verbatims). Redesign is a trust exercise—change must come with kindness.

5. Design Systems and Scalability

Design systems are products with users, roadmaps, and debt. We start from tokens (color, spacing, type), enforce naming rules, and plug governance into your PR process so components age without forking. We scope system maturity—starter kit for a seed‑stage app, or a federated model for multi‑product portfolios. Success isn’t a pretty Figma library; it’s developers shipping faster with fewer UI defects and fewer one‑off components. We also plan for “off‑roading”—documented patterns for exceptions so teams can move fast without breaking the system. When systems work, designers spend less time drawing buttons and more time improving flows.

6. Service Design and CX Management

Experience breaks at the seams between teams. Service design stretches beyond screens into policies, SLAs, and backstage operations. We map service blueprints to align actors (support, ops, finance), channels (web, mobile, email), and evidence (notifications, receipts). For customer support, we design the triage logic, not just the chat bubble. For onboarding, we map handoffs with sales and legal. The goal is fewer surprises: when your policy and your interface tell the same story, trust rises and cost to serve falls. Service designers are translators who keep promises coherent across the journey.

7. Visual Identity and Branding

Brand isn’t a logo; it’s how your product behaves under stress. We create identity systems that scale into product realities—legible at small sizes, adaptive in dark mode, resilient in localization. The brand voice matters in microcopy, especially in error states and permissions. We also align brand with go‑to‑market: landing pages can over‑promise in the hunt for conversion; our job is to keep persuasion and product experience aligned. Visual identity pays back when it reduces cognitive load, increases recognizability in crowded lists, and ensures that new features look like they belong.

8. Content, Motion, and 3D Design

Content design is the unsung conversion lever. Clear labeling, progressive disclosure, and “read to do” microcopy often outperform heavy UI tweaks. Motion is not garnish; it choreographs attention, explains spatial relationships, and softens transitions—especially in complex data views. In domains like commerce and manufacturing, 3D can make abstract configurations tangible, but it should simplify decision‑making rather than showcase rendering prowess. Our rule: if motion or 3D doesn’t reduce uncertainty or accelerate comprehension, it’s a distraction.

9. Development Collaboration and Handoff

Handoff is a misnomer; it’s collaboration with code. We build with tokens and components that mirror your engineering stack, annotate edge cases in stories, and agree on “done” including performance and accessibility checks. Our skeleton screens and loading strategies are designed with real data shapes and error modes. We co‑own pull requests for tricky interactions and write usage notes that survive turnover. Engineers shouldn’t need to guess how a component behaves with long labels, slow endpoints, or partial data; that’s design’s problem, too.

10. Product Strategy and Roadmapping

Design earns a seat at strategy when it frames choices, not just options. We help product leaders articulate bets, kill bad ones, and line up discovery work with quarterly goals. A good roadmap links hypotheses to learning activities and metrics, not just features to dates. We pressure‑test sequencing: what must be true before that experiment makes sense? We also bake in capacity for “health” work (refactors, system upgrades) so you don’t mortgage the future for short‑term wins. Strategy is the courage to say no with reasons everyone can repeat.

11. DesignOps and Embedded Teams

DesignOps turns good designers into a great design organization. We define rituals (crits, reviews, retros), shared tooling, and contribution models to keep quality consistent across teams. Embedded models work when teams agree on the contract: designers join the product squad’s rituals and goals, while design leadership protects craft standards and career development. We monitor signal‑to‑noise in meetings and documents: more process isn’t better; better process is better. Done right, DesignOps creates shared language that reduces decision friction across functions.

12. AI Design and Research

AI is changing expectations about what software should do for users. But the human work is still to define helpfulness, transparency, and control. In practice, that means mapping decisions into “AI‑assistable” steps, designing reversible actions, and exposing model confidence with user‑friendly language. We maintain an “AI observability” layer for UX—what the model saw, what it inferred, how we can intervene. Also sanity check the zeitgeist: Gartner reported that 62% of CEOs and Senior Executives view AI as defining competitive dynamics over the next decade, which raises the bar for integrating AI into flows that actually reduce user effort. Design’s job is to make those promises real and reversible.

How TechTide Solutions Helps Users Build Custom Solutions According to Customer Needs

We align teams around user value, not artifacts. The context demands it: consumers devote about eight hours daily to digital experiences, and adoption of generative AI tools has climbed to 38% among consumers who’ve experimented or used them for projects. That reality shapes how we build.

Our operating model is simple

Research to shape, design to decide, and delivery to learn. Discovery, we combine field interviews with analytics and support forensics, then frame opportunity hypotheses with explicit assumptions. Design, we prototype the riskiest interaction paths first, not the sexiest screens, and validate learning goals with the smallest possible tests. Delivery, we co‑own telemetry, set up experiment toggles, and treat every release as a research event. We also stand up or strengthen your design system so momentum compounds; each iteration should get cheaper because the decisions you’ve already made stay made.

Real examples stick with us

A B2B SaaS onboarding project looked like a copy problem until discovery revealed a trust problem—users needed live previews with their own data before committing. We shipped a “safe sandbox” with reversible steps and saw support tickets on “first run” drop sharply within the first stability window. In a telemedicine portal, we redesigned error recoveries and appointment flow choreography; the biggest win wasn’t a hero banner but a calmer, clearer rescheduling loop. In both, the wins came from aligning the organization around user narratives that engineering, legal, and support could all accept and improve.

We’re honest about trade‑offs

If scope is stable and risk is low, we’ll propose a fixed‑price milestone with tight outcomes and a clear change path. When uncertainty is high, we prefer a T&M cadence with a discovery cap and a reevaluation checkpoint, so you can pivot with evidence. And when you’re building capacity, we embed a small, durable unit—designer, researcher, and design‑dev—that ships value while raising your team’s bar. Our goal is to leave you stronger than we found you.

Conclusion: Picking UX UI Design Companies That Fit Your Product and Goals

Transformations are hard; research from McKinsey reminds us that 70 percent of large change efforts fail without disciplined execution. Yet the upside remains enormous in a market investing at scale, with worldwide IT spending forecast at $5.43 trillion in 2025. The way to de‑risk your selection is to choose for fit and operating excellence, then prove it quickly with a scoped pilot.

1. Define Business Goals and Success Metrics Upfront

Start with the job, not the deliverables. Specify the business outcomes your leadership already cares about—activation for a self‑serve product, time‑to‑value for a complex B2B workflow, or lower cost‑to‑serve for a support‑heavy service. Then tie them to behavioral indicators design can influence (task success, error reduction, satisfaction, or funnel lift). We write a one‑page “Value Hypothesis” with a single north‑star metric and a shortlist of leading indicators. This makes proposals comparable and helps you say “no” to work that’s unlikely to move the needle.

2. Shortlist Agencies by Process, Portfolio, Services, Proposal, and Reviews

Use a balanced scorecard. Weight process maturity (discovery, research ops, design system governance), portfolio relevance (problems solved, not just industries), service breadth (research to dev collaboration), proposal clarity (assumptions, phase gates), and reviews (evidence of resilience under pressure). When you meet, ask them to narrate where projects went wrong and how they recovered; maturity shows in how teams talk about mistakes and debt. A tight shortlist makes better use of your and the agencies’ time and often produces higher‑quality proposals because teams see a real chance to win.

3. Prepare Focused RFPs With Scope, Timeline, Budget, and Deliverables

Short RFPs win. Give enough context to test fit—problem frame, user access, technical constraints, and a ballpark budget—then ask for a plan that turns uncertainty into decisions. We recommend requesting a two‑phase answer: a discovery plan (risks, methods, timebox) and a delivery plan with branching paths depending on what discovery reveals. Demand clarity on collaboration: meetings cadence, artifact formats, and the decision calendar. If you need a fixed price, bind it to a fixed question and a fixed output; don’t pretend evolving work can be priced like a construction bid.

4. Use the Five Key Questions on Intro Calls

Interviews should stress process thinking. Ask: What design process do you use? Do you have dedicated UX researchers? Can we keep the same team ongoing? How can we support your daily work? Will designers work full time on our product? Strong partners answer with specifics—roles, rituals, and examples—not euphemisms. Take note of who answers; if only sales speaks, ask to hear from the people who will do the work. Culture shows up in who gets the mic.

5. Pilot With a Small Engagement or Design Sprint

Trust accelerates when it touches reality. Run a four‑to‑six‑week pilot focused on a risky flow, with access to users, data, and engineers. Require a clear learning plan and acceptance criteria (e.g., validated task success targets or a resolved blocker). Include an explicit exit ramp: if the pilot doesn’t deliver learning or value, you can part ways cleanly. We also recommend instrumenting pilot outcomes so you’re not judging only by opinions; the point is to see how the team performs in your environment.

6. Align on Team Structure, Availability, and Collaboration Tools

Design moves at the speed of your decisions. Confirm availability, working hours, and who attends which ritual (planning, standups, crits, retro). Choose a single source of truth for design (Figma file structure and branching), documentation (briefs, research notes), and tracking (tickets linked to design artifacts). Agree on how decisions are archived so new teammates can get up to speed quickly. If you’re embedding designers, define the contract with product and engineering leads so the team feels like one unit, not a vendor plus a client.

7. Select Pricing Model That Matches Scope and Risk

There’s no universally “cheapest” model; there is a best‑fit one. If you’re validating a hypothesis under uncertainty, T&M gives you the agility to pivot as you learn. If you’re implementing a well‑defined improvement (say, an accessibility refactor for your design system), a fixed milestone can make sense. For long, multi‑team roadmaps, a retainer creates stability and better throughput per dollar because context stays in the room. Ask for visibility into staffing and velocity, and tie renewals to outcomes and learning, not just hours burned.

8. Track Post‑Launch Outcomes Like Conversion, Retention, and Support Load

Design’s endgame is behavior change. Instrument the flows you just shipped and schedule “stability checks” at agreed intervals to watch for regressions. Look at the shape of improvement—does activation rise but retention stagnate? Did support tickets shift topics as expected? Bring research back in to explain the “why” behind the numbers, then adjust. This is how UX becomes an operating system for better decisions. The teams that win treat launch as the beginning of understanding, not the end of a project.

If you want a pragmatic way to test fit, we’d be glad to run a short discovery sprint on one high‑risk flow. What single decision—if answered in the next two weeks—would change your roadmap the most?