Market overview: The latest global payments research still describes an industry anchored by $2.4 trillion, and that gravity pulls every product roadmap toward reliability. At Techtide Solutions, we treat payments as critical infrastructure, not a “checkout feature.” That posture changes how we design systems, run incident drills, and prioritize observability. It also changes how we read trend reports. We read them like architects, not tourists.

Understanding payment trends shaping 2025–2026

Market overview: Even conservative strategy shops admit the pool is enormous, with BCG pointing to $1.6 trillion in payments revenues, and scale always amplifies small design choices. In our view, this cycle is less about shiny payment methods. It is more about how money moves, how identity travels, and how risk gets priced. The winners will make complexity invisible without making control impossible. That is a narrow engineering path.

1. From “how to pay” to “how money moves” across consumer, business, and government payments

Payments used to be a channel decision. Now it is a system decision. The best teams model money movement end-to-end, including authorization, settlement, exceptions, and reversals. In our builds, the “ledger first” mindset prevents painful reconciliation later. Product leaders also need a language for funds flow. Without it, every incident becomes a debate about definitions.

Government disbursements, payroll, refunds, and B2B settlement also shape consumer expectations. That convergence matters. A customer does not care if a delay was “bank side.” They only see a broken promise.

2. Competing payment rails and regional payment systems reshaping global interoperability

Cards remain dominant in many markets, yet alternative rails keep winning share in specific journeys. Regional instant transfer systems set new norms for speed and confirmation. Interoperability becomes both a product feature and a geopolitical constraint. We see it in routing logic, compliance checks, and even error message design.

Our practical rule is simple. Build a “rail abstraction” early. Otherwise, every new market expansion becomes a rewrite disguised as integration.

3. AI-driven change: agentic commerce, smarter routing, and automation in payment operations

AI changes payments in two places at once. It changes the customer interface through assistants. It also changes back-office operations through automation. The second shift is less visible, yet it is usually more valuable. Routing, retries, and dispute triage are ideal for structured decisioning.

We prefer “human-directed automation.” That means clear policies, audit trails, and safe fallbacks. When AI touches money movement, “explainability” becomes a reliability feature.

4. Digital assets and stablecoins moving from experimentation toward regulated use cases

Stablecoins are no longer only a crypto topic. They are a treasury topic. They also force clearer thinking about settlement finality. In cross-border corridors, teams chase speed and fee predictability. Stablecoins can offer both, but only with strong compliance controls.

Related Posts

- Top 30 WordPress Alternatives for Faster, Safer Websites in 2026

- Top 30 Online Payment Methods for Ecommerce and Digital Businesses

- Top 30 free html editors to Build, Preview, and Publish Web Pages

- Top 30 Best CMS Hosting for WordPress Picks and Selection Criteria for 2026

- Top 10 WordPress Website Design Companies for Custom WordPress Sites in 2026

Our viewpoint is cautious optimism. Use stablecoins for defined flows first, like supplier payouts. Avoid mixing speculative exposure into payment operations.

5. Cash declines, but checks and mixed payment portfolios persist in business payments

Cash declines unevenly, and businesses still carry mixed portfolios. Checks persist because they encode a workflow, not because they are “good payments.” Many firms still need approvals, remittance details, and paper-like audit comfort. Modernization succeeds when digital rails replicate those control points. Otherwise, users quietly route around the new system.

In implementations, we map the “why” behind each legacy method. That map becomes the migration plan. Removing a tool without replacing its function invites shadow processes.

6. Data standards and modernization pressure, including ISO 20022 migration needs

Modern payments are as much data as they are money. Richer metadata enables automated reconciliation and better fraud detection. That also raises the bar for data governance. Field-level validation becomes a frontline control. Small parsing mistakes can cascade into settlement and reporting issues.

We recommend treating message translation as product code, not glue code. Schema versioning, contract tests, and backward compatibility planning reduce late surprises. Clean data turns operations from reactive to predictive.

7. Embedded finance and platform-led payments as a growth engine across industries

Platforms increasingly monetize payments as part of the workflow. The “embedded” angle is not magic. It is distribution, context, and better conversion. In practice, platform-led payments win when they remove steps. They also win when they reduce administrative work.

From our side, embedded payments require clean separation of concerns. Identity, authorization, and accounting must remain portable. Otherwise, the platform becomes a lock-in trap for its own teams.

8. Trust as infrastructure: digital identity, authentication, and fraud defense as core capabilities

Trust is built from small, repeated confirmations. Authentication is one piece. Authorization checks are another. Fraud defense also includes user messaging, support workflows, and refund posture. We see trust as infrastructure because it must be engineered and monitored.

A strong trust stack includes device signals, behavioral signals, and velocity controls. It also includes post-incident learning loops. Teams that ship payments without a fraud feedback pipeline will relearn the same lessons.

Quick Comparison of payment trends

Market overview: The investment climate shapes tooling choices, and CB Insights notes fintech funding landing at $33.7B, which pushes buyers toward consolidation. We advise teams to pick platforms that match their operating model, not their aspirational architecture. The “best tool” is often the one your team can observe and govern. Integrations that look simple at contract time can become brittle in production. The table below captures ten common picks we see in real projects.

| Tool | Best for | From price | Trial/Free | Key limits |

|---|---|---|---|---|

| Stripe | Fast iteration, broad APIs | Usage-based | Sandbox | Complex routing needs extra work |

| Adyen | Global acquiring, unified commerce | Custom quote | Test environment | Onboarding can be rigorous |

| Checkout.com | International cards, performance tuning | Custom quote | Sandbox | Coverage varies by region |

| PayPal Braintree | Wallet access, quick launch | Usage-based | Sandbox | Less control over some wallet UX |

| Square | Omnichannel for smaller merchants | Usage-based | Demo tools | Enterprise edge cases need planning |

| Worldpay | Scale acquiring and processing | Custom quote | By request | Integration experience can vary |

| Nuvei | Alternative methods and marketplaces | Custom quote | Sandbox | Method availability differs by country |

| Plaid | Bank linking and verification | Usage-based | Sandbox | Coverage depends on institution support |

| Marqeta | Card issuing and controls | Custom quote | Sandbox | Program management adds overhead |

| AWS (payments workloads) | Event-driven scale and observability | Consumption-based | Free tier options | Security ownership stays with you |

Selection principle: we want one control plane for money movement. That control plane spans routing, risk policy, and reconciliation. A provider can supply pieces, but ownership still matters. In our experience, teams regret “feature shopping” later. They rarely regret investing in clean abstractions early.

Top 30 payment trends tools and services to watch in 2025–2026

We picked these 30 services because they shape how money moves, gets authorized, gets settled, and gets safeguarded. Some are rails. Others are wallets, gateways, fraud stacks, or the hardware that touches the card. The scoring is outcome-first, not feature-first. We ask one question: how quickly can a real team ship a safer, smoother payment experience?

Each tool gets a weighted score on seven criteria. Value-for-money and feature depth carry the most weight, because budgets and capability decide roadmaps. Ease of setup matters, because “later” is where projects go to stall. Integrations get their own weight, because payments live inside a messy stack. UX, security, and support round it out, since reliability and trust are the product.

We keep reviews frank. We call out deal-breakers, vague pricing, and common implementation traps. If a tool is “enterprise,” we treat contracts and compliance work as part of the cost. If a tool is “consumer,” we focus on adoption friction and merchant reach.

1. Mastercard

Mastercard is a global card network with deep product, risk, and data teams. Its strength is not a single dashboard. It is the combination of acceptance reach, rules, and risk tooling that sits behind the swipe.

Tagline: Turn “can you pay?” into “paid, protected, and recognized.”

Best for: enterprise merchants, fintech product teams managing card acceptance at scale.

- Network rails and rules → higher approval rates with fewer edge-case failures.

- Risk and identity programs → cut manual review steps across recurring payments.

- Issuer and acquirer connectivity → reach first value in weeks, not quarters.

Pricing & limits: From $0/mo to adopt as a merchant via an acquirer. Trial: N/A. Caps: commercial terms, geography, MCC rules, and program eligibility set the real limits.

Honest drawbacks: You do not “self-serve” Mastercard the way you self-serve SaaS. Control often sits with acquirers and issuers, so experimentation can feel slow.

Verdict: If you need global acceptance and durable trust signals, this helps you stabilize payments and reduce declines over a quarter. Beats niche wallets on reach; trails Stripe on developer-first iteration speed.

Score: 4.4/5 and .

2. Visa Consulting & Analytics

Visa Consulting & Analytics sits inside Visa’s broader payments ecosystem. The team blends payments domain experts with analytics practitioners. The value is pattern recognition at network scale.

Tagline: Make payment strategy decisions with fewer guesses and faster payback.

Best for: banks, large merchants, and fintech exec teams planning major payment shifts.

- Market and portfolio analysis → prioritize the initiatives that move approval and spend.

- Benchmarking and modeling → save weeks of internal spreadsheet cycles per decision.

- Engagement playbooks → reach first value after kickoff, often within 2–6 weeks.

Pricing & limits: From $0/mo to start discussions; engagements are quote-based. Trial: N/A. Caps: scope, data availability, and regulatory constraints define deliverables.

Honest drawbacks: It is not a product you “turn on” for daily operations. Deliverables can be high-level if your data access is limited.

Verdict: If you need to choose a payments direction with confidence, this helps you de-risk bets and align stakeholders in a month or two. Beats generalist consultants on payments context; trails in-house teams on company-specific nuance.

Score: 4.0/5 and .

3. Worldline

Worldline is a payments processor and services provider with teams across acquiring, issuing, and acceptance. Its footprint is especially relevant for multi-country commerce. The core promise is operational scale without rebuilding your own stack.

Tagline: Consolidate payments processing so expansion stops feeling like reinvention.

Best for: mid-market to enterprise merchants, platforms expanding across regions.

- Acquiring and processing services → launch new markets with fewer local rebuilds.

- Omnichannel acceptance options → reduce channel-specific workstreams by one to two sprints.

- Implementation programs → reach first value in 4–12 weeks, depending on scope.

Pricing & limits: From $0/mo base on many plans; processing fees are contract-based. Trial: N/A. Caps: country coverage, risk appetite, and underwriting timelines are the usual limits.

Honest drawbacks: Contracting can be heavy for smaller teams. Reporting and tooling may feel less “developer-native” than modern APIs.

Verdict: If you want one processor to support multi-market growth, this helps you standardize acceptance and reduce operational sprawl within a quarter. Beats cobbling local providers together; trails Stripe on self-serve speed.

Score: 4.0/5 and .

4. Apple Pay

Apple Pay is Apple’s wallet layer, backed by platform and security teams. It lives inside devices people already trust daily. The leverage comes from biometric confirmation and stored credentials.

Tagline: Turn checkout into a two-tap “done” moment on Apple devices.

Best for: ecommerce teams, mobile product teams optimizing conversion on iOS.

- Biometric wallet checkout → reduce form-fill friction and cart abandonment.

- Tokenization with network support → cut risky data-handling steps for your team.

- Familiar UX patterns → reach first value in days once your PSP supports it.

Pricing & limits: From $0/mo; transaction fees depend on your processor and card terms. Trial: N/A. Caps: only works where Apple Pay is available and on compatible devices.

Honest drawbacks: You cannot force adoption outside the Apple ecosystem. Custom checkout flows are constrained by platform rules.

Verdict: If you want higher mobile conversion with less fraud exposure, this helps you ship a faster checkout in a sprint. Beats manual card entry on speed; trails some local wallets on regional coverage.

Score: 4.3/5 and .

5. Google Pay

Google Pay is Google’s wallet and payments surface across Android and the web. Product and platform teams focus on identity, security, and merchant acceptance. The real advantage is reach across Google’s ecosystem.

Tagline: Make paying feel native across Android, Chrome, and Google surfaces.

Best for: app-first merchants, marketplaces, and teams with heavy Android traffic.

- Stored payment credentials → speed repeat purchases and reduce checkout drop-off.

- Processor-friendly integrations → remove several custom vaulting steps for engineers.

- Recognizable UX → reach first value within days on common payment stacks.

Pricing & limits: From $0/mo; standard processing fees come from your PSP. Trial: N/A. Caps: availability varies by country, device, and merchant configuration.

Honest drawbacks: Branding and flow control are limited. Support paths can feel indirect if you integrate through intermediaries.

Verdict: If Android conversion is a priority, this helps you shorten checkout and lift repeat payments within weeks. Beats raw card fields on speed; trails Apple Pay on consistency across a single hardware ecosystem.

Score: 4.1/5 and .

6. PayPal

PayPal blends a consumer wallet with merchant payment acceptance. The teams behind it cover risk, disputes, and cross-border payments. The platform’s advantage is familiarity for many buyers.

Tagline: Convert more shoppers by letting them pay the way they already trust.

Best for: SMB ecommerce, DTC brands, and marketplaces wanting fast wallet adoption.

- Wallet checkout → reduce guest checkout friction and increase completed orders.

- Buyer authentication and risk tooling → save manual review time on suspicious orders.

- Quick buttons and plugins → reach first value in hours on common storefronts.

Pricing & limits: From $0/mo; fees are typically per transaction and vary by product. Trial: N/A. Caps: account holds, dispute exposure, and payout timing are practical limits.

Honest drawbacks: Dispute processes can be stressful for merchants. Account limitations and reserves can disrupt cash flow during spikes.

Verdict: If you need a recognized pay option fast, this helps you add trusted checkout and accept payments within a day. Beats lesser-known wallets on buyer comfort; trails Stripe on unified developer control.

Score: 4.0/5 and .

7. Venmo

Venmo is a consumer-focused P2P app under PayPal, supported by payments and risk teams. Its cultural footprint helps it spread by habit. For merchants, the appeal is meeting customers where they already are.

Tagline: Let customers pay in a familiar social-first wallet experience.

Best for: US-focused ecommerce, youth-skewing brands, and event-driven sellers.

- Venmo at checkout → reduce “where’s my card” friction for mobile buyers.

- Shared PayPal rails → save integration steps if you already run PayPal.

- Simple enablement paths → reach first value in days through supported platforms.

Pricing & limits: From $0/mo; merchant fees are typically per transaction. Trial: N/A. Caps: US usage focus and eligibility rules limit global strategies.

Honest drawbacks: It is not a universal wallet internationally. Some buyers still prefer card rewards or BNPL options.

Verdict: If your audience already uses Venmo, this helps you remove checkout hesitation and collect money faster within weeks. Beats bank transfers on ease; trails Apple Pay on device-level biometric flow.

Score: 3.8/5 and .

8. Zelle

Zelle is a bank-backed P2P transfer network in the US. The teams behind it focus on bank integrations and fraud controls. The core value is fast transfers between participating bank accounts.

Tagline: Move money bank-to-bank fast, with fewer middle steps.

Best for: US consumers, and some SMBs that invoice and get paid via bank apps.

- Bank-native transfer flow → reduce “download another app” friction for payers.

- Wide bank participation → save onboarding steps compared with niche transfer tools.

- Familiar bank UX → reach first value the moment both sides are enrolled.

Pricing & limits: From $0/mo for most consumers; business availability varies by bank. Trial: N/A. Caps: sending limits, bank policies, and fraud controls shape throughput.

Honest drawbacks: It is not built for rich merchant checkout experiences. Chargebacks are not a thing here, so mistakes can be hard to unwind.

Verdict: If you need fast bank transfers for simple pay-and-receive use cases, this helps you collect funds quickly without card rails. Beats checks on speed; trails card acceptance on buyer protections and ecommerce fit.

Score: 3.6/5 and .

9. FedNow Service

FedNow is the Federal Reserve’s instant payments service. The teams around it emphasize resilience, settlement, and bank connectivity. Its role is foundational, not flashy.

Tagline: Enable instant account-to-account payments with central-bank settlement.

Best for: US financial institutions, fintechs partnering with banks for real-time payouts.

- Instant payment rail → deliver payouts in minutes, not next business day.

- Bank integration ecosystem → reduce bespoke bank-by-bank settlement workflows.

- Operational readiness tooling → reach first value in months, once your bank connects.

Pricing & limits: From $0/mo to evaluate; network and participation costs vary by institution. Trial: N/A. Caps: bank participation, message types, and risk controls limit use cases.

Honest drawbacks: Your product timeline depends on bank partners. Real-time fraud controls must mature, or losses can move faster too.

Verdict: If you want instant payouts with settlement finality, this helps you modernize disbursements over one to two quarters. Beats ACH on speed; trails card push-to-card on ubiquity today.

Score: 4.1/5 and .

10. The Clearing House RTP Network

The Clearing House RTP Network is a US real-time payments rail run by the bank-owned Clearing House. Product and ops teams focus on uptime, messaging standards, and bank onboarding. It is built for immediate movement of funds.

Tagline: Send and receive real-time payments that clear in seconds.

Best for: banks, treasury teams, and platforms that need instant B2B payments.

- Real-time push payments → reduce DSO by moving cash faster.

- Messaging and request-for-payment patterns → cut reconciliation steps for finance teams.

- Bank connectivity paths → reach first value in months, once participants are live.

Pricing & limits: From $0/mo to explore; participation and per-message fees depend on partners. Trial: N/A. Caps: network rules, participant coverage, and limits per payment apply.

Honest drawbacks: Coverage is not universal across every bank. Product design must plan for fallbacks when recipients cannot receive RTP.

Verdict: If you want instant money movement with richer payment data, this helps you speed settlement and reconciliation within a quarter or two. Beats wires on cost and speed; trails ACH on universal reach.

Score: 4.1/5 and .

11. Payments Canada Real-Time Rail

Payments Canada’s Real-Time Rail is part of Canada’s payments modernization agenda. The teams involved coordinate banks, standards, and core infrastructure partners. The promise is real-time account-to-account payments at national scale.

Tagline: Bring instant payments to Canada with a modern national rail.

Best for: Canadian financial institutions, fintechs planning real-time pay-ins and payouts.

- Real-time payment capability → reduce settlement delays for consumers and SMBs.

- Standards-based messaging → save custom data-mapping steps across partners.

- Centralized rail onboarding → reach first value after institutional rollout milestones.

Pricing & limits: From $0/mo to track and plan; production access is institution-led. Trial: N/A. Caps: timing, participant readiness, and mandated requirements define limits.

Honest drawbacks: Delivery schedules and access depend on ecosystem coordination. Early product plans need fallbacks until coverage is broad.

Verdict: If you build for Canadian real-time payments, this helps you prepare for instant settlement and better data flows over the next few quarters. Beats legacy batch rails on immediacy; trails mature real-time systems on today’s availability.

Score: 3.7/5 and .

12. SWIFT

SWIFT is a global messaging network used by financial institutions worldwide. Its teams focus on standards, interoperability, and operational resilience. The value is global reach for cross-border financial communication.

Tagline: Move cross-border payment instructions with shared standards and control.

Best for: banks, treasury operations, and enterprises managing international payments.

- Standardized financial messaging → reduce translation errors across correspondent chains.

- Directory and reference data patterns → save manual routing checks during operations.

- Institutional onboarding model → reach first value in months, not days.

Pricing & limits: From $0/mo to learn; connectivity and message costs are institution-specific. Trial: N/A. Caps: membership requirements, sanctions compliance, and bank capabilities set boundaries.

Honest drawbacks: This is not a plug-and-play merchant payment tool. Transparency and speed still depend on correspondent banking realities.

Verdict: If you need dependable global financial messaging, this helps you standardize cross-border operations over a quarter or two. Beats ad hoc bilateral links on scale; trails local instant rails on speed.

Score: 4.2/5 and .

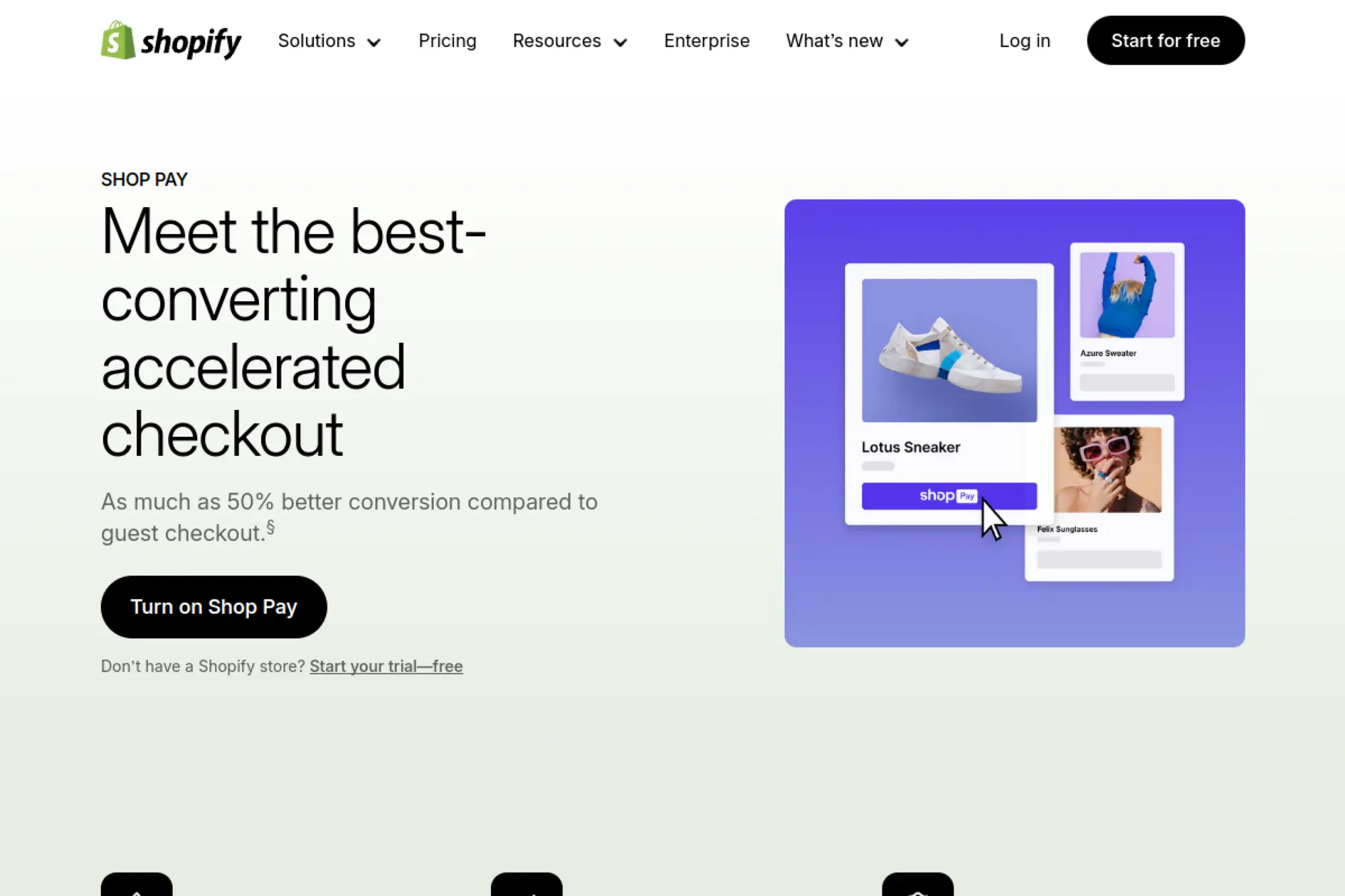

13. Shopify Shop Pay

Shop Pay is Shopify’s accelerated checkout, built by teams obsessed with ecommerce conversion. It benefits from Shopify’s merchant footprint. The product shines when you want less checkout friction without custom engineering.

Tagline: Turn returning shoppers into one-tap buyers on Shopify-powered stores.

Best for: Shopify merchants, lean ecommerce teams chasing higher checkout conversion.

- Accelerated checkout flow → reduce address and card entry to near zero.

- Shopify-native data reuse → save several configuration steps versus third-party wallets.

- Theme and admin enablement → reach first value in under an hour for many stores.

Pricing & limits: From $0/mo as part of Shopify commerce flows; processing fees depend on your setup. Trial: tied to Shopify plan terms; often available on store trials. Caps: best experience stays inside Shopify’s ecosystem.

Honest drawbacks: It is less useful on non-Shopify platforms. Deeply custom checkout requirements may fight platform constraints.

Verdict: If you sell on Shopify and want faster checkout, this helps you lift conversion within days. Beats generic card fields on speed; trails Apple Pay on cross-site wallet portability.

Score: 4.3/5 and .

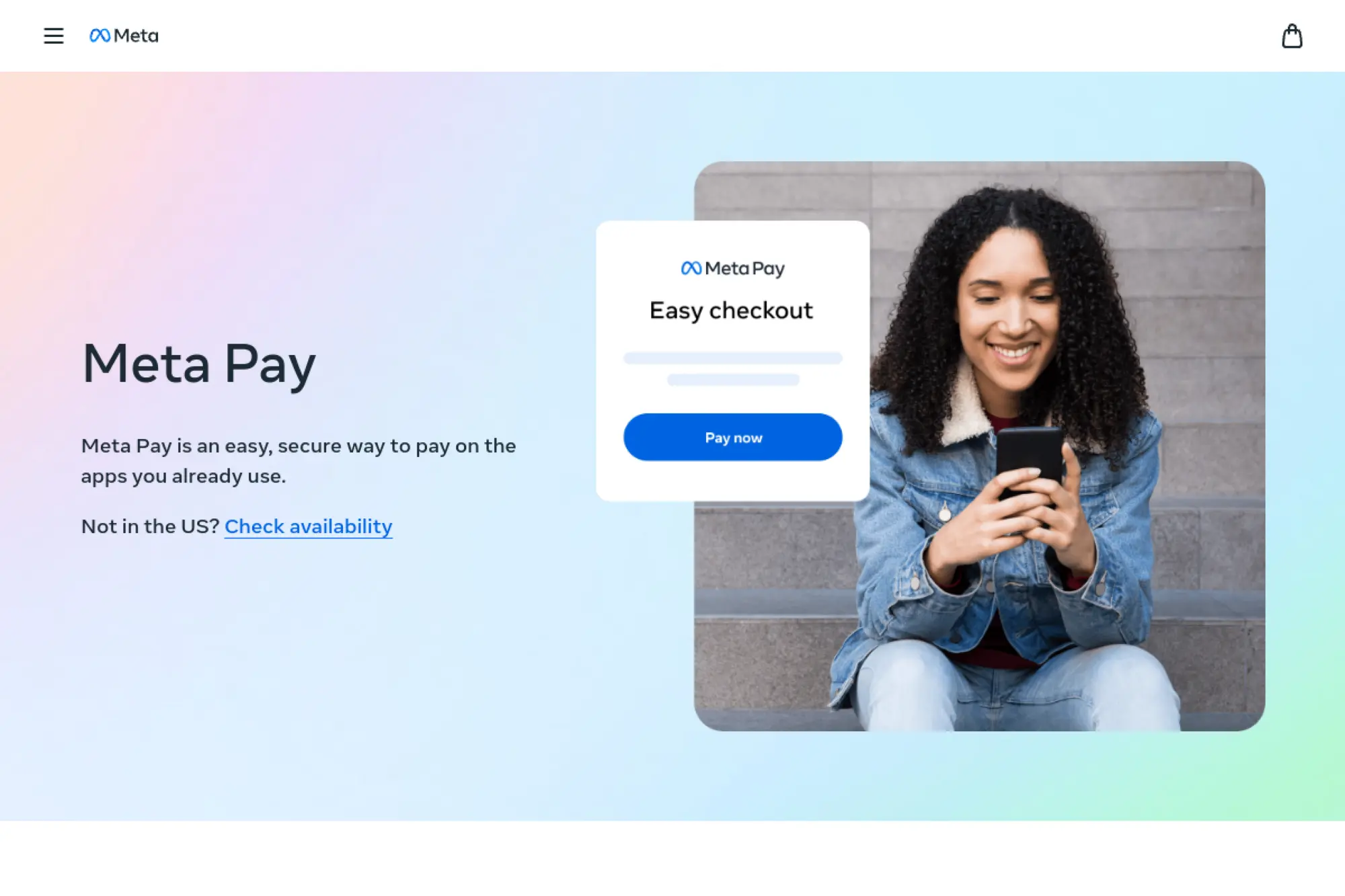

14. Facebook Pay

Facebook Pay is Meta’s in-app payments layer, historically branded under Facebook. Teams behind it support commerce across Meta’s family of apps. The strategic value is reducing friction inside social discovery.

Tagline: Let buyers complete purchases without leaving the scroll.

Best for: social-first sellers, SMBs running commerce inside Meta surfaces.

- In-app payment flows → reduce drop-off from app-switching during purchase.

- Meta commerce integrations → save steps versus stitching your own social checkout.

- Familiar consumer UX → reach first value in days once approved and configured.

Pricing & limits: From $0/mo; selling fees and payment costs depend on the commerce surface. Trial: N/A. Caps: eligibility, region availability, and policy enforcement are real constraints.

Honest drawbacks: Policy changes can reshape your funnel overnight. Data access and branding control can be limited compared with your own site.

Verdict: If you sell where attention already lives, this helps you shorten the path to paid in weeks. Beats external links on continuity; trails owned checkout on control and portability.

Score: 3.6/5 and .

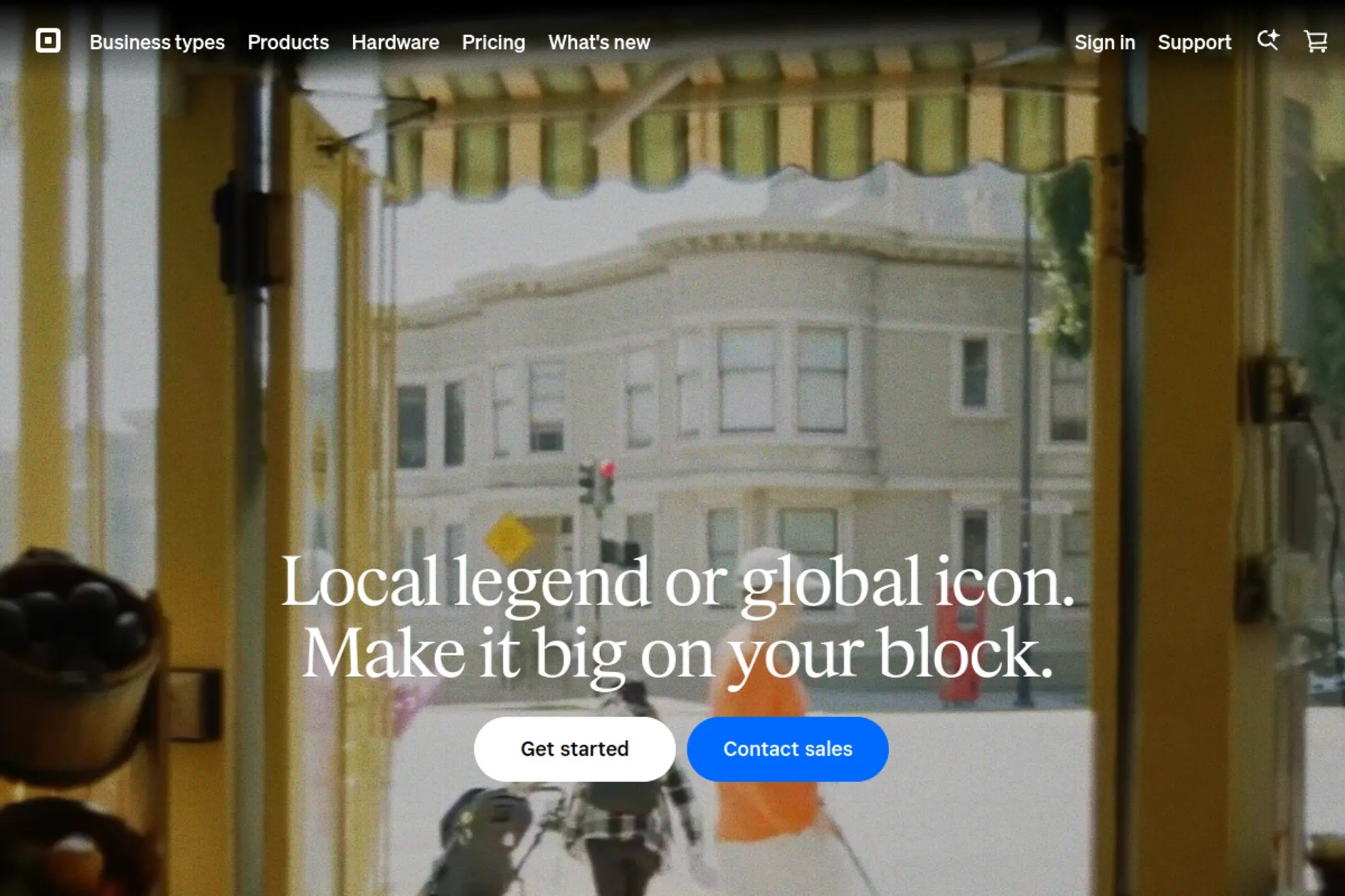

15. Square

Square builds payment acceptance, POS software, and business tools under one roof. Its teams are strong in hardware, SMB workflows, and omnichannel reporting. The platform is designed to get you selling fast, then keep you organized.

Tagline: Start taking payments today, then run your whole counter from one system.

Best for: retail and food SMBs, pop-ups, and service businesses needing POS plus payments.

- POS-first payment flow → reduce training time for staff and seasonal hires.

- Inventory, invoices, and online add-ons → save tool-switching steps each day.

- Guided setup and hardware pairing → reach first value in an afternoon.

Pricing & limits: From $0/mo for core POS; payment processing is typically per transaction. Trial: N/A. Caps: advanced features, locations, and staff tools vary by plan and region.

Honest drawbacks: Costs can climb as you add locations and add-ons. Deep customization is limited compared with building on raw APIs.

Verdict: If you want to accept payments and run operations without glue code, this helps you get live and stay tidy within days. Beats patchwork POS stacks on simplicity; trails Stripe on developer-extensible flexibility.

Score: 4.3/5 and .

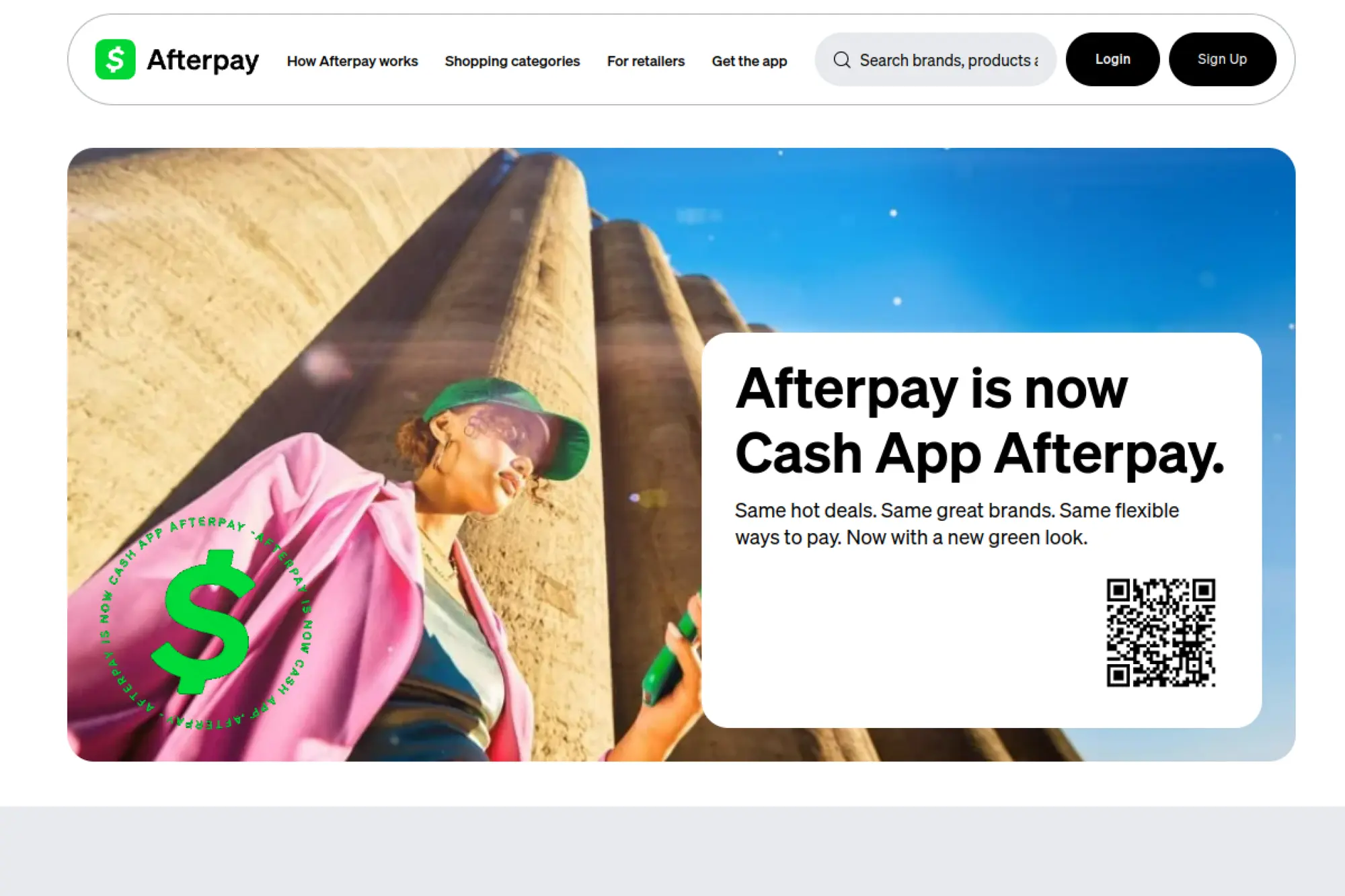

16. Afterpay

Afterpay is a buy-now-pay-later provider with teams focused on underwriting, merchant enablement, and consumer experience. The pitch is simple: split the payment, keep the purchase. Merchants use it to lift conversion and average order value.

Tagline: Turn “not today” into “yes, in installments.”

Best for: ecommerce merchants, DTC brands selling higher-consideration items.

- Installment checkout option → reduce sticker shock and increase completed orders.

- Platform and PSP integrations → save weeks versus building installment logic yourself.

- Merchant onboarding flows → reach first value in days once approved.

Pricing & limits: From $0/mo; merchant fees are typically per transaction and contract-based. Trial: N/A. Caps: eligibility, region coverage, and consumer limits affect conversion.

Honest drawbacks: BNPL can increase returns and customer service load. Brand perception varies, and some categories face restrictions.

Verdict: If you sell items that benefit from payment flexibility, this helps you lift conversion within a month. Beats plain cards on affordability framing; trails card wallets on universal acceptance.

Score: 3.9/5 and .

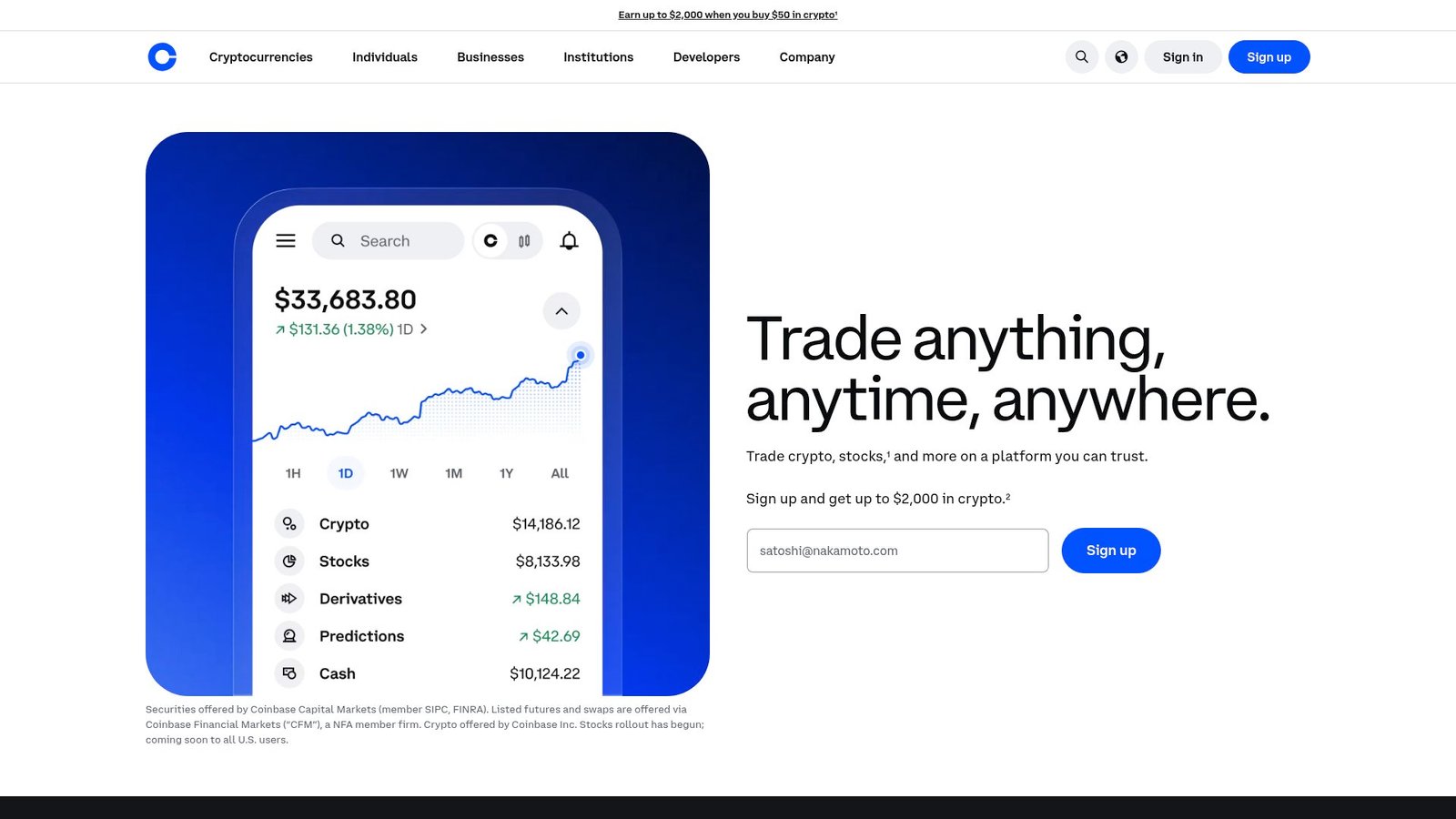

17. Coinbase

Coinbase is a crypto platform with product, compliance, and security teams built for regulated markets. For payments trends, it matters as a bridge between crypto assets and everyday spend. Its strengths are custody, onboarding, and trust signals for mainstream users.

Tagline: Bring crypto on-ramps and off-ramps closer to real commerce.

Best for: crypto-forward fintechs, teams exploring stablecoin settlement or crypto payouts.

- On-ramp and custody workflows → reduce user setup friction for crypto-linked payments.

- APIs and compliance tooling → save weeks versus stitching multiple vendors together.

- Established user experience → reach first value in weeks with clear scope.

Pricing & limits: From $0/mo to start; fees often apply per transaction or spread. Trial: N/A. Caps: geography, asset support, and compliance checks define access.

Honest drawbacks: Volatility and regulatory change can break product assumptions. Some customers will never want crypto in their payment journey.

Verdict: If you need a regulated crypto gateway, this helps you test crypto-based flows without building custody from scratch in a quarter. Beats DIY custody on risk reduction; trails card rails on mainstream universality.

Score: 3.7/5 and .

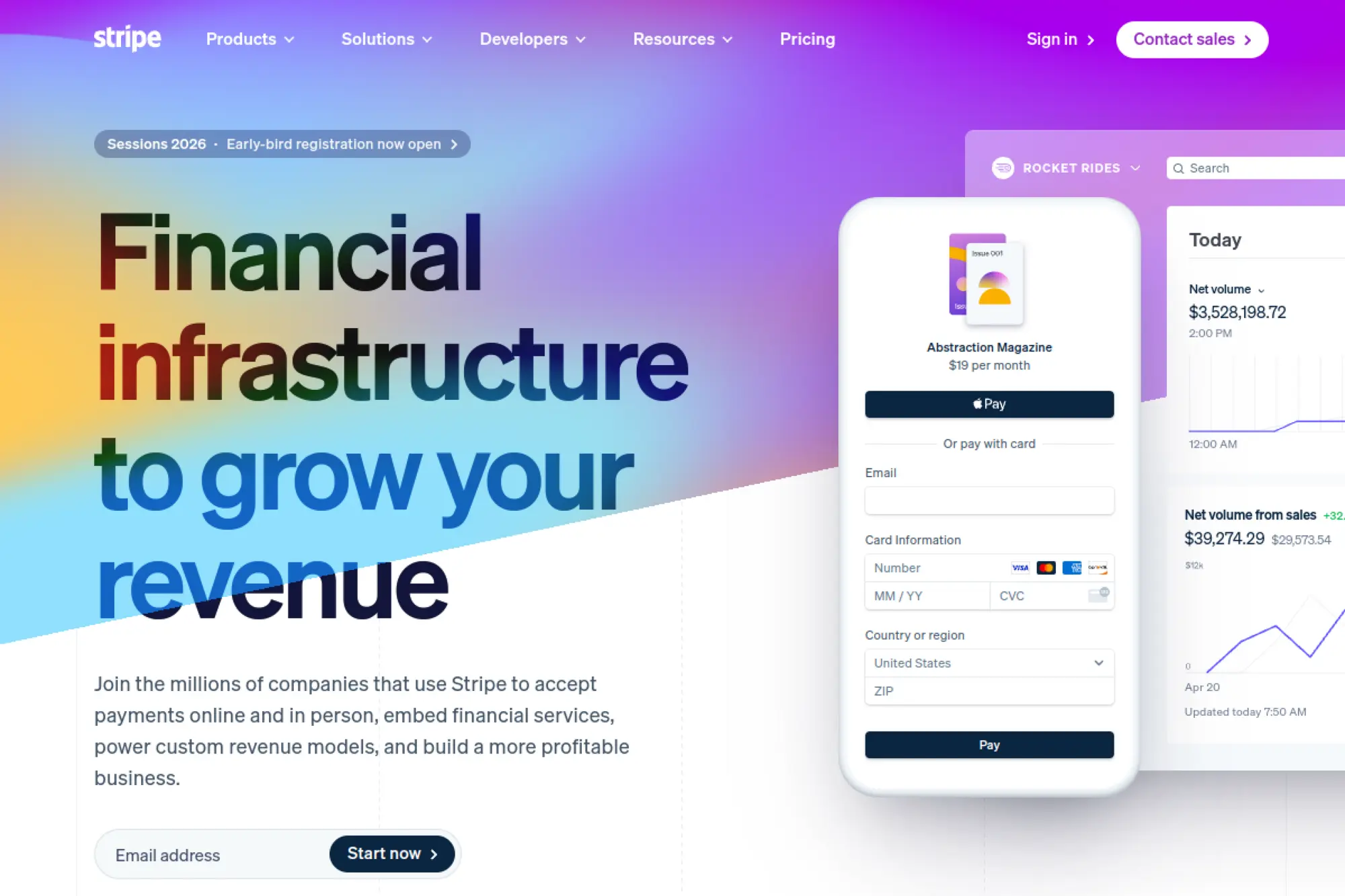

18. Stripe

Stripe is a developer-first payments platform with strong engineering and product teams. It shines when you want to assemble payments like building blocks. The ecosystem around it is often as valuable as the core APIs.

Tagline: Ship payments, billing, and payouts with fewer engineering detours.

Best for: startups to enterprise product teams, platforms monetizing marketplaces.

- Unified APIs for pay-ins and payouts → reduce integration sprawl across products.

- Rich ecosystem integrations → save days per tool connection across analytics and ops.

- Great docs and test tooling → reach first value in hours for a basic checkout.

Pricing & limits: From $0/mo; most products charge per transaction or per usage. Trial: N/A. Caps: risk underwriting, dispute rates, and product availability vary by country.

Honest drawbacks: Costs rise with volume and premium add-ons. Support response speed can depend on your tier and contract.

Verdict: If you want to launch and iterate on payments quickly, this helps you go live fast and optimize within weeks. Beats many processors on developer velocity; trails some bank rails on lowest-unit economics at massive scale.

Score: 4.6/5 and .

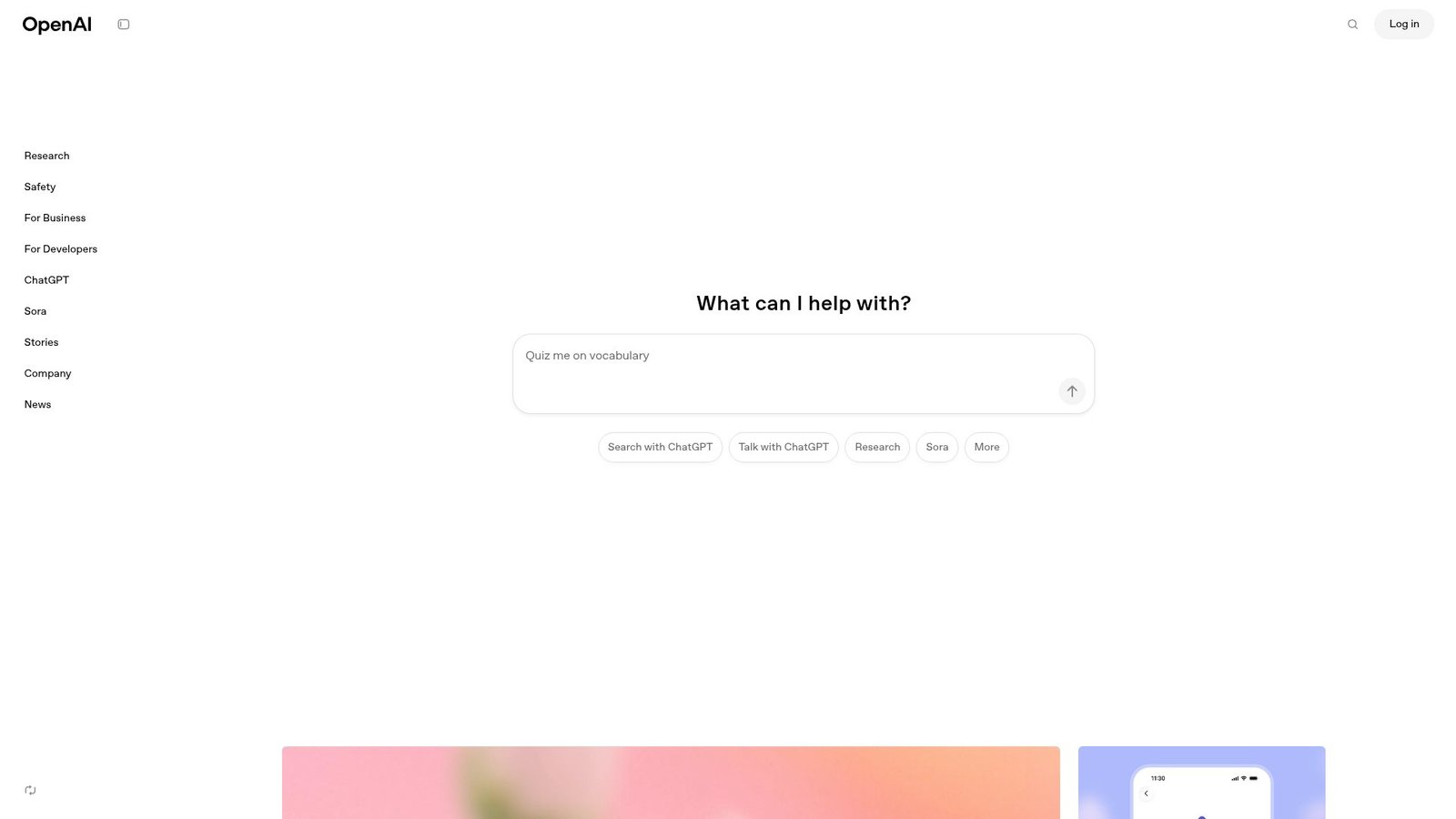

19. OpenAI

OpenAI builds AI models and tools used across customer support, risk ops, and developer workflows. In payments, the teams matter because disputes, fraud, and compliance create endless text-heavy queues. The best use cases are assistive and automative, not mystical.

Tagline: Turn payment ops backlogs into faster decisions and calmer customers.

Best for: payment ops teams, support leaders, and fintech product teams automating workflows.

- Case summarization and agent assist → reduce handle time per ticket and dispute.

- Workflow automation via APIs → save multiple copy-paste steps across tools per case.

- Fast prototyping toolkit → reach first value in days with a narrow, safe pilot.

Pricing & limits: From $0/mo to experiment; usage pricing depends on model and volume. Trial: availability depends on product access terms. Caps: rate limits, context limits, and governance controls shape designs.

Honest drawbacks: You must design for privacy and policy constraints. Bad prompts can create confident mistakes, so humans still need guardrails.

Verdict: If you want to reduce payment ops drag, this helps you speed triage and responses within weeks. Beats static macros on flexibility; trails purpose-built fraud tools on deterministic controls.

Score: 4.2/5 and .

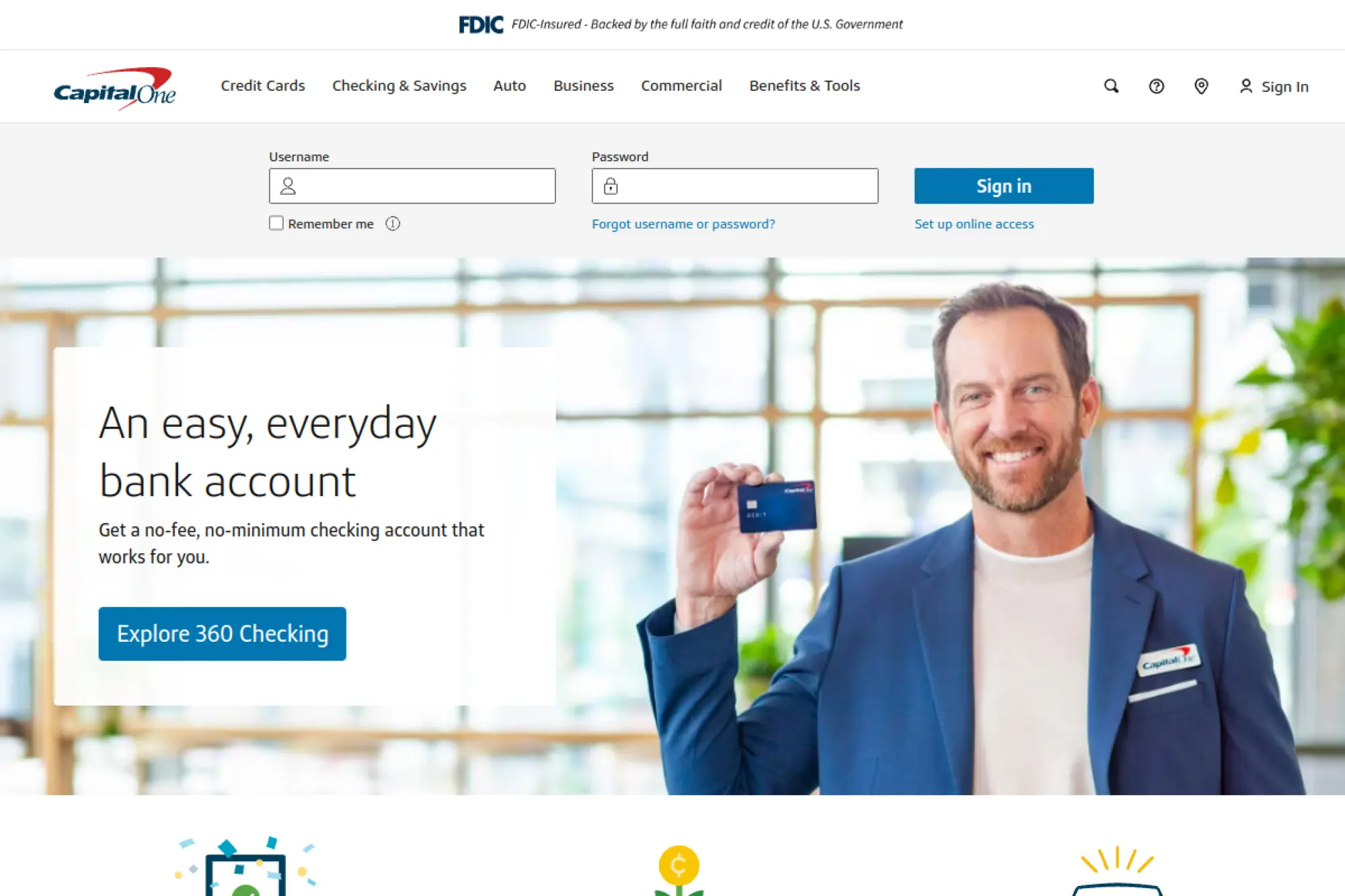

20. Capital One

Capital One is a major US financial institution with teams across cards, banking, and risk. For payment trends, it matters as an issuer, lender, and digital banking player. The practical angle is what it enables for customers and business accounts.

Tagline: Pair modern banking tools with card programs people actually use.

Best for: consumers and SMBs, plus fintech partners working with established issuers.

- Card and banking products → simplify how users fund purchases and manage cash.

- Digital servicing and alerts → reduce support contacts through self-serve visibility.

- Established onboarding processes → reach first value after account opening, often same week.

Pricing & limits: From $0/mo for some accounts; fees vary by product and requirements. Trial: N/A. Caps: credit limits, eligibility, and account terms define real usage ceilings.

Honest drawbacks: Product fit varies by state, segment, and underwriting. Partner integrations can involve long compliance and contracting cycles.

Verdict: If you need stable consumer banking and card infrastructure, this helps you support day-to-day payments and credit use over a month. Beats smaller banks on scale; trails fintech apps on niche, rapidly evolving features.

Score: 3.8/5 and .

21. Bankers Almanac Validate

Bankers Almanac Validate sits within LexisNexis Risk Solutions. The teams focus on reference data, validation, and risk reduction for payments routing. It is less about “sending money” and more about avoiding expensive mistakes.

Tagline: Validate bank details before the payment becomes a problem.

Best for: payment operations teams, compliance teams handling cross-border routing data.

- Bank detail validation workflows → reduce rejects, returns, and repair fees.

- Reference data integration paths → save manual lookup steps per beneficiary setup.

- API and batch options → reach first value in weeks, depending on systems.

Pricing & limits: From $0/mo to evaluate; production pricing is typically quote-based. Trial: often available via pilot; terms vary. Caps: coverage, record types, and contract usage limits apply.

Honest drawbacks: It does not fix messy upstream customer input by itself. Smaller teams may find procurement heavier than the initial technical work.

Verdict: If you send high volumes of bank transfers, this helps you cut payment failures and ops fire drills within a quarter. Beats manual spreadsheets on reliability; trails all-in-one PSPs on end-to-end payment execution.

Score: 4.0/5 and .

22. Discover Global Network

Discover Global Network is Discover’s payments network offering, including acceptance relationships and network services. Teams cover network operations, risk, and partner enablement. The relevance is choice, routing, and acceptance strategy beyond the biggest two networks.

Tagline: Add network diversity to improve acceptance and resilience.

Best for: issuers, acquirers, and merchants optimizing network mix and acceptance.

- Network acceptance options → reduce single-network dependency in your payment stack.

- Partner ecosystem connectivity → save negotiation cycles by leveraging existing rails.

- Established operating model → reach first value in months through partners.

Pricing & limits: From $0/mo to engage; fees are negotiated via issuers and acquirers. Trial: N/A. Caps: acceptance footprint, region coverage, and partner support define impact.

Honest drawbacks: For some merchants, buyer demand is lower than Visa and Mastercard. Your ability to influence routing can be limited by processor setups.

Verdict: If you want network redundancy and broader acceptance strategy, this helps you diversify and reduce routing risk over a quarter. Beats single-network dependence on resilience; trails dominant networks on universal consumer pull.

Score: 3.7/5 and .

23. Citizens Bank

Citizens Bank is a US bank serving consumer and business customers. Teams span treasury services, business banking, and digital channels. For payment trends, it matters where bank rails meet modern cash management expectations.

Tagline: Keep business cash moving with bank-grade controls and visibility.

Best for: SMB finance teams, mid-market treasury teams seeking dependable bank services.

- Treasury and cash management tools → reduce manual reconciliation and missed payments.

- Bank integration options → save steps versus juggling multiple banking portals.

- Relationship-led onboarding → reach first value in weeks after setup completes.

Pricing & limits: From $0/mo for some account tiers; fees depend on balances and services. Trial: N/A. Caps: transaction limits, eligibility, and product availability vary by segment.

Honest drawbacks: Digital UX can feel less fluid than fintech-first tools. Implementation timelines depend on internal banking processes and approvals.

Verdict: If you need stable banking rails for payroll, vendors, and receivables, this helps you reduce cash surprises within a quarter. Beats DIY spreadsheets on control; trails modern PSPs on developer-driven automation.

Score: 3.6/5 and .

24. Ingenico

Ingenico is a long-standing payment terminal and acceptance technology provider. Hardware and software teams focus on secure devices, deployment, and payment certifications. The real value is reliable in-person acceptance at scale.

Tagline: Make in-store payments dependable, compliant, and repeatable across locations.

Best for: retailers, acquirers, and enterprise merchants deploying fleets of terminals.

- Certified payment terminals → reduce rollout risk and compliance headaches.

- Processor and gateway compatibility → save integration work across acquiring partners.

- Fleet deployment programs → reach first value in weeks once hardware ships.

Pricing & limits: From $0/mo software-wise; hardware and service costs vary by deal. Trial: N/A. Caps: certification cycles, regional regulations, and device availability constrain timelines.

Honest drawbacks: Hardware refresh cycles are slower than SaaS updates. Custom UI or app ecosystems can require specialist development and testing.

Verdict: If you need in-person payments that just work across many stores, this helps you standardize checkout within a quarter. Beats consumer devices on durability; trails all-in-one SMB POS on out-of-box simplicity.

Score: 3.9/5 and .

25. Castles Technology

Castles Technology builds payment terminals and acceptance hardware for global markets. Teams focus on secure devices, certifications, and scalable deployments. It shows up when you need hardware choice beyond the most famous brands.

Tagline: Deploy secure card acceptance hardware without locking into one ecosystem.

Best for: acquirers, ISOs, and merchants managing multi-region terminal strategies.

- Terminal portfolio options → match device types to store formats and checkout speed.

- Integration with payment stacks → save hardware-specific rewrites during rollouts.

- Deployment and device management → reach first value in weeks for a pilot fleet.

Pricing & limits: From $0/mo platform-wise; hardware pricing and services vary by contract. Trial: N/A. Caps: certification timelines and processor compatibility drive feasibility.

Honest drawbacks: Software ecosystems can be less mature than closed POS platforms. Support quality may depend on regional partners and distributors.

Verdict: If you need flexible payment hardware across different markets, this helps you scale acceptance with fewer vendor bottlenecks within a quarter. Beats single-vendor lock-in on flexibility; trails top POS suites on unified software experiences.

Score: 3.7/5 and .

26. Mir Pay

Mir is a card payment system associated with Russia’s domestic card ecosystem. Teams behind it support network operations, issuance, and acceptance where available. In trend terms, it reflects regional payment sovereignty and routing alternatives.

Tagline: Enable card payments in markets where Mir acceptance is relevant.

Best for: region-specific merchants, payment teams handling localized acceptance requirements.

- Domestic card rail compatibility → reduce payment failures for eligible cardholders.

- Local processing relationships → save routing work compared with unsupported networks.

- Standard card-like UX → reach first value after acquirer enablement, often weeks.

Pricing & limits: From $0/mo base; merchant fees depend on acquirers and contracts. Trial: N/A. Caps: geography, regulatory constraints, and partner availability strongly limit adoption.

Honest drawbacks: International acceptance can be limited and changeable. Compliance requirements and risk reviews can block use cases quickly.

Verdict: If you operate where Mir is needed, this helps you avoid needless declines and keep checkout functional within a quarter. Beats “no option” on acceptance; trails global networks on reach and portability.

Score: 2.9/5 and .

27. Pix

Pix is Brazil’s instant payment system, supported by the Central Bank of Brazil and ecosystem participants. The teams across the ecosystem emphasize speed, availability, and broad usability. The outcome is simple: fast money movement for daily commerce.

Tagline: Make instant account-to-account payments feel as easy as cash.

Best for: Brazilian merchants, platforms operating in Brazil, and fintechs doing payouts.

- Instant payment acceptance → reduce settlement delays and improve cash flow.

- QR-based payment flows → save checkout steps compared with card entry on mobile.

- Familiar consumer behavior → reach first value in weeks via PSP and bank partners.

Pricing & limits: From $0/mo for many users; merchant and PSP pricing varies. Trial: N/A. Caps: transaction limits, bank participation, and fraud controls vary by provider.

Honest drawbacks: Real-time rails move fraud faster, too. Reconciliation can get tricky without strong reference fields and tooling.

Verdict: If you sell in Brazil and want instant payments, this helps you improve settlement speed within a month. Beats cards on immediacy in many flows; trails cards on global interoperability.

Score: 4.2/5 and .

28. Bizum

Bizum is a Spanish payment solution built around bank-linked transfers. Teams across the ecosystem focus on simple sending and receiving tied to phone numbers. It matters because it fits local habits, not just global playbooks.

Tagline: Make local bank-linked payments feel instant and familiar in Spain.

Best for: Spain-focused merchants, SMBs collecting payments from local customers.

- Phone-number-linked payments → reduce friction versus typing long bank details.

- Bank ecosystem participation → save onboarding steps compared with new-wallet adoption.

- Simple user experience → reach first value quickly once your PSP supports it.

Pricing & limits: From $0/mo for many consumers; merchant pricing varies by provider. Trial: N/A. Caps: region focus and bank-specific limits affect larger payments.

Honest drawbacks: It is not a global solution for cross-border commerce. Some ecommerce stacks have fewer out-of-box integrations than cards.

Verdict: If your customers are in Spain and expect Bizum, this helps you reduce checkout hesitation within weeks. Beats manual transfers on ease; trails card networks on international scale.

Score: 3.8/5 and .

29. Unified Payments Interface UPI

UPI is India’s real-time payments system, coordinated through NPCI and implemented by banks and apps. Teams across the ecosystem focus on interoperability, scale, and merchant usability. The result is a payment layer that behaves like infrastructure.

Tagline: Accept instant bank payments at scale with a simple identity layer.

Best for: merchants in India, platforms enabling payouts and collections in India.

- Real-time bank payment flow → reduce reliance on cards for everyday transactions.

- App ecosystem interoperability → save user onboarding steps across payment apps.

- QR and intent-based UX → reach first value in days with the right provider.

Pricing & limits: From $0/mo for many users; merchant pricing varies by PSP and bank. Trial: N/A. Caps: transaction limits, risk controls, and routing rules can vary.

Honest drawbacks: Dispute and support processes vary by app and bank. International use is limited compared with card networks.

Verdict: If you operate in India and want fast, low-friction payments, this helps you collect and disburse funds quickly within weeks. Beats cards on local ubiquity; trails cards on cross-border acceptance.

Score: 4.4/5 and .

30. China UnionPay

China UnionPay is a major card network with international acceptance through UnionPay International. Teams focus on network operations, partnerships, and risk controls across markets. Its relevance is clear when your customers carry UnionPay cards.

Tagline: Accept and route payments for UnionPay cardholders with fewer surprises.

Best for: global merchants with China-linked demand, travel and luxury merchants.

- UnionPay acceptance enablement → reduce declines for a key cardholder segment.

- Acquirer and partner connectivity → save routing and contracting cycles via existing rails.

- Card-like checkout experience → reach first value in weeks through your processor.

Pricing & limits: From $0/mo base; fees depend on acquirers and network arrangements. Trial: N/A. Caps: acceptance coverage varies by country and processor configuration.

Honest drawbacks: Demand is segment-dependent, so ROI can be uneven. Some reporting and settlement details depend heavily on your acquiring partner.

Verdict: If you serve customers who prefer UnionPay, this helps you capture otherwise-lost transactions within a quarter. Beats “card not supported” on conversion; trails Visa and Mastercard on universal default acceptance.

Score: 3.8/5 and .

Consumer-facing payment trends: wallets, biometrics, and connected commerce

Market overview: Digital identity is becoming a mainstream wallet-adjacent capability, and Gartner expects 500 million smartphone users to use a digital identity wallet, which reframes what “verified” means at checkout. Consumer payment change is rarely about one feature. It is about compounding micro-frictions. A second saved step in checkout can be worth more than a whole new payment method. We therefore treat consumer payments as product ergonomics backed by hard security.

1. Digital wallet adoption as a mainstream expectation in online checkout experiences

Digital wallets have shifted from novelty to expectation. Consumers now treat wallet buttons as a sign of legitimacy. When they are missing, trust drops. Wallets also compress checkout time by skipping manual entry. That speed is not just convenience. It reduces abandonment under weak connectivity.

From our builds, wallet readiness means more than adding a button. It includes fulfillment timing, refund paths, and consistent receipt messaging. A fast pay flow with a slow refund flow still feels broken.

2. Digital identity and biometrics to reduce friction while improving authentication confidence

Biometric prompts feel effortless when they work. They also shift the risk boundary to the device. That can be a win, but it changes failure modes. Locked accounts and broken device upgrades become payment blockers. Support teams then become part of the payment system.

We recommend designing “recovery journeys” before launching biometric-first flows. Recovery includes identity proofing, device binding, and safe fallbacks. Without recovery, friction just moves downstream.

3. Consumer tolerance for added security steps as fraud concerns rise

Consumers hate friction, yet they hate fraud more. That creates space for step-up checks when messaging is clear. Confusing prompts feel like scams. Clear prompts feel like protection. The difference is copy, timing, and consistency.

We advise teams to add security steps only when value is obvious. “We blocked a suspicious attempt” lands better than “verify again.” Transparency reduces support burden. It also reduces chargeback pressure later.

4. Instant payments expectations expanding from transfers into real-time refunds and bill posting

Instant transfers created a new baseline. Now consumers want instant outcomes. Refund speed is a loyalty feature. Bill posting speed becomes part of personal finance trust. Even if settlement is not instant, status updates must be instant.

Our architectural preference is event-driven status propagation. The payment system emits lifecycle events. The app subscribes and renders those states. That makes “pending” less mysterious and more informative.

5. Connected commerce experiences, including tap-to-device comfort and walkout-style payments

Connected commerce blurs the line between browsing and paying. Tap-to-device acceptance expands where payments can happen. Walkout-style models emphasize sensors and trust. Both trends reward reliability more than novelty. A single false decline ruins the magic.

We treat these experiences as distributed systems. Sensors, devices, and payment rails all fail differently. Resilience requires idempotency, local caching, and graceful degradation. A “fallback to standard checkout” is not defeat. It is good product hygiene.

6. Trust signals that matter in payment trends: alerts, transparency, and who consumers trust most

Trust signals are often simple. Real-time alerts reduce panic. Clear merchant descriptors reduce disputes. Transparent fees reduce refunds. Strong receipts reduce support tickets. These are not marketing details. They are operational controls.

In our view, trust also comes from consistent identity. If a user sees three different names for the same merchant, confusion follows. Clean descriptors and predictable branding lower chargebacks. They also make fraud detection easier.

Merchant and platform payment trends: in-app, subscription, and new form factors

Market overview: Commerce volume keeps pressure on uptime, and Deloitte projects holiday sales of $1.61 trillion to $1.62 trillion, which makes payment reliability a board concern. Merchant payments are also becoming software problems. That shift changes who owns decisions. Product teams now share ownership with finance and risk teams. Platforms, especially, need payments to feel native inside workflows.

1. In-app payments as a growth lever for platforms and software providers

In-app payments are a conversion engine because they keep users inside context. They also let platforms monetize workflow, not attention. We have seen vertical software providers turn payments into a retention moat. The trick is to embed receipts, refunds, and support inside the app. Otherwise, payments feel bolted on.

Engineering-wise, in-app payments need strong domain boundaries. The core product should not depend on a single provider’s quirks. A well-designed adapter layer protects future negotiation leverage.

2. Account-to-account payments gaining traction for cost control and recurring payment scenarios

Account-to-account flows appeal when fees matter and confirmation is strong. They also reduce card lifecycle complexity. For recurring payments, they can lower involuntary churn. However, authorization models differ across rails. Some require mandates. Others require re-authentication.

We suggest building a shared “consent object” in your domain model. Consent should store scope, expiry, and revocation data. That object becomes a bridge across rail types.

3. Buy now, pay later features becoming a core option in modern checkout design

BNPL has become a product surface, not just a financing offer. It changes basket size and conversion patterns. It also changes returns, disputes, and customer support scripts. Merchants must reconcile BNPL settlements against orders correctly. That is harder than it looks.

Our recommendation is to model “tender type” explicitly in the order system. Do not treat BNPL like a card. It has its own lifecycle. Clear modeling reduces accounting confusion later.

4. SoftPOS tap-to-phone acceptance to reduce hardware dependency and expand contactless reach

SoftPOS reduces the friction of deploying acceptance. It also reduces the logistics burden of terminals. For SMBs, that can unlock pop-up commerce and mobile service payments. For enterprises, it can serve as a backup channel during outages. Yet device fleet management becomes the new complexity.

We advise merchants to treat phones like regulated endpoints. Mobile device management, attestation, and OS update policies become payment controls. Without governance, risk expands silently.

5. Unattended payments and self-service kiosks driving new UX and reliability requirements

Unattended payments are a brutal test of reliability. There is no cashier to smooth over errors. UX must be unambiguous and quick. Hardware must tolerate heat, dust, and poor connectivity. Payment declines must trigger safe recoveries.

We build kiosk systems with offline-aware state machines. The device queues intent and reconciles later. Clear “cancel and retry” paths prevent stuck transactions. That design reduces both fraud and customer frustration.

6. Subscription economy pressure on card-on-file management, credential updates, and cancellation journeys

Subscriptions magnify payment edge cases. Credential updates, expired cards, and issuer declines create silent churn. Users then blame the product, not the rail. Cancellation journeys also face regulatory and reputational pressure. A “dark pattern” accusation can outweigh a quarter of retention gains.

We recommend building a subscription reliability dashboard. Track failures by reason and issuer response. Pair that data with proactive messaging. “Update your payment method” should feel helpful, not threatening.

7. Tokenization acceleration to reduce manual entry and strengthen digital payment security

Tokenization reduces exposure of sensitive data. It also makes repeat checkout smoother. The strategic value is not only security. It is portability across devices and channels. When tokenization is done well, user experience becomes consistent across web and mobile.

In implementation, we treat tokens as first-class identifiers. We never treat them as “just strings.” Metadata, lifecycle, and revocation need explicit handling. That rigor reduces hard-to-debug payment failures.

8. Personalized payment credentials and controls tied to spending rules and risk preferences

Consumers increasingly expect controls. They want spending limits, category blocks, and real-time alerts. Merchants and platforms also want controls for refunds and payouts. Those controls are policy, not code. Policy should be configurable, auditable, and testable.

We typically model controls as a policy engine with clear inputs. Inputs include device trust, velocity signals, and transaction context. Outputs are actions like allow, deny, or step-up. That structure supports experimentation without chaos.

9. New payment form factors, including device-embedded payments such as in-car transactions

Device-embedded payments change what “merchant present” means. In-car transactions are the obvious example. Voice assistants and wearables also matter. These contexts demand low attention UX. They also demand strong confirmation patterns to avoid accidental purchases.

Our design pattern is “preview then commit.” The device presents a clear summary. The user confirms through a trusted gesture. Confirmation should be consistent across devices. Consistency reduces fraud and disputes.

10. Big Tech and super app expansion shaping competition and consumer expectations

Big Tech shapes defaults. Defaults become habits. Habits become market power. Merchants must accept popular wallets, yet they also fear margin pressure. Platforms, meanwhile, compete with the same companies that provide the operating system. That tension will not disappear.

We advise teams to reduce dependency on any single funnel. Build multi-rail acceptance and clear fallback flows. Make sure your analytics can isolate performance by method. Otherwise, you cannot negotiate or optimize intelligently.

11. SMB digitization and online storefront adoption influencing payment acceptance priorities

SMBs are still modernizing their first digital storefront. Many start with an all-in-one platform. That choice usually bundles payments, shipping, and marketing. It speeds launch, but it can limit customization. As SMBs grow, they often outgrow default settings.

In our client work, we look for “graduation paths.” A startup stack should evolve without replatforming pain. Clear data export and modular payment integration help. That planning keeps growth from becoming a technical crisis.

Enterprise and cross-border payment trends: real-time rails, stablecoins, and data standards

Market overview: The long arc still points toward scale, with Statista projecting digital payments reaching US$38.07tn by 2030, which raises the premium on automation and exception handling. Enterprises feel payment change differently than consumers. They feel it in treasury operations, reconciliation work, and audit posture. Cross-border pressure also exposes hidden costs. Speed expectations collide with compliance reality.

1. Real-time payments adoption in business payments, including operational impacts on treasury teams

Real-time rails change treasury rhythm. Cash positioning becomes more dynamic. Cutoff times matter less, but controls matter more. Mistakes move faster too. That forces stronger pre-send validation and tighter approval workflows.

We recommend implementing pre-flight checks as a service. That service validates payee data, sanctions posture, and policy rules. Treasury teams then gain confidence without slowing operations. Monitoring must also become continuous, not batch.

2. Mixed payment-method portfolios in midsize organizations, with checks still present despite modernization

Midsize firms often run a portfolio. They use cards, ACH-style transfers, wires, and checks. Each method maps to a business need. That complexity is not always waste. It can be resilience. However, it creates reconciliation strain.

We see success when firms unify remittance data first. Payment method modernization follows naturally. A shared payment reference model reduces duplicate vendor records. It also improves dispute response speed.

3. Cross-border money movement innovation driven by cost pressure, FX volatility, and speed expectations

Cross-border payments are where “simple UX” meets messy reality. FX spreads, correspondent banking hops, and compliance checks add latency. Businesses still expect predictable arrival. That expectation is a product requirement, not a wish.

Our approach is to expose certainty levels. Show estimated delivery windows and fees early. Log every hop for traceability. That traceability is gold during investigations. It also supports customer support with facts.

4. Stablecoins connecting crypto to fiat commerce through commercialization and compliance requirements

Stablecoins can reduce cross-border friction, but they add governance work. Key management, custody choices, and compliance screening become central. Settlement can be fast, yet business acceptance depends on accounting clarity. Treasury teams need clear rules for holding, converting, and reporting.

We recommend treating stablecoin flows like a new rail. Build them behind the same orchestration interface as other rails. That keeps policy consistent. It also avoids “special crypto code” scattered across services.

5. Interoperability as a competitive necessity across open banking payments and multi-rail acceptance

Interoperability is no longer a nice-to-have. Enterprises expect multi-rail acceptance because customers do. Open banking style flows increase competitive pressure on card fees. Yet not every rail provides the same dispute protections. Product teams must be honest about tradeoffs.

We suggest building a unified payment intent API. The intent carries amount, currency, payee, and metadata. A router selects the best rail given context. That design enables experimentation without new downstream systems.

6. ISO 20022 data standardization enabling automation, improved searchability, and better fraud management

Data richness is operational leverage. Standardized fields support better matching, faster investigations, and clearer reporting. Searchability matters more than teams expect. During an incident, the difference between “searchable remittance” and “free text” is hours.

We treat data mapping as a product migration. That means test fixtures, dual-writing strategies, and careful rollout plans. A rushed mapping can break downstream accounting. The standard helps only when the implementation is disciplined.

7. Value-added services for monetization in lower-yield rails, including reconciliation and invoice automation

As base rails commoditize, value moves upward. Reconciliation services become differentiators. Invoice automation reduces back-office pain. These are not flashy features. They are the features CFOs remember.

We see a strong pattern in platforms. They bundle payments with invoicing, accounting exports, and payout scheduling. That bundle raises switching costs. It also creates genuine customer value. The best bundles stay transparent and configurable.

8. Embedded finance APIs and platform integration to orchestrate payments inside business workflows

Enterprises increasingly want payments inside their core tools. That includes ERPs, procurement, and expense platforms. Embedded finance APIs make that possible. Yet “API available” is not the same as “integration safe.” Idempotency, retries, and webhooks define the real experience.

We build integration layers that assume failure. Every call can time out. Every webhook can arrive twice. A durable event log helps. It also creates audit evidence that compliance teams appreciate.

9. Programmable compliance and regulatory intelligence as a scalable operating model

Compliance is shifting from manual review to programmable policy. That does not mean removing humans. It means focusing humans on exceptions. Policies must adapt across regions and rails. That adaptation is easier when rules are modular.

We recommend implementing compliance as code with governance. Changes require review, testing, and staged rollout. Audit logs must be immutable. When regulators ask “why was this allowed,” you need a precise answer. Good systems can provide it quickly.

How TechTide Solutions delivers custom solutions for evolving payment trends

Market overview: In the same McKinsey report, analysts describe simpler interfaces hiding a complex ecosystem, and we see that complexity in every production incident review. Our work focuses on reducing that complexity for our clients. We design payment systems that can evolve without constant rewrites. We also help teams build operational maturity, not just integrations. Shipping payments is easy. Operating payments is the hard part.

1. Discovery-led roadmap for payment trends adoption based on customer needs and product goals

We start with discovery because payments touch everything. We map the customer journey, then map the money journey. Those are not the same map. The gap between them is where churn, disputes, and fraud live. We also inventory constraints like regulatory scope and support capacity.

From there, we prioritize outcomes. Faster refunds might beat new payment methods. Better reconciliation might beat a new dashboard. Roadmaps win when they reduce operational toil. That is our default lens.

2. Custom payment integrations: wallets, real-time rails, BNPL, and embedded finance APIs

Integration work is rarely “just an API.” It is data modeling, risk tuning, and lifecycle correctness. We build payment orchestration layers that support multiple providers. That keeps switching costs low. It also enables A/B testing across rails.

In practice, we implement consistent primitives. Payment intent, capture, refund, dispute, and payout should look uniform internally. Provider adapters translate to external quirks. That separation speeds future launches. It also reduces vendor lock-in risk.

3. Security and compliance by design: fraud controls, identity workflows, observability, and scalable architecture

Security cannot be a wrapper around payments. It must be inside the flow. We implement layered controls like device trust, velocity checks, and anomaly detection. Identity workflows must include recovery. Observability must include business metrics, not only CPU graphs.

Our architecture stance is pragmatic. Use event-driven patterns where they reduce coupling. Use synchronous calls where user experience requires it. Log everything that matters, but protect sensitive data. Good payments systems are both fast and accountable.

Conclusion: What to prioritize next in payment trends strategy

Market overview: The automation wave keeps accelerating, and Gartner forecasts worldwide AI spending reaching nearly $1.5 trillion, which will inevitably reshape payment operations. Strategy now is not about picking one winner rail. It is about building optionality. The next cycle will punish brittle stacks. It will reward teams that can route, observe, and govern change.

1. Build multi-rail readiness to support customer choice across wallets, cards, and account-to-account flows

Multi-rail readiness is a design choice. It requires internal abstractions and consistent event models. It also requires business alignment on routing goals. Cost, authorization rate, and fraud posture often conflict. Teams must choose how to balance them.

We suggest starting with a unified payment intent. Then add adapters per rail. Add routing rules as configuration, not code. That makes experimentation safer. It also makes incident mitigation faster.

2. Invest in digital identity, biometrics, and fraud defense to keep trust ahead of convenience

Trust is the limiting reagent in payment growth. Without trust, conversion gains evaporate in disputes. Identity and biometrics reduce friction, yet they must be paired with recovery paths. Fraud defense must include customer communications. Silence breeds chargebacks.

Our practical advice is to measure trust outcomes. Track disputes, friendly fraud patterns, and support contacts. Pair that with authentication success rates. Then iterate. Security is never “done.” It is a posture.

3. Modernize data and operations for instant payments, including real-time monitoring and exception handling

Instant rails require instant operations. That means real-time monitoring, not batch reports. Exceptions must be triaged quickly. Refund automation becomes more important. Manual processes do not scale with always-on settlement.

We recommend an operational control center. It should show payment states, queue backlogs, and provider health. Alerting should be actionable, not noisy. When an incident hits, teams need a single source of truth. That source should be technical and financial.

4. Plan for stablecoin and digital asset use cases with clear governance and compliance controls

Stablecoin adoption should be intentional. Pick defined use cases and explicit corridors. Define custody, key management, and conversion rules early. Compliance screening must be integrated, not bolted on. Reporting requirements must be understood before launch.

We also advise separating “experimentation” from “production settlement.” Sandbox exploration is healthy. Production money movement needs strict guardrails. Governance is not bureaucracy here. It is operational safety.

5. Design for connected commerce and emerging form factors without compromising user control

Connected commerce will keep expanding into new contexts. Devices will initiate payments. Assistants will suggest purchases. That future can be convenient, but it can also feel coercive. User control must remain clear. Confirmation patterns must be consistent.

We recommend designing consent as a product surface. Make permissions visible and revocable. Provide easy transaction history search. Let users set limits and alerts. Those controls reduce disputes and increase confidence. They also reduce regulatory risk.

6. Turn compliance into an advantage by making policy and reporting capabilities modular and adaptable

Compliance can be a competitive advantage when it is modular. Modular policy enables quick adaptation across regions. Modular reporting reduces audit fire drills. Teams that treat compliance as a product capability move faster with less fear. That is the paradox.

As a next step, we suggest running a payment architecture workshop. Bring product, finance, risk, and engineering into one room. Map your money movement flows and exception paths. Then ask one hard question: which part of your payment stack would fail silently, and how would you know?