At Techtide Solutions, we treat payments as product design, not plumbing. Checkout is where trust, speed, and risk collide. Customers rarely describe it that way. They simply leave when it feels awkward.

Market signals support that urgency. Statista’s market forecast projects digital payments transaction value reaching US$5.12tn in 2025, which mirrors what we see in client roadmaps. McKinsey frames the same story from the supply side, describing payments as a durable profit engine with $2.5 trillion in revenue across the industry. Deloitte’s ConsumerSignals work adds behavioral context from over 100,000 consumers, which aligns with rising expectations for instant, embedded purchasing. On the conversion side, Baymard’s benchmark puts average cart abandonment at 70.19%, and payment friction is a frequent culprit.

In real deployments, the lesson is blunt. When Shopify pushes Shop Pay, it is really pushing convenience as a moat. When Amazon leans on cards, gift balances, and wallets, it is engineering certainty. We build for that same certainty, but for teams without Amazon’s margin for error.

Online payment methods explained: what they are and why businesses offer multiple options

1. What “online payment methods” mean in ecommerce checkouts

Online payment methods are the ways a customer can authorize money movement during checkout. Some methods feel familiar, like credit cards. Others feel native, like Apple Pay or PayPal.

From a technical lens, each method is a different combination of rails, identity, and risk rules. Cards run on card networks with chargeback rights. Bank transfers run on account-based rails with different confirmation patterns.

We like to define “payment method” by what it implies for user flow. Does the customer stay on your site. Do they authenticate with their bank. Do they expect instant confirmation.

2. How online payments are processed through payment gateways and providers

Most online payments travel through a gateway, then an acquiring layer, then the underlying rail. Gateways tokenize and route sensitive data. Providers also deliver fraud tools, reporting, and dispute handling.

Behind the scenes, your system sends an authorization request and receives a response. Later, capture and settlement finalize the money movement. That time gap matters for inventory and fulfillment logic.

In our integrations, we treat payment events as a state machine. Idempotency, retries, and webhooks are not optional. They are the difference between clean ledgers and support tickets.

Related Posts

- Top 30 WordPress Alternatives for Faster, Safer Websites in 2026

- Top 30 Best CMS Hosting for WordPress Picks and Selection Criteria for 2026

- Top 10 WordPress Website Design Companies for Custom WordPress Sites in 2026

- Top 30 best SEO software tools for 2026: A Practical Stack for SEO, AEO, and AI Visibility

- Top 30 Cheap Email Service Providers for Email Hosting and Marketing

3. Why offering multiple online payment methods can increase conversion and reduce cart abandonment

Choice reduces hesitation. A customer who distrusts cards may trust a wallet. A customer without a card may rely on bank debit or cash on delivery.

Conversion gains often come from “expected defaults,” not exotic options. In many stores, adding PayPal, Apple Pay, and local bank methods removes the final mental barrier. Customers want to pay in the way they already practice.

We also see a second-order benefit. Multiple methods let teams steer risk. Higher-risk carts can be nudged toward stronger authentication flows.

4. How recognizable payment brands can increase trust at checkout

Checkout trust is partly borrowed. Visa, Mastercard, PayPal, and Apple Pay function as trust shortcuts. That shortcut matters most for new brands and first-time buyers.

Brand recognition also reduces form fatigue. Wallet buttons signal a faster path. Customers know they will not retype billing addresses or card details.

From our perspective, trust signals should be consistent. The payment brand should match the post-purchase experience. Confusing receipts and merchant descriptors create disputes.

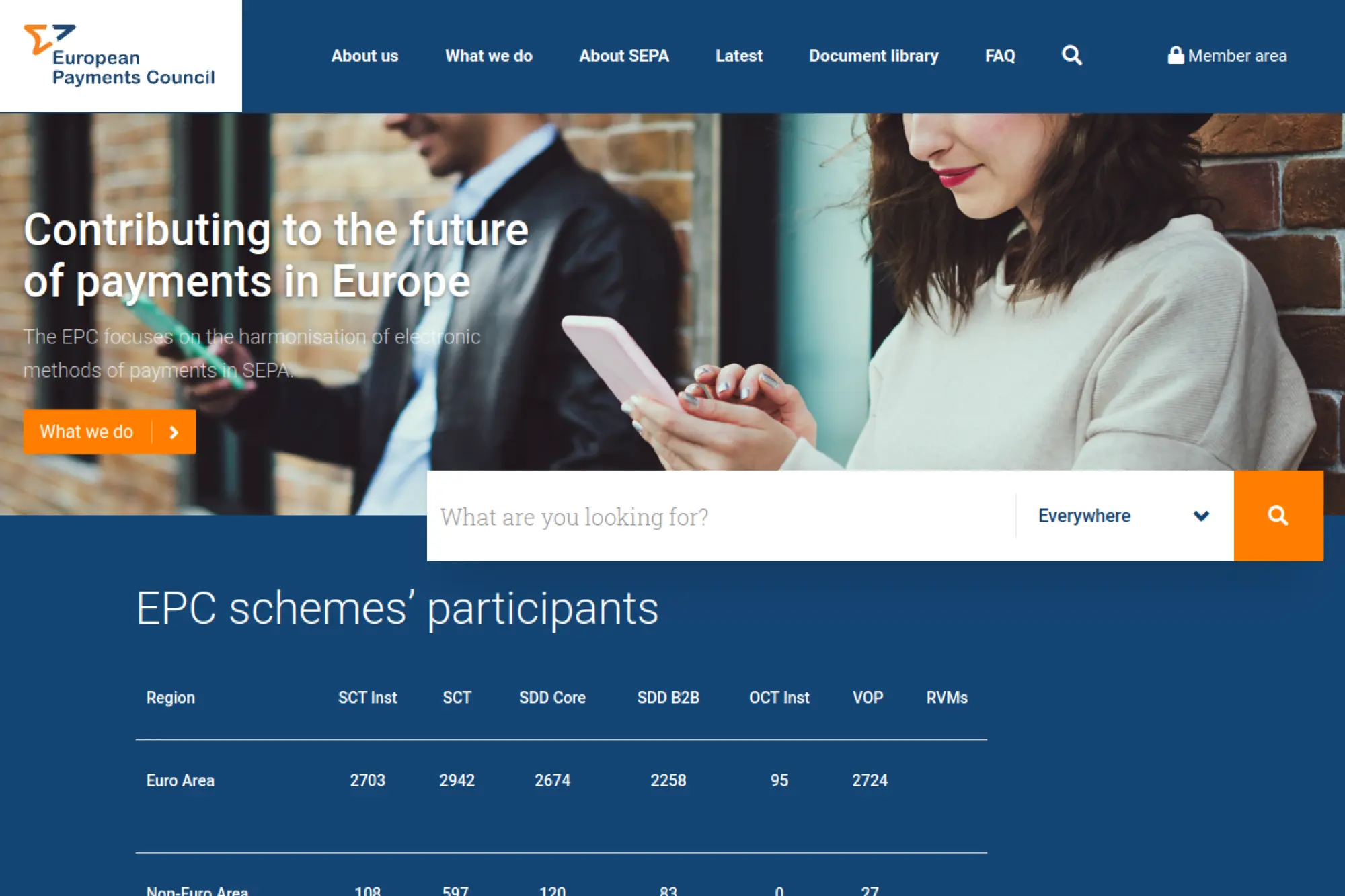

5. How regional preferences shape which online payment methods customers expect

Regional preference is not a cultural footnote. It is a hard conversion constraint. Customers often carry a “default rail” shaped by banks, telecoms, and regulation.

In the Netherlands, iDEAL is a baseline expectation for many shoppers. n Belgium, Bancontact can carry the same weight. And in parts of Southeast Asia, wallets like GrabPay or GCash feel more normal than cards.

Our rule is simple. Offer what the region expects first. Add global methods next.

6. Key trade-offs to plan for: fees, settlement speed, disputes, and fraud risk

No payment method is universally “best.” Each one shifts cost, timing, and liability. Planning is easier when trade-offs are explicit.

- Fees: cards and wallets can be predictable, but expensive at scale.

- Settlement: bank transfers can be slower, yet final once confirmed.

- Disputes: chargeback-heavy rails demand stronger evidence workflows.

- Fraud: low-friction methods invite abuse without strong risk controls.

We design the mix as a portfolio. Different rails protect different failure modes.

Quick Comparison of online payment methods

We do not believe in “one best payment method.” We believe in “one best mix” per audience, product, and risk profile. The table below is our compact shortlist for many ecommerce and digital-first builds.

| Tool | Best for | From price | Trial/Free | Key limits |

|---|---|---|---|---|

| Credit and debit cards | Broad acceptance worldwide | Per-transaction pricing | N/A | Chargebacks and card testing fraud |

| PayPal | Trust and fast guest checkout | Per-transaction pricing | Yes, sandbox | Account holds and policy sensitivity |

| Apple Pay | Mobile-first frictionless checkout | Included via processors | N/A | Device and ecosystem constraints |

| Google Pay | Android-heavy customer bases | Included via processors | N/A | Browser and device variation |

| ACH bank transfer | Domestic US account payments | Often lower than cards | Provider-dependent | Returns and delayed confirmation |

| SEPA Direct Debit | Recurring payments in Europe | Often lower than cards | Provider-dependent | Mandate management complexity |

| iDEAL | High conversion in the Netherlands | Provider-dependent | Provider-dependent | Redirect flow and bank UX variance |

| Klarna | Higher-ticket carts via installments | Provider-dependent | Provider-dependent | Returns and customer support handoffs |

| Afterpay | DTC brands and checkout flexibility | Provider-dependent | Provider-dependent | Eligibility rules and refunds timing |

| Cash on delivery | Markets with low card penetration | Operational overhead | N/A | Failed deliveries and cash handling risk |

For most teams, this shortlist is a starting spine. After launch, we expand based on analytics, support tickets, and fraud patterns. That feedback loop is where payments become a competitive advantage.

Top 30 online payment methods to accept in 2026

Choosing payment methods is a conversion job, not a tech flex. Our scoring favors what helps real buyers pay fast, trust the flow, and finish checkout without calling support. We grade each option on seven factors, then compute a weighted total. Value-for-money and feature depth carry the most weight, since fees and flexibility decide margins. Setup effort and integrations matter next, because “accepted” is not the same as “working.” UX, security, and support round it out, since a single failed payment can lose a customer for good.

We also look for practical outcomes: fewer form fields, fewer steps, faster authorization, and cleaner refunds. Where pricing is contract-based, we state what is usually true for self-serve onboarding. We flag the trade-offs that tend to surface after launch. In short, we reward methods that get you paid with less friction, and less surprise.

1. PayPal

PayPal is a long-running payments company with consumer wallets and merchant tools. Its teams focus on fraud controls, disputes, and global checkout reliability.

Outcome: let customers pay without typing card details.

Best for: solo merchants and SMB ecommerce teams that want recognizable checkout trust.

- PayPal Checkout buttons → reduces form-fill fatigue and lifts mobile completion rates.

- Wallet + stored funding sources → can skip 10–20 fields for returning buyers.

- Quick embed and hosted flows → time-to-first-value is often 1–2 hours.

Pricing & limits: From $0/mo; pay-per-transaction fees vary by country and risk. Trial length: none needed, since it is usage-based. Published caps are limited; account limits can apply during early volume ramps.

Honest drawbacks: Disputes can feel seller-unfriendly for some categories. Branding can pull attention away from your storefront, especially in express flows.

Verdict: If you want fast trust on day one, PayPal helps you convert cautious buyers within a week. Beats many wallets on familiarity; trails Stripe on developer-first customization.

Score: 4.3/5 and .

2. Apple Pay

Apple Pay is Apple’s wallet layer built into iOS and macOS. The product teams prioritize biometric confirmation and low-friction checkout on Apple devices.

Outcome: turn checkout into a quick confirm, not a typing test.

Best for: DTC brands and mobile-first retailers with a high iPhone customer share.

- Biometric approval flow → cuts cart abandonment from long shipping and card forms.

- Works through many payment processors → can remove manual entry steps entirely.

- Enable via your gateway dashboard → time-to-first-value is often same-day.

Pricing & limits: From $0/mo to enable, since pricing is usually your processor’s standard card rates. Trial length: not applicable. Limits depend on issuer rules and wallet configuration, not a published Apple Pay cap.

Honest drawbacks: It only helps customers on Apple devices, so coverage is uneven. Some advanced payment routing features depend on your processor, not Apple Pay.

Verdict: If you need faster mobile checkout, Apple Pay helps buyers finish in seconds once enabled. Beats manual card entry on speed; trails PayPal on cross-device ubiquity.

Score: 4.5/5 and .

3. Google Pay

Google Pay is Google’s wallet experience across Android and Chrome. Its teams optimize tokenized payments and a familiar “tap to pay” pattern online.

Outcome: make paying feel native for Android and Chrome shoppers.

Best for: ecommerce teams with meaningful Android traffic and global audiences.

- Saved cards and addresses → reduces checkout typing and mis-keyed details.

- Processor-enabled tokenization → can remove 8–15 checkout fields for repeat buyers.

- Standard button integrations → time-to-first-value is often a few hours.

Pricing & limits: From $0/mo; you typically pay your processor’s card fees. Trial length: none required. Transaction limits are usually set by issuers and risk systems, not Google Pay itself.

Honest drawbacks: User adoption varies by region and device mix. Debugging can be slower when issues span browser, device, and gateway layers.

Verdict: If you want a clean Android-friendly checkout, Google Pay helps you shorten purchase time quickly. Beats raw card forms on speed; trails Apple Pay on uniform device experience.

Score: 4.2/5 and .

4. Amazon Pay

Amazon Pay extends Amazon’s stored payment and address data to other stores. The teams lean into familiarity for shoppers who already trust Amazon checkout.

Outcome: borrow Amazon’s saved details to reduce checkout friction.

Best for: mid-market ecommerce teams and marketplaces targeting frequent Amazon buyers.

- Stored shipping and payment info → reduces address entry and drop-off points.

- Account-based login flow → can remove multiple checkout steps for returning users.

- Merchant onboarding plus integration → time-to-first-value is often 1–3 days.

Pricing & limits: From $0/mo; fees are typically per transaction and vary by terms. Trial length: none needed. Limits can appear during early processing history, depending on risk review.

Honest drawbacks: Some shoppers dislike leaving your brand context for an Amazon-branded flow. Availability and feature depth vary by country and platform.

Verdict: If your buyers live on Amazon, Amazon Pay helps them pay faster with fewer errors. Beats generic wallets on familiarity for those users; trails PayPal on broad consumer reach.

Score: 3.9/5 and .

5. Klarna

Klarna is a major buy-now-pay-later provider with consumer-facing apps and merchant programs. Its risk and underwriting teams focus on installment approvals and repayments.

Outcome: offer installments that can lift average order value.

Best for: DTC retail teams and fashion or home brands selling mid-priced carts.

- Installment options at checkout → helps shoppers say “yes” to bigger baskets.

- Payment messaging and placement tools → can reduce decision friction in 1–2 steps.

- Partner-led integrations → time-to-first-value is often 1–2 weeks.

Pricing & limits: From $0/mo; merchant pricing is commonly per transaction and often quote-based. Trial length: typically none in the classic sense. Limits are approval-driven, since each buyer gets a decision per purchase.

Honest drawbacks: BNPL can increase returns, especially in apparel categories. Your margin can feel the fee pressure on lower-priced items.

Verdict: If you want higher AOV without building in-house credit, Klarna helps you add installments in weeks. Beats card-only checkout on flexibility; trails cards on universal acceptance.

Score: 4.0/5 and .

6. Afterpay

Afterpay is a BNPL brand known for pay-in-four style offers in several markets. The teams emphasize simple repayment schedules and straightforward consumer UX.

Outcome: give shoppers a predictable split-payment option at checkout.

Best for: SMB ecommerce brands and youth-skewing retailers optimizing conversion.

- Pay-in-installments flow → increases affordability perception without changing list price.

- Platform plugins and gateways → can cut implementation steps down to a few clicks.

- Clear on-site messaging patterns → time-to-first-value is often under two weeks.

Pricing & limits: From $0/mo; merchant fees are typically per transaction and contract-based. Trial length: not usually offered as a “trial,” since approval is underwriting-driven. Buyer caps vary by account history and purchase behavior.

Honest drawbacks: BNPL branding can attract deal-seekers who return more. Some merchants dislike limited control over approval outcomes and repayment timing.

Verdict: If you need a simple installment offer, Afterpay helps you reduce sticker shock quickly. Beats longer-term lenders on clarity; trails Affirm on flexible term variety.

Score: 3.9/5 and .

7. Affirm

Affirm is a consumer credit and BNPL provider with multiple term lengths. Its product and risk teams focus on transparent payment plans and real-time approvals.

Outcome: sell higher-ticket items with monthly payments buyers can understand.

Best for: higher-AOV ecommerce teams and merchants selling electronics, fitness, or travel.

- Multiple installment terms → helps shoppers choose a monthly payment that fits.

- Prequal and promotional messaging options → can reduce “can I afford this” steps.

- Gateway and platform integrations → time-to-first-value is often 1–3 weeks.

Pricing & limits: From $0/mo; merchant fees are typically per transaction and negotiated. Trial length: not commonly structured as a trial. Limits are buyer-specific, since approvals depend on underwriting and purchase context.

Honest drawbacks: Fees can be hard to justify on low-margin SKUs. Some promos add operational complexity, especially around returns and partial refunds.

Verdict: If you sell expensive carts, Affirm helps you increase conversion within a month. Beats pay-in-four tools on term flexibility; trails cards on simplicity for low tickets.

Score: 4.1/5 and .

8. Sezzle

Sezzle is a BNPL provider with a focus on installment payments and merchant partnerships. Its teams lean into quick approvals and simple consumer repayment schedules.

Outcome: add pay-in-installments without rebuilding your checkout.

Best for: SMB retailers and niche DTC brands that want BNPL with manageable complexity.

- Pay-in-four style checkout → helps price-sensitive buyers complete purchases.

- Common ecommerce platform plugins → can reduce setup to a handful of steps.

- Merchant onboarding workflows → time-to-first-value is often 1–2 weeks.

Pricing & limits: From $0/mo; merchant fees are generally per transaction and contract-based. Trial length: typically none. Buyer limits vary, since approvals are decisioned at purchase time.

Honest drawbacks: Brand recognition is smaller than Klarna or Afterpay in some markets. Reporting depth can feel light if you want granular cohort analysis.

Verdict: If you want BNPL without heavyweight ops, Sezzle helps you launch installments in weeks. Beats custom financing on speed; trails larger BNPLs on global demand.

Score: 3.7/5 and .

9. Zip

Zip is a BNPL provider offering installment-style payments and shopper tools. Its teams focus on checkout approvals and repayment management across supported regions.

Outcome: reduce sticker shock with a familiar split-pay option.

Best for: mid-market ecommerce teams and retailers with younger, budget-conscious buyers.

- Installment checkout option → helps buyers commit without waiting for payday.

- Partner integrations and platform support → can skip custom build steps entirely.

- Merchant setup with underwriting → time-to-first-value is often 2–4 weeks.

Pricing & limits: From $0/mo; merchant pricing is usually per transaction and negotiated. Trial length: not typical. Limits are buyer- and order-dependent, since approval is part of the flow.

Honest drawbacks: Coverage and brand recognition vary by country. Refund operations can add edge cases, especially with partial shipments.

Verdict: If you want an installment offer, Zip helps you add it without lending in-house. Beats cards on affordability messaging; trails PayPal on universal familiarity.

Score: 3.6/5 and .

10. Venmo

Venmo is a consumer payments app under PayPal’s umbrella. Its teams emphasize person-to-person ease and a social, mobile-native feel.

Outcome: let US shoppers pay with a wallet they already use daily.

Best for: US-focused ecommerce brands and SMB sellers targeting younger buyers.

- Venmo button at checkout → reduces card entry and speeds mobile payments.

- Wallet login and stored funding → can remove 8–15 form fields instantly.

- Often enabled through existing PayPal rails → time-to-first-value is often same-day.

Pricing & limits: From $0/mo; fees are generally per transaction through your processing setup. Trial length: none required. Limits can apply at the user or account level, depending on verification.

Honest drawbacks: It is primarily US-centric, so it will not cover global carts. Some customers still prefer card entry for rewards or corporate cards.

Verdict: If you sell to US mobile shoppers, Venmo helps you remove friction in a single button. Beats manual cards on speed; trails Apple Pay on device-level biometrics.

Score: 4.0/5 and .

11. Cash App

Cash App is a consumer finance app with peer payments and wallet-like spending. Its teams focus on fast transfers and a simple mobile experience.

Outcome: capture wallet-funded purchases without forcing card entry.

Best for: digital sellers and SMB merchants with audiences already using Cash App.

- Wallet-style pay flow → helps customers complete purchases with less data entry.

- App-first authentication → can reduce checkout to a confirm-and-return pattern.

- Integration depends on your platform or provider → time-to-first-value is often days.

Pricing & limits: From $0/mo; pricing is usually transaction-based and provider-dependent. Trial length: none needed. Limits can be user-specific, since wallets may enforce verification tiers.

Honest drawbacks: Merchant availability can depend on partners, not just your intent. Consumer support expectations may rise when payments feel “app-owned,” not store-owned.

Verdict: If your buyers live in Cash App, this helps you meet them where they pay within weeks. Beats bank transfer flows on speed; trails PayPal on merchant tooling maturity.

Score: 3.5/5 and .

12. WeChat Pay

WeChat Pay is a major wallet inside Tencent’s WeChat ecosystem. Its teams optimize QR-based commerce and in-app payments for WeChat-native users.

Outcome: accept payments from customers who shop inside WeChat.

Best for: cross-border merchants and travel or luxury brands selling to Chinese shoppers.

- In-app wallet payments → helps customers pay without leaving familiar social contexts.

- QR and partner gateway support → can remove manual bank steps and reduce friction.

- Onboarding and compliance checks → time-to-first-value is often 2–6 weeks.

Pricing & limits: From $0/mo; processing fees are typically transaction-based and contract-led. Trial length: not typical. Limits depend on user verification and cross-border compliance requirements.

Honest drawbacks: Settlement, reporting, and refunds can feel complex across currencies. Approval paths can be slow if your business model triggers extra review.

Verdict: If you target Chinese customers, WeChat Pay helps you convert in the channels they trust within a month. Beats cards on local familiarity; trails Stripe on developer documentation consistency.

Score: 3.8/5 and .

13. Alipay

Alipay is a large wallet and payments ecosystem associated with Ant Group. Its teams focus on wallet acceptance, cross-border commerce, and buyer trust signals.

Outcome: unlock wallet payments for Chinese travelers and cross-border shoppers.

Best for: international ecommerce teams and merchants with China-origin demand.

- Wallet-based checkout → reduces card-decline risk for buyers who prefer wallets.

- Partner acquiring options → can cut onboarding steps by using existing PSP rails.

- Documentation plus partner support → time-to-first-value is often 3–8 weeks.

Pricing & limits: From $0/mo; fees are usually per transaction and set by contract. Trial length: none required. Limits vary by user status, currency corridors, and compliance review.

Honest drawbacks: Integration can be partner-dependent, which reduces your direct control. Dispute handling and refund timing can be unfamiliar if you only know card rules.

Verdict: If you sell cross-border, Alipay helps you take preferred wallet payments within one to two months. Beats cards on local preference; trails PayPal on Western consumer recognition.

Score: 3.9/5 and .

14. China UnionPay

China UnionPay is a major card network with global acceptance partnerships. Its teams focus on network routing, issuer relationships, and cross-border authorization.

Outcome: accept a major card brand for China-linked spending.

Best for: international retailers and marketplaces serving travelers and overseas Chinese buyers.

- Network acceptance via processors → expands card coverage beyond Visa and Mastercard.

- Gateway routing support → can reduce declines by choosing better authorization paths.

- Enable through your acquirer → time-to-first-value is often 1–3 weeks.

Pricing & limits: From $0/mo; network and processor fees apply per transaction. Trial length: not applicable. Limits depend on issuer controls and your acquiring setup.

Honest drawbacks: Visibility into routing and decline reasons can be limited in basic dashboards. Support quality varies widely by processor and region.

Verdict: If you want broader card coverage, UnionPay helps you reduce missed payments within weeks. Beats “Visa-only” setups on reach; trails wallets on one-tap checkout.

Score: 3.7/5 and .

15. Visa

Visa is a global card network connecting issuers, acquirers, and merchants. Its teams invest heavily in authorization reliability and fraud prevention frameworks.

Outcome: accept the default card choice for a huge share of shoppers.

Best for: every ecommerce business that needs mainstream card coverage.

- Universal card acceptance → captures buyers who will not use wallets or BNPL.

- Strong processor ecosystem → can reduce setup steps by choosing a ready-made gateway.

- Turn on via your payment provider → time-to-first-value is often 1–3 days.

Pricing & limits: From $0/mo; you pay per-transaction processing fees via your acquirer. Trial length: none needed. Limits are set by issuers and merchant risk rules, not Visa alone.

Honest drawbacks: Card entry adds friction versus one-tap wallets. Chargebacks can be expensive in time, even when you win cases.

Verdict: If you want baseline acceptance, Visa helps you get paid by most customers immediately. Beats niche methods on coverage; trails Apple Pay on mobile speed.

Score: 4.4/5 and .

16. Mastercard

Mastercard is a global card network supporting consumer and business cards. Its teams focus on secure authorization, network services, and fraud tooling partnerships.

Outcome: cover a massive share of card-paying customers worldwide.

Best for: any online business that cannot afford card coverage gaps.

- Broad issuer acceptance → reduces “I can’t pay” moments at checkout.

- Works with nearly every gateway → can save days versus custom payment builds.

- Enablement via processors → time-to-first-value is often under a week.

Pricing & limits: From $0/mo; merchant fees are transaction-based through your acquirer. Trial length: not applicable. Limits follow issuer and risk policies, not a single published network cap.

Honest drawbacks: Raw card checkout still requires typing and can hurt mobile conversion. Decline reasons can be opaque without advanced processor tooling.

Verdict: If you want dependable card acceptance, Mastercard helps you convert standard buyers right away. Beats local methods on global reach; trails wallets on speed.

Score: 4.3/5 and .

17. American Express

American Express is a card network and issuer with a premium cardholder base. Its teams emphasize fraud controls, cardmember services, and high-spend acceptance programs.

Outcome: win higher-spend customers who prefer Amex rewards.

Best for: premium brands and B2B sellers targeting corporate spenders.

- Access to Amex cardholders → can lift AOV when customers want points and perks.

- Processor support for Amex acceptance → saves custom routing steps in most stacks.

- Turn on through your acquirer → time-to-first-value is often within days.

Pricing & limits: From $0/mo; per-transaction fees vary by contract and category. Trial length: none. Limits depend on issuer decisions and merchant risk rules.

Honest drawbacks: Costs can run higher than other card rails for some merchants. Some customers do not carry Amex, so it cannot be your only card option.

Verdict: If you sell premium carts, Amex helps you capture reward-driven buyers quickly. Beats BNPL on simplicity for high-credit customers; trails Visa on universal coverage.

Score: 4.0/5 and .

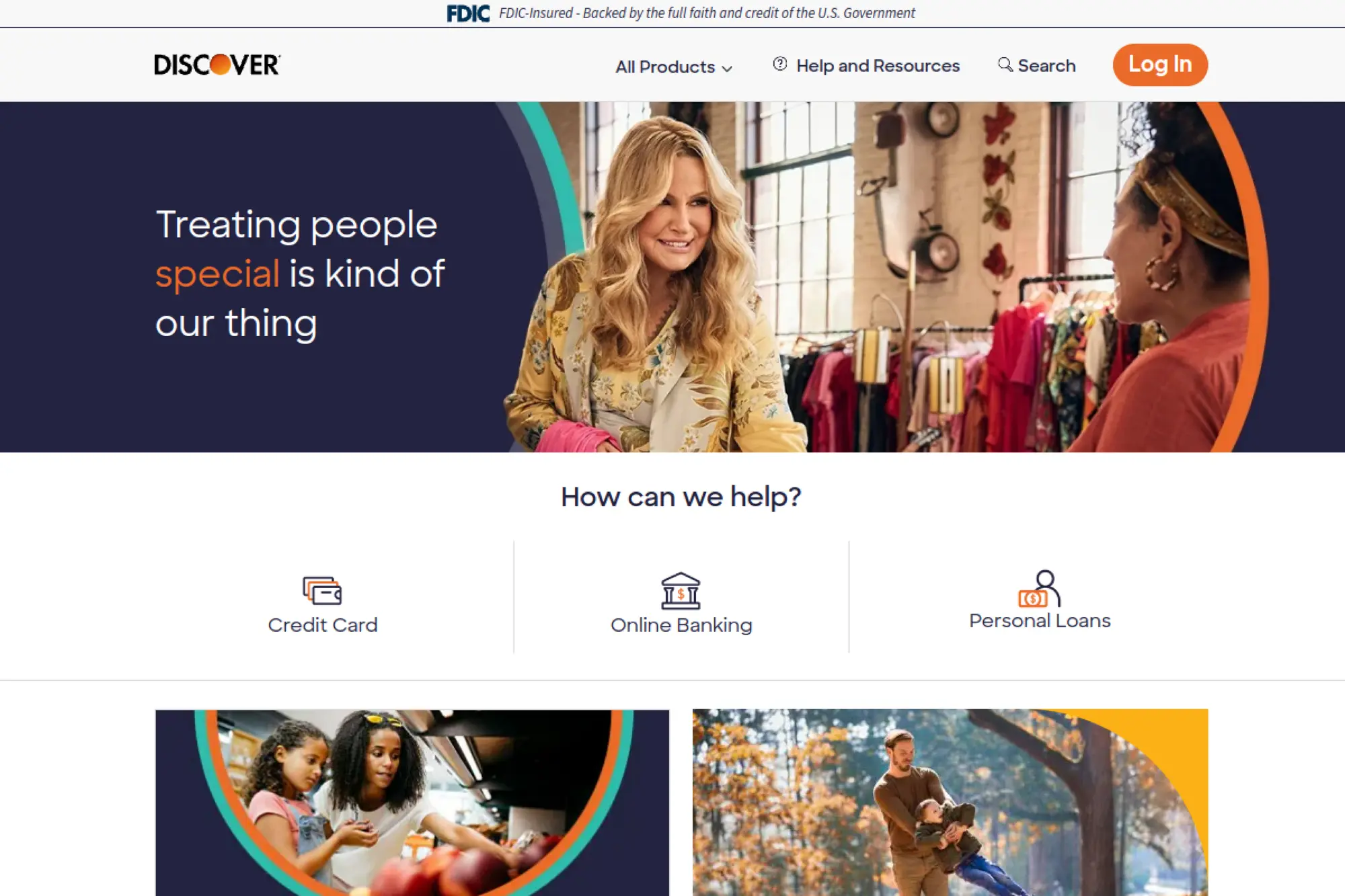

18. Discover

Discover is a card brand with issuer and network roles in several markets. Its teams focus on card acceptance, fraud controls, and consumer card services.

Outcome: avoid losing buyers who show up with a Discover card.

Best for: US-facing merchants and subscription businesses wanting full card coverage.

- Additional mainstream card rail → reduces checkout failures from missing card brands.

- Supported by most processors → can avoid extra integration work entirely.

- Enable via your gateway settings → time-to-first-value is often under a week.

Pricing & limits: From $0/mo; transaction fees depend on your processor agreement. Trial length: not applicable. Limits depend on issuer controls and merchant underwriting.

Honest drawbacks: It rarely drives incremental conversion like wallets do. Reporting and optimization features depend on your processor, not the network.

Verdict: If you want complete card acceptance, Discover helps you close small but painful gaps fast. Beats niche wallets on reach; trails Apple Pay on speed.

Score: 3.8/5 and .

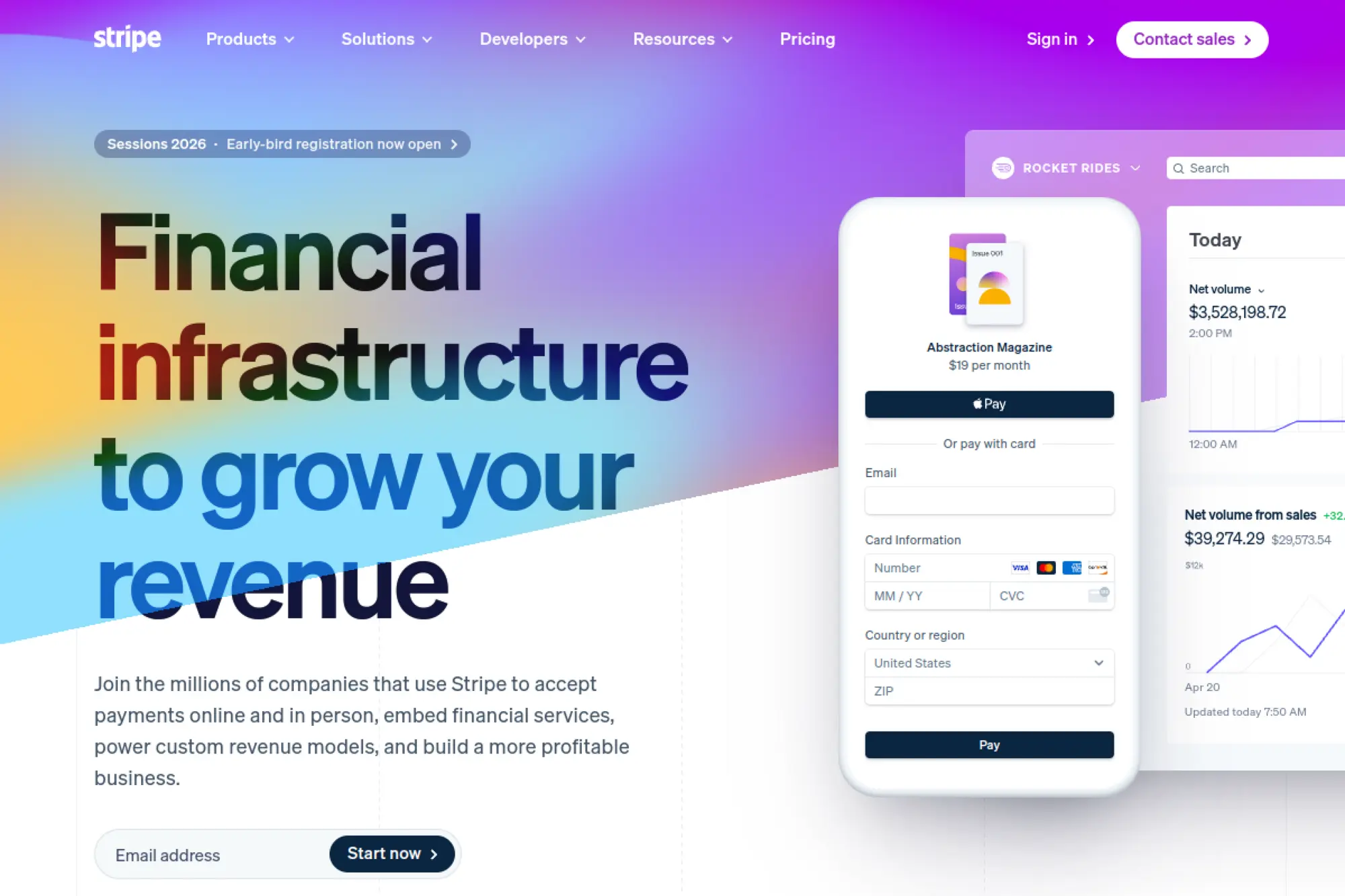

19. Stripe

Stripe is a developer-focused payments company with APIs and a broad product suite. Its teams invest in documentation, reliability, and modular building blocks for checkout.

Outcome: launch and optimize payments without rebuilding your stack later.

Best for: startups and product-led teams that want control plus fast iteration.

- Flexible checkout building blocks → supports custom flows, subscriptions, and saved payments.

- Large integration ecosystem → can remove manual finance steps through automations and webhooks.

- Strong docs and test tooling → time-to-first-value is often 1–3 days.

Pricing & limits: From $0/mo; pay per successful transaction, with rates depending on method and region. Trial length: none required. Limits and reserves can apply for high-risk categories or rapid volume changes.

Honest drawbacks: Costs can rise as you add methods, billing, and revenue tools. Advanced setups often require engineering time, not just toggles.

Verdict: If you want a payments foundation you can grow on, Stripe helps you ship improvements weekly. Beats Square on developer depth; trails PayPal on instant consumer recognition.

Score: 4.6/5 and .

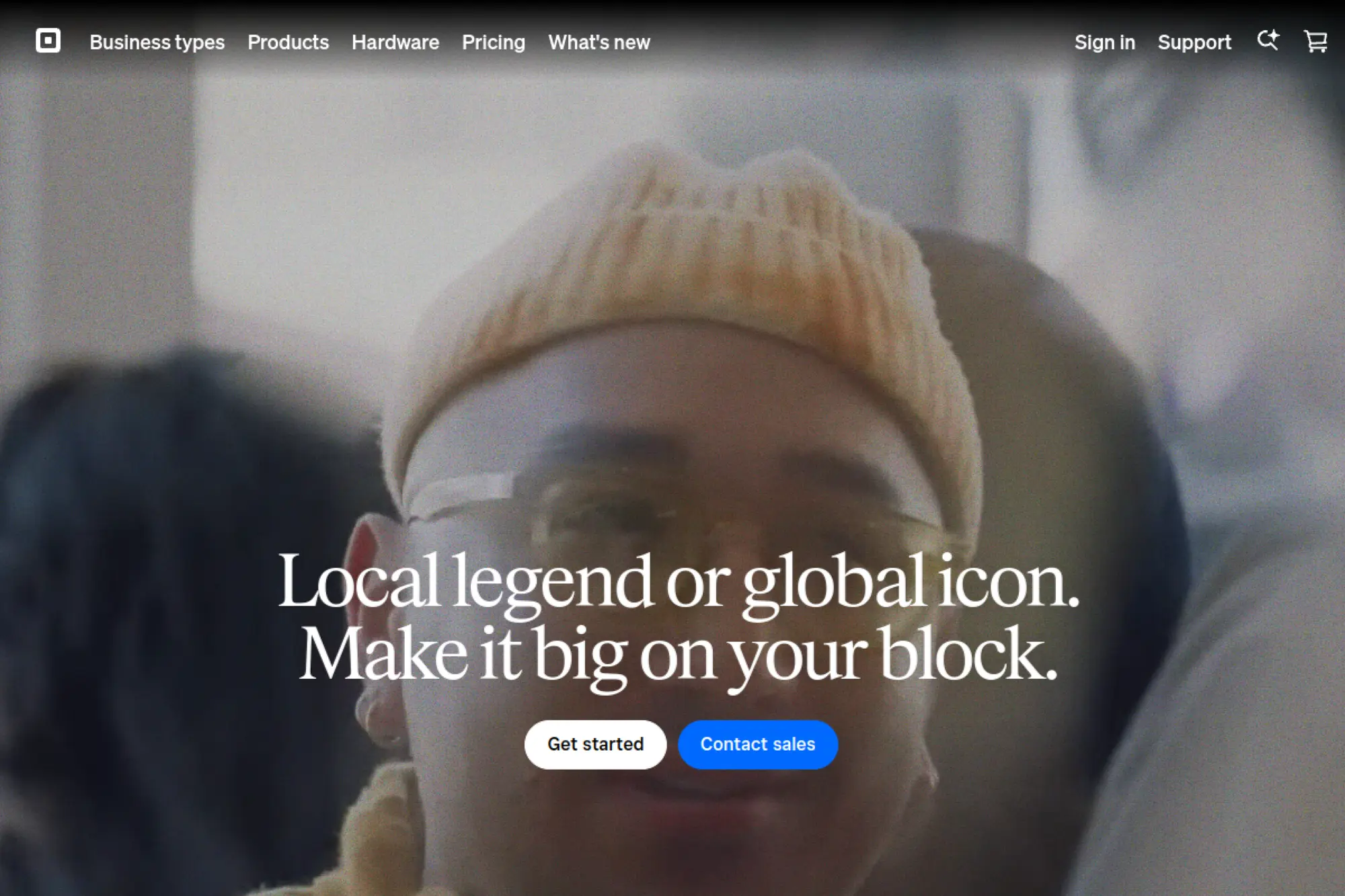

20. Square

Square is a commerce and payments company known for seller-friendly tools. Its teams focus on quick onboarding, unified reporting, and simple payment acceptance.

Outcome: start taking payments fast, with less configuration overhead.

Best for: SMB retailers and service businesses that want easy setup and a single dashboard.

- Unified payments and commerce tools → reduces tool sprawl for small teams.

- App ecosystem plus add-ons → can automate receipts, invoices, and basic follow-ups.

- Fast onboarding and defaults → time-to-first-value is often same-day.

Pricing & limits: From $0/mo for core acceptance; add-ons can cost extra depending on products. Trial length: none needed. Limits and holds can occur for new sellers or unusual ticket sizes.

Honest drawbacks: Custom checkout control can be narrower than API-first platforms. International availability is more limited than some global processors.

Verdict: If you want speed and simplicity, Square helps you get paid this week with minimal fuss. Beats many PSPs on ease; trails Stripe on deep customization.

Score: 4.2/5 and .

21. Verifone

Verifone is a payments company historically known for terminals and enterprise payment systems. Its teams support omnichannel acceptance, device management, and payment security programs.

Outcome: unify online and in-person payments under enterprise controls.

Best for: multi-location retailers and enterprises needing managed payments operations.

- Omnichannel payment tooling → reduces reconciliation gaps between store and online sales.

- Enterprise integrations and services → can save weeks of internal device and gateway work.

- Managed rollout options → time-to-first-value is often 4–8 weeks.

Pricing & limits: From $0/mo in some structures, though enterprise contracts may include platform fees. Trial length: uncommon, since onboarding is project-based. Limits depend on underwriting and contract terms.

Honest drawbacks: It can feel heavy for small teams with simple online checkout needs. Implementation often requires coordination across IT, finance, and operations.

Verdict: If you need enterprise-grade control, Verifone helps you standardize payments over a quarter. Beats lightweight tools on governance; trails Stripe on self-serve speed.

Score: 3.8/5 and .

22. Pay.com

Pay.com is positioned as an online payments brand, typically used through provider-led onboarding. The team focus can vary by region, since offerings may be partner-dependent.

Outcome: consolidate checkout options into a single, managed payment flow.

Best for: SMBs and lean ecommerce teams that want a guided setup, not a custom build.

- Hosted or managed checkout approach → reduces engineering effort for basic acceptance.

- Provider-led integrations → can remove many manual gateway configuration steps.

- Guided onboarding experience → time-to-first-value is often 1–3 weeks.

Pricing & limits: From $0/mo in some packages; quote-based pricing is common for managed setups. Trial length: not always offered. Limits and reserves can apply, especially for new or high-risk merchants.

Honest drawbacks: Feature transparency can be lower than major self-serve platforms. Ecosystem depth may trail Stripe or PayPal, depending on your required integrations.

Verdict: If you want a hands-on path to “live,” Pay.com can help you launch payments within a month. Beats DIY tools on guidance; trails market leaders on documented extensibility.

Score: 3.3/5 and .

23. Bitcoin

Bitcoin is a decentralized network, not a single company. The ecosystem is built by open-source contributors, wallet teams, exchanges, and payment gateway providers.

Outcome: accept global payments without relying on card networks.

Best for: digital goods sellers and international merchants comfortable with crypto operations.

- Direct wallet-to-wallet payments → reduces dependence on card approvals and chargebacks.

- Gateway and invoicing tools → can automate confirmations and save manual matching time.

- Self-custody or processor setup → time-to-first-value ranges from hours to weeks.

Pricing & limits: From $0/mo if you self-custody; gateways may add monthly or per-transaction fees. Trial length: not applicable. Limits are not protocol-set, but exchanges and processors may enforce caps.

Honest drawbacks: Volatility can turn revenue into a timing game without instant conversion. Refunds and support get tricky, since payments are not reversible by default.

Verdict: If you need borderless payments, Bitcoin helps you accept value quickly with the right ops. Beats cards on irreversibility; trails cards on mainstream buyer adoption.

Score: 3.4/5 and .

24. Ethereum

Ethereum is a decentralized smart-contract network supported by open-source teams and client developers. The wider ecosystem includes wallets, stablecoin issuers, and payment tool builders.

Outcome: accept programmable payments, including stablecoin-based checkout.

Best for: web3-native businesses and global sellers who want on-chain settlement options.

- Smart-contract compatible payments → enables escrow-like flows and automated releases.

- Stablecoin acceptance via wallets → can cut FX steps and reduce cross-border friction.

- Wallet and gateway setup paths → time-to-first-value ranges from 1 day to 4 weeks.

Pricing & limits: From $0/mo to accept directly, though network fees apply per transaction. Trial length: not applicable. Limits are not enforced by the protocol, but tools and exchanges may apply caps.

Honest drawbacks: Network fees can spike, which hurts low-ticket purchases. Customer support burden rises, since lost wallet access is not recoverable by you.

Verdict: If you want programmable settlement, Ethereum helps you launch crypto checkout in weeks. Beats Bitcoin on programmability; trails card rails on consumer familiarity.

Score: 3.3/5 and .

25. ACH transfers

ACH is a US bank-to-bank transfer system governed by network rules and bank participation. The operational “team” is usually your bank or payment provider handling files, returns, and disputes.

Outcome: move money with lower fees than cards for many use cases.

Best for: B2B sellers and subscription companies handling larger invoices or recurring debits.

- Bank debit and credit flows → reduces card fee pressure on high-value transactions.

- Processor integrations for verification → can cut manual bank detail checks by hours.

- Enable via billing or invoicing tools → time-to-first-value is often 1–2 weeks.

Pricing & limits: From $0/mo through many providers; per-transfer fees vary by platform. Trial length: none required. Limits depend on bank rails, return risk, and provider underwriting.

Honest drawbacks: Settlement is slower than cards, so cash timing changes. Returns and unauthorized debit claims can create delayed surprises.

Verdict: If you want cheaper bank payments, ACH helps you collect recurring revenue within a month. Beats cards on cost; trails cards on instant authorization.

Score: 4.1/5 and .

26. SEPA bank transfer

SEPA is a European payments scheme for euro transfers across participating countries. Execution depends on banks and PSPs that implement scheme rules and messaging standards.

Outcome: accept euro bank transfers with familiar EU payment expectations.

Best for: EU-focused merchants and B2B sellers invoicing in euros.

- Euro bank transfer rails → reduces card reliance for buyers who prefer bank payments.

- PSP automations for reconciliation → can save 15–30 minutes per payout matching cycle.

- Enablement through EU PSPs → time-to-first-value is often 1–3 weeks.

Pricing & limits: From $0/mo via many providers; per-transfer pricing varies by bank and PSP. Trial length: not applicable. Limits depend on bank policies and your provider’s risk settings.

Honest drawbacks: Customer experience can be slower than instant methods. Refund handling and reference matching can be messy without strong reconciliation tooling.

Verdict: If you invoice EU customers, SEPA helps you get paid with fewer card fees in weeks. Beats cards on cost for large invoices; trails iDEAL on instant consumer checkout.

Score: 3.9/5 and .

27. iDEAL

iDEAL is a widely used bank transfer payment method in the Netherlands. Its ecosystem includes banks, acquirers, and PSP teams that focus on smooth, bank-authenticated checkout.

Outcome: let Dutch customers pay using their trusted online banking flow.

Best for: EU merchants selling into the Netherlands and subscription services with Dutch users.

- Bank-authenticated payment flow → reduces card declines and increases trust locally.

- PSP support and platform plugins → can cut integration down to a single toggle.

- Well-worn user experience patterns → time-to-first-value is often under two weeks.

Pricing & limits: From $0/mo; fees are usually per transaction through your PSP. Trial length: none needed. Limits depend on bank rules and your PSP’s risk policies.

Honest drawbacks: It is region-specific, so it will not help outside Dutch-heavy traffic. Refund timing and reference handling can vary across providers.

Verdict: If you want Dutch conversion, iDEAL helps you feel local within days. Beats cards on local trust; trails cards on global coverage.

Score: 4.2/5 and .

28. Bancontact

Bancontact is a major Belgian payment method used via cards and bank-linked flows. Its ecosystem relies on Belgian banks and PSPs that standardize the checkout experience.

Outcome: capture Belgian buyers who prefer local payment rails.

Best for: EU ecommerce teams and merchants with meaningful Belgium traffic.

- Local payment acceptance → reduces checkout hesitation from unfamiliar foreign methods.

- PSP integrations and routing → can remove the need for separate local acquiring work.

- Standard checkout patterns → time-to-first-value is often 1–2 weeks.

Pricing & limits: From $0/mo; per-transaction fees apply through your PSP or acquirer. Trial length: not applicable. Limits depend on bank controls and provider underwriting.

Honest drawbacks: It is not a global method, so its ROI depends on Belgium share. Some platforms expose limited reporting detail unless you upgrade your payments stack.

Verdict: If Belgium matters to your revenue, Bancontact helps you reduce friction within weeks. Beats cards on local preference; trails wallets on one-tap speed.

Score: 3.9/5 and .

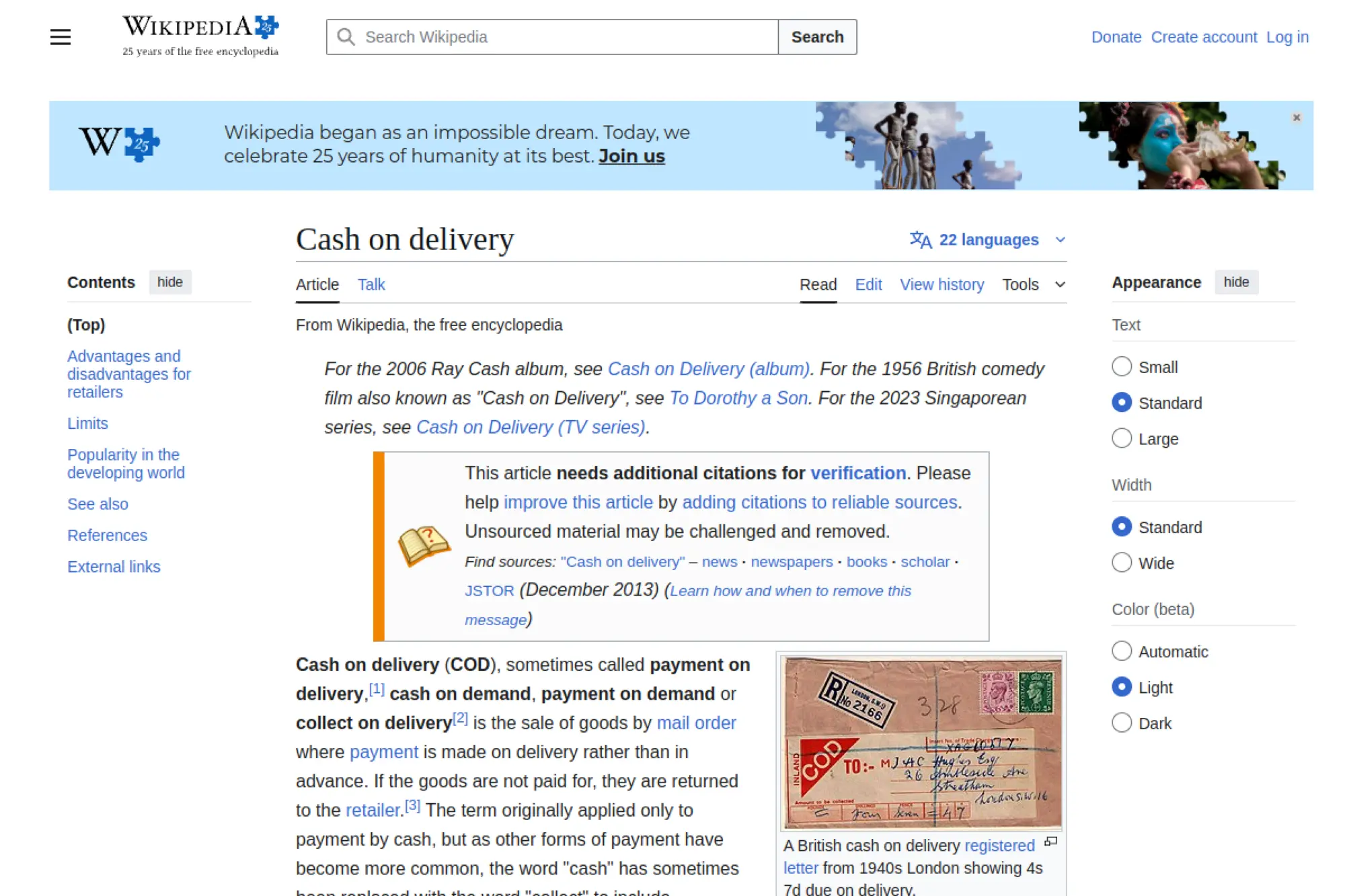

29. Cash on delivery COD

Cash on delivery is a fulfillment-linked payment method rather than a single provider. The “team” is your logistics partners, drivers, and support staff managing collection and reconciliation.

Outcome: win buyers who distrust online prepayment.

Best for: ecommerce sellers in high-trust-gap markets and merchants shipping physical goods.

- Payment at delivery → increases trust for first-time buyers wary of online fraud.

- Carrier collection workflows → can reduce failed deliveries by confirming intent earlier.

- Operational setup with shipping partners → time-to-first-value is often 1–3 weeks.

Pricing & limits: From $0/mo to offer, though carriers often charge collection and remittance fees. Trial length: not applicable. Limits depend on carrier policies, cash handling rules, and return risk.

Honest drawbacks: RTO and refusal rates can spike, which wrecks unit economics. Cash handling increases fraud risk and adds reconciliation work for your finance team.

Verdict: If you need trust before payment, COD helps you unlock demand within a month. Beats cards on skepticism-heavy audiences; trails digital methods on operational simplicity.

Score: 3.2/5 and .

30. Echecks

Echecks are electronic check payments processed through bank rails and payment providers. The experience depends on your processor’s teams handling verification, returns, and settlement.

Outcome: accept bank-backed payments without forcing card usage.

Best for: B2B merchants and service businesses that invoice and want bank-friendly options.

- Electronic check flow → supports customers who prefer checks without mailing delays.

- Verification and reconciliation tools → can save multiple manual follow-ups per week.

- Provider-based enablement → time-to-first-value is often 1–2 weeks.

Pricing & limits: From $0/mo through many PSPs; per-transaction fees vary by provider. Trial length: none required. Limits depend on risk settings, bank verification, and return history.

Honest drawbacks: Settlement is slower than cards and wallets. Returns and insufficient-funds events can create delayed revenue reversals.

Verdict: If you want a check-like option online, echecks help you collect bank payments within weeks. Beats paper checks on speed; trails cards on instant confirmation.

Score: 3.8/5 and .

Key types of online payment methods and where each fits best

1. Cards: credit cards and debit cards for broad acceptance

Cards remain the default for global ecommerce. They are familiar, fast, and widely supported by platforms. They also come with a mature dispute system.

We typically support Visa, Mastercard, American Express, Discover, JCB, UnionPay, and Diners Club. That list looks boring, yet it covers most global demand. It also simplifies reconciliation and customer support scripts.

Card risks are well-known. Card testing, friendly fraud, and chargebacks demand monitoring. Strong velocity checks and device signals help.

2. Digital wallets and mobile wallets for faster, mobile-friendly checkout

Wallets compress the checkout form into a button. Apple Pay and Google Pay reduce typing. PayPal reduces perceived risk for new buyers.

In practice, wallets also change fraud patterns. Stolen card entry becomes harder, but account takeover becomes more relevant. That shift changes what “good fraud tooling” looks like.

Beyond the global trio, we often see Amazon Pay, Venmo, Cash App Pay, Samsung Pay, Alipay, and WeChat Pay. Regional wallet leaders include GrabPay, GCash, Paytm, PhonePe, M-Pesa, and Airtel Money.

3. Bank transfers for high-value and B2B online payments

Bank transfers fit high-value carts and invoice-like payments. They also suit customers who want bank-native confirmation. For business-to-business flows, transfers align with procurement habits.

Common rails include ACH credit transfer, SEPA Credit Transfer, SWIFT wire, Faster Payments, and Interac e-Transfer. Each rail has different confirmation semantics. That affects fulfillment and access provisioning.

We design these flows around “pending” states. Clear communication prevents support escalations. Automated reminders reduce unpaid invoices.

4. Bank debits for lower-dispute recurring payments

Bank debits shine when you bill repeatedly. They tend to reduce classic chargebacks. Customers also perceive them as “utility style” payments.

Typical options include ACH debit, SEPA Direct Debit, Bacs Direct Debit, BECS Direct Debit, and PAD. Each requires mandate or authorization handling. That mandate is a compliance artifact and a product UX problem.

From our builds, mandate storage and auditability matter. When disputes happen, evidence must be easy to retrieve. Otherwise, finance teams burn days.

5. Bank redirects for authenticated bank-based checkout flows

Bank redirects hand the customer to their bank for authentication. That reduces certain fraud types. It also increases checkout steps.

Common redirect methods include iDEAL, Sofort, Giropay, Bancontact, EPS, Przelewy24, and Trustly. These methods can convert extremely well in their core markets. Outside those markets, they confuse customers.

We treat redirect UX as a choreography problem. Clear labels, consistent return handling, and strong error messages make it work.

6. Buy now pay later BNPL for installments and higher-ticket purchases

BNPL can lift conversion for higher-ticket purchases. It can also reduce sticker shock. Customers see a smaller periodic cost instead of a full amount.

Providers like Klarna, Afterpay, Affirm, Zip, and PayPal Pay Later are common. Each provider has its own eligibility rules and customer support model. That affects your returns and refunds operations.

We recommend BNPL only when merchandising supports it. If your returns policy is vague, BNPL disputes become messy. Clear terms save everyone time.

7. Cryptocurrency payments for specific tech-savvy and international use cases

Crypto payments can reduce cross-border friction for a niche audience. They can also attract communities that prefer self-custody. For most mainstream stores, demand remains limited.

Bitcoin and Ethereum are the names customers recognize. USDC can be useful for price stability in some flows. Volatility, refunds, and accounting treatment still need careful design.

We advise teams to treat crypto as an optional rail. The operational playbook matters more than the marketing announcement. If finance cannot reconcile it, it will be turned off.

8. Prepaid cards, gift cards, and store cards for controlled spending and loyalty

Prepaid and gift instruments are powerful for controlled budgets and gifting. They reduce the need for a bank account in some markets. They also drive repeat purchases.

We commonly support prepaid Visa, prepaid Mastercard, and branded gift cards. Store credit systems can also behave like a payment method. That is especially true for marketplaces and returns-heavy retailers.

The hidden work is ledger accuracy. Gift balances are liabilities. Partial captures, split tenders, and refunds require careful accounting logic.

9. Autopay for subscriptions, memberships, and recurring billing

Autopay is less a payment method and more a product promise. Customers expect continuity. They also expect painless updates when cards expire.

Card-on-file subscriptions are common for SaaS and memberships. Direct debit autopay often fits utilities and long-running services. The best choice depends on dispute posture and customer comfort.

In our systems, we build graceful failure handling. Dunning, retries, and self-serve payment updates protect revenue. Clear emails reduce panic and chargebacks.

10. Cash and cash on delivery for markets where cash remains preferred

Cash still matters, even in digital commerce. And cash on delivery can unlock customers who distrust online payments. It also suits logistics networks that already handle collections.

The operational cost is real. Failed deliveries rise when customers have no upfront commitment. Returns can be higher, and cash handling can invite leakage without controls.

We encourage COD only with strong logistics partners. Real-time order confirmation and delivery tracking reduce risk. Fraud screening still helps, even for COD.

11. Checks and echecks as legacy-friendly online payment methods

Checks persist in certain industries. Professional services, education, and healthcare sometimes require them. Some buyers need familiar paperwork and approval trails.

Paper checks are operationally slow. eChecks can modernize the experience while preserving the “check” mental model. ACH-based eCheck flows also fit invoice payments.

We treat check support as a workflow project. Deposit confirmation, refunds, and reconciliation must be explicit. Otherwise, support teams become the clearinghouse.

12. QR code payments and digital payment links for offline-to-online selling

QR codes and payment links connect physical moments to digital checkout. They work well for pop-ups, events, and invoices. They also suit social commerce and chat-based selling.

In some markets, QR-based rails like Pix, UPI, PromptPay, and QRIS are everyday behavior. For global stores, QR often means a hosted payment link. That is still useful for customer support and recovery flows.

We design QR and links as secure, expiring sessions. Signed URLs, tight scopes, and clear receipts reduce abuse. It also improves the “pay later” experience.

How to choose the right online payment methods for your business

1. Start with customer location and local online payment method expectations

Start with geography because expectations are learned locally. A checkout optimized for the U.S. may fail in Europe. A Southeast Asia-first checkout may feel alien in Canada.

From our discovery workshops, we map target countries to default rails. Then we map rails to providers that can actually settle funds where you operate. That second map is where plans often break.

Local methods also shape support load. If your team cannot answer “where is my payment,” conversion gains can evaporate.

2. Use demographics to align online payment methods with age-group preferences

Demographics change which rails feel normal. Younger customers often prefer wallets. Older customers may prefer cards or bank transfers, depending on region.

We avoid stereotypes by using real session data. Device type, browser autofill patterns, and payment button clicks tell the truth. Surveys help, but behavior wins.

Demographics also influence trust cues. Some groups trust bank login redirects. Others distrust redirects and prefer on-site entry.

3. Match payment methods to your business model: ecommerce, on-demand, SaaS, and professional services

Business model dictates payment timing. Ecommerce needs authorization, capture, and refunds tied to fulfillment. On-demand services need quick confirmation and strong fraud controls.

SaaS and memberships need reliable recurring billing. Professional services need invoicing, partial payments, and paper trails. A single gateway can support all, but configuration differs.

We push teams to define “done” for money movement. Does “paid” mean authorized, captured, or settled. That answer shapes the product.

4. Consider average order value and whether you sell high-ticket items

Higher-ticket carts magnify risk and hesitation. Customers want reassurance and flexible financing. They also need clearer refund expectations.

BNPL and bank transfers can help here. So can wallet options that reduce input errors. For high-ticket catalogs, we also recommend stronger identity checks and manual review tooling.

Lower-ticket carts benefit from speed. Wallets, saved methods, and minimal fields matter more than exotic rails.

5. Decide which methods must support recurring payments and autopay

Recurring billing is unforgiving. A failed card update can churn a loyal customer. A confusing autopay enrollment can create disputes.

We recommend selecting at least one strong recurring rail. Cards are convenient but dispute-prone. Direct debit can be sticky, but mandates add friction at signup.

Autopay also needs customer controls. Self-serve cancellation, pause options, and clear billing reminders reduce anger. Angry customers do not ask for refunds politely.

6. Compare processing fees across cards, wallets, BNPL, and bank payments

Fees affect margin, but they also affect operations. Lower-cost rails can increase support effort. Higher-cost rails can reduce disputes through better UX.

We advise teams to model total cost, not just processing cost. Include fraud tooling, dispute labor, and reconciliation time. Finance and support should co-own that model.

Pricing also varies by region and category. Your real rate is your blended mix, not the headline. That mix is a controllable lever.

7. Plan for disputes and chargebacks based on payment method type

Disputes follow the rail. Card chargebacks have strict evidence expectations. Wallet disputes may flow through the wallet provider first. Bank debits have return rights in some schemes.

We build dispute readiness into the product. Clear descriptors, accurate receipts, and fulfillment proof reduce losses. We also store metadata that support teams can actually find.

Policy clarity matters too. Vague return terms invite friendly fraud. Precise terms reduce “I forgot” claims.

8. Balance fraud prevention with checkout friction and drop-offs

Fraud controls can become a conversion tax. Too little control invites abuse. Too much control scares honest buyers.

Our approach is adaptive. We apply stronger checks only when signals justify them. Device reputation, velocity, and mismatch patterns guide the decision.

We also invest in observability. If fraud spikes after adding a method, we want to know quickly. Slow detection is expensive in payments.

9. Confirm payment provider compatibility with your ecommerce platform and tools

Compatibility can be the silent killer of payment plans. A method may exist in theory but not in your platform’s plugin. It may also break your tax, shipping, or subscription stack.

We validate compatibility early. That includes webhooks, refunds, partial captures, and accounting exports. The last item matters more than teams expect.

We also check operational fit. Can support search transactions easily. Can finance reconcile payouts without custom scripts.

10. Validate the mix with surveys, analytics, and checkout performance data

Validation is iterative. We start with hypotheses, then watch real flows. Checkout analytics show where customers hesitate and where payments fail.

Surveys reveal what customers wish they had. Session replays reveal what they could not figure out. Support tickets reveal what broke in production.

After launch, we run structured experiments. We change button order, copy, and defaults. Small details can shift revenue noticeably.

Implementing online payment methods: security, compliance, and checkout optimization

1. Security fundamentals: encryption, tokenization, and virtual cards

Security starts with minimizing sensitive data exposure. Tokenization helps by replacing card numbers with surrogate tokens. That reduces breach impact and compliance scope.

Encryption should cover data in transit and at rest. We also recommend strict key management and access controls. Payment logs should never become a shadow database of secrets.

Practical engineering habits we enforce

- Prefer hosted fields or wallet buttons when feasible.

- Store tokens, not raw card data, in your systems.

- Audit admin access and rotate secrets regularly.

2. Compliance checklist for online payment methods including PCI DSS readiness

Compliance is easier when architecture is intentional. PCI DSS readiness depends on how you capture and store payment data. Using hosted components can reduce your scope significantly.

We also plan for privacy and data retention. Payment data intersects with identity data. That intersection triggers legal obligations and customer expectations.

Documentation matters as much as code. Incident response plans, access reviews, and vendor due diligence keep audits from derailing roadmaps.

3. Pre-launch testing: transaction flows, cross-device QA, and error handling

Payments fail in creative ways. Pre-launch testing should include successful purchases, failures, cancellations, and edge cases. Refund testing is not optional.

Cross-device QA matters because wallets behave differently by browser and device. Redirect methods also behave differently by bank. We test return URLs, deep links, and session timeouts.

Error handling should be humane. Clear messages reduce duplicate attempts. Duplicate attempts create duplicate charges, and that creates disputes.

4. Mobile-first checkout: wallets, autofill, and one-click payment experiences

Mobile checkout success is about reducing typing. Wallets help, but so does good form design. Autofill-friendly fields and correct input types reduce friction.

We also recommend fast page loads. Payment pages are fragile under latency. Customers abandon quickly when spinners linger.

For saved methods, we enforce strong account security. Convenience without protection invites account takeover fraud.

5. Streamlining checkout: guest checkout, saved payment methods, and trust signals

Streamlining is not only about fewer fields. It is about fewer decisions. A clean default path beats a complex menu of choices.

Guest checkout often improves conversion, especially for first-time buyers. Saved methods help returning buyers. Trust signals like clear policies and recognizable payment icons support both groups.

We also focus on clarity at the moment of confirmation. The customer should know what happens next. Confusion after purchase leads to chargebacks.

6. Operational planning: refunds, reconciliation, and reporting across payment types

Operations is where payment complexity lives. Refunds differ by method. Settlement and payout timing differ by provider. Reporting formats differ across dashboards.

We build unified reporting layers when methods multiply. That includes payout mapping, fee breakdowns, and transaction status normalization. Without normalization, finance cannot close books cleanly.

Support workflows matter too. A refund button without context becomes a blunt instrument. We prefer guided workflows with guardrails.

7. Managing bank-transfer timelines and delayed confirmation payment methods

Delayed confirmation methods require careful product states. Customers may pay, but you may not know immediately. That gap can break “instant access” products.

We solve this with clear pending states and webhook-driven updates. For digital goods, we sometimes offer provisional access with risk controls. For physical goods, we align fulfillment to confirmation rules.

Communication is the real optimization here. Timelines should be explained before the customer pays. Surprises drive support costs.

8. Reducing disputes: clear terms for BNPL, autopay, and subscription billing

Disputes often start as misunderstanding. BNPL adds another party, which can blur responsibility. Autopay can surprise customers who forgot enrollment.

We design with explicit consent. Clear copy, confirmation emails, and self-serve billing history reduce conflict. Subscription cancellation should be easy to find.

We also recommend consistent merchant descriptors. Customers should recognize the charge instantly. Recognition is the cheapest fraud prevention tool.

TechTide Solutions: Custom solutions for online payment methods and flexible checkout experiences

1. Building custom checkout flows tailored to customer needs and payment preferences

We build checkout like we build core product flows. That means user research, instrumentation, and iterative releases. It also means respecting regional norms without fragmenting your codebase.

Our typical approach separates presentation from orchestration. The UI can be localized and adjusted quickly. The orchestration layer enforces consistent state, logging, and reconciliation.

When clients expand internationally, we add methods like iDEAL, Bancontact, and SEPA Direct Debit without rewriting the entire checkout. That modularity prevents “payment sprawl” from slowing delivery.

2. Secure integrations with payment gateways, digital wallets, and BNPL providers

Integrations fail when teams treat them as simple API calls. Real integrations require webhook reliability, replay safety, and strong observability. They also require security reviews and vendor governance.

We implement provider-agnostic abstractions where it makes sense. That enables routing, redundancy, and future migrations. At the same time, we avoid over-abstraction that hides useful provider features.

What we harden by default

- Webhook signature verification and replay protection.

- Idempotent charge creation with robust retry logic.

- Consistent refund and cancellation semantics across methods.

3. Data-driven payments: analytics, monitoring, reporting, and reconciliation built into your product

Payments generate high-signal data. Decline reasons reveal bank behavior. Wallet adoption reveals device mix. Dispute rates reveal policy confusion.

We instrument payment funnels as first-class analytics flows. That includes step timing, method selection, error codes, and provider latency. With that data, we can tune method order and defaults.

Reconciliation is where data becomes money. We build exports and mappings that finance teams can trust. When finance trusts the data, product teams can ship faster.

Conclusion: Building a customer-first mix of online payment methods

1. Prioritize the payment options customers expect, then expand strategically

Customer-first does not mean offering everything. It means offering what feels normal for your buyers. Start with cards and the dominant wallet options for your audience.

Next, add the methods that reduce friction in your target regions. Bank redirects and direct debits can outperform cards in the right markets. BNPL can help when price sensitivity is high.

We prefer a deliberate rollout. Each added method should earn its complexity through measurable impact.

2. Continuously optimize online payment methods using feedback, performance, and fraud signals

Payment optimization is ongoing. The best mix changes as customers shift devices and habits. Fraud also adapts to your defenses.

We recommend treating payments as a monitored system. Watch declines, latency, disputes, and support tickets. Then adjust routing, UX defaults, and risk rules.

Small changes can yield outsized gains. A clearer error message can prevent duplicate attempts. A better descriptor can prevent a dispute.

3. Future-proof your payment stack for new wallets, regional methods, and evolving checkout expectations

Future-proofing is architectural, not predictive. Build modular payment components. Keep orchestration logic separate from UI. Store normalized transaction states for clean reporting.

As new wallets and regional rails emerge, you want fast integration without regressions. That requires automated testing, strong logging, and disciplined abstractions. It also requires a team that respects payments as critical infrastructure.

If we were to ask one guiding question, it would be this. Which payment option would your best customer be annoyed not to see at checkout?