As product engineers at Techtide Solutions, we watch Spain’s app scene through the wider lens of digital spending. Global IT outlays are forecast to reach $5.43 trillion in 2025, which lifts cloud, mobile, and platform budgets that Spanish teams plug into daily. That rising tide matters because it expands cross-border demand while strengthening local hiring, vendor ecosystems, and compliance services that export well across the EU.

Market overview of app development in spain: hubs, demand, and hiring channels

Spain’s digital base is broad and always‑on. Internet usage reached 46.2 million in 2025, which keeps mobile funnels full and pushes companies to harden their app delivery pipelines. We read this as a signal: your growth thesis can treat Spain as both a target market and a nearshore delivery source for multilingual, privacy‑aware software.

1. Spain’s mobile-first momentum makes it a strategic European hub

Spain’s app economy grows inside an EU platform of payments, privacy, and telecom standards, and it does so with consumer habits that favor mobile touchpoints. We see that in how retailers, banks, and travel brands prioritize app journeys over desktop flows. At Techtide Solutions, we also see mobile-first in the briefs themselves. Product owners ask for deep push personalization, offline resilience, and metered telemetry from day one. Those requests sync with what we see in procurement: organizations want native performance and accessible experiences that meet European regulations without slowing releases.

Barcelona hosts Mobile World Congress, which shapes tech roadmaps as much as press cycles. Vendors announce devices, networks, and SDK features that developers can exploit within a quarter. That proximity reduces the time from lab to production in categories like on‑device AI, eSIM identity, and private 5G. It also gives Spanish teams an uncommon advantage: fast feedback from OEMs and an active partner community across carriers and chipset makers.

2. Key talent hotspots: Barcelona, Madrid, Valencia, Las Palmas de Gran Canaria

Barcelona blends design and systems thinking. Madrid leans enterprise and fintech. Valencia brings startup pace with strong university pipelines and emerging AI studios. Las Palmas extends nearshore overlap with the Americas and supports product teams that cover both hemispheres without red‑eye fatigue. We hire in these hubs because each offers a different delivery profile. Designers sourced in Poblenou speak Apple’s Human Interface language fluently; platform engineers recruited in Chamartín know how to land a robust release in a regulated bank. That mix helps us shape squads that match your product’s constraints rather than forcing a one‑size pattern.

Local universities feed the funnel with capstone projects, hackathons, and applied research. When a product needs a knowledge graph, a digital wallet, or a Kotlin Multiplatform core, we can recruit for those specifics. A vibrant meet‑up scene helps too. Guilds in Android, iOS, DevOps, and product analytics enable continuous learning and peer review, which shortens the time to adopt a new build tool, backend framework, or accessibility pattern.

3. Why Spain for app projects: timezone alignment, multilingual teams, and strong cost–performance

Spain sits in a sweet spot for collaboration. Teams cover Europe without friction and overlap with the East Coast long enough to run live triage or design reviews. Multilingual squads shift between Spanish, Catalan, Basque, and English easily, which improves research, support, and app store responses. Cost–performance remains compelling because you can staff senior architects and hands‑on leads without inflating burn. We combine that advantage with transparent sprint rituals, so product owners get predictable velocity and durable codebases rather than only short‑term speed.

Clients care about compliance and operability as much as features. Spain’s exposure to GDPR, PSD2, and public‑sector security baselines like the Esquema Nacional de Seguridad prepares teams to design for audit logs, encryption at rest, and fine‑grained roles early. Those habits travel well to health, public services, and fintech stacks in other countries.

4. In-demand skills for app development in spain: Android, iOS, React Native, Flutter, Swift, Kotlin, Firebase

Hiring signals mirror production realities. Kotlin and Swift sit at the core for native paths. React Native and Flutter power cross‑platform MVPs, companion apps, and internal tools. Firebase accelerates event pipelines, feature flags, and soft‑launch gating when fast learning loops matter. On our benches, we also see Compose and SwiftUI replacing older UI layers, which lets teams ship design‑system updates with far less rework. For observability, we push structured logging and metrics that map to user journeys. That makes crash‑free sessions and time‑to‑first‑action visible to everyone, not just engineers.

Related Posts

- Top 30 Mobile App Development Companies in France to Consider

- Top 30 Outsourcing Software Development Companies in Vietnam: Comparison, Vendors, and How to Choose

- Top 30 Cybersecurity Companies In Vietnam For 2025

- Top 30 custom application development companies in 2025: research-based shortlist and buyer’s guide

- Top 30 App Development in Singapore Companies and Services to Hire in 2025

Modern apps rely on modular architectures. We lean on clean boundaries between domain, data, and UI, backed by dependency injection and contract tests. That sets up safe refactors when a team swaps local storage for offline sync, introduces new payment flows, or moves from a monolith backend to event‑driven services.

5. Choosing between agencies and freelance marketplaces for app development in spain

Agencies shine when you need cross‑disciplinary cohesion: product, design, mobile, backend, SRE, and QA under one roof. Freelance platforms help when you need a niche skill for a defined burst, like migrating an analytics SDK or exporting a Kotlin module to a cross‑platform shell. We advise founders to blend both. Anchor the backbone with a stable core team, then add specialists for sprints that spike risk, such as payments certification or data residency moves.

Procurement patterns matter. Agencies bill by outcomes or retained capacity and absorb delivery risk with battle‑tested rituals. Freelancers give elasticity and keep costs variable. The right choice flows from your roadmap and the blast radius of a missed date. For regulated launches, predictability trumps marginal savings. For a marketing pilot, lean capacity can be perfect.

6. Use review-backed directories to vet vendors and shortlists

We suggest scanning review platforms that enforce buyer verification and portfolio checks. Look for narrative case studies with code screenshots, architecture diagrams, and post‑mortem lessons rather than generic praise. Cross‑reference reference calls with engineers, not only executives, and ask how the team manages rollbacks, hotfixes, and weekend releases. If a vendor’s process cannot explain incident retros or SLA compliance, the risk sits under the surface.

In our own evaluations, we check whether a partner can explain trade‑offs clearly. A solid shop can defend why it chose native on one path and cross‑platform on another and how that choice interacts with accessibility, offline needs, or in‑store flows. Evidence beats slogans.

7. Industry demand spans healthcare, finance, eCommerce, logistics, travel, and education

Healthcare wants secure messaging, home tests, and remote monitoring with clinical-grade auditability. Finance expects instant onboarding, fraud controls, and open banking integrations. Retail pushes loyalty, click‑and‑collect, and last‑mile orchestration. Travel focuses on rebooking flows, vouchers, and shopper UX that respects multi‑currency quirks. Education combines identity, content protection, and live assessments. Spanish vendors deliver across those frontiers because the domestic market contains exemplars in each domain, from global airlines to top‑tier banks and hotel groups.

We map sector patterns into accelerators. Code templates for feature flags, A/B loops, and telemetry let teams start strong and learn quickly. Those playbooks reduce second‑order risk because the organization internalizes the operating model, not just the code.

8. Architecture-first and agile delivery models are widely adopted

Spanish teams tend to ask for architecture upfront. That includes data models, API contracts, and a runway for observability. With foundation in place, agile rituals make sense: a backlog shaped by product outcomes, capped WIP, and demos that verify business value as much as pixel fit. We insist on definition‑of‑done criteria that include tests, performance thresholds, and release notes. That discipline preserves speed while defending maintainability once usage spikes or compliance rules change.

Quick Comparison of app development in spain

Budget owners still ask whether Spain’s mobile market is large enough to justify a dedicated play. The paid channel alone is meaningful, with in‑app advertising spend reaching US$2.16bn in 2025, so demand discovery, creative testing, and post‑install optimization can happen locally before scaling region‑wide.

| Company/Service | Best for | From price | Trial/Free | Key limits |

|---|---|---|---|---|

| Apiumhub | Architecture-heavy native builds | On request | Intro consult | Selective intake |

| Sngular | Enterprise mobile at scale | On request | No | Complex onboarding |

| Plain Concepts | Cloud-native with AI features | On request | No | Prefers long engagements |

| Intelygenz | Data-driven product work | On request | No | Focus on larger teams |

| Hiberus | Omnichannel and public sector | On request | No | Enterprise cadence |

| Opentrends | Government apps and portals | On request | No | Scoped by tender |

| Slashmobility | Mobile-first launches | On request | No | Capacity varies |

| Karumi | Android and iOS specialists | On request | No | Limited parallel streams |

| Yeeply | Marketplace staffing | On request | Profile signup | Quality depends on curation |

| ABAMobile | Industrial and NFC use cases | On request | No | Narrow sector focus |

For a longer bench, here are additional Spain‑based companies and services we shortlist in different scenarios: Lasting Dynamics, Lãberit, Paradigma Digital, VASS, Minsait, NTT Data Spain, GFT Spain, Hiberus (mobile guilds across geographies), Deusto Sistemas, Runroom, Multiplica, Biko, Z1 Digital Studio, Inqbarna, Mobivery, Redradix, Aluxion, Digital55, Opentrends (SEIDOR Opentrends), Yeeply, TechBehemoths directory, Clutch directory, GoodFirms directory, university transfer offices in Barcelona and Madrid, regional accelerators in Valencia and Málaga, and product studios in San Sebastián. We consider mix, governance, and reliability first, then narrow by stack, compliance, and roadmap risk.

Top 30 app development in spain companies and services

Spain’s app-development scene blends deep engineering with design sensibility, and it shows in the outcomes: highly usable products that still meet the hard requirements of security, privacy, and scale. From Barcelona’s product studios and Madrid’s enterprise consultancies to rising hubs in the Canary Islands and Valencia, we see teams pairing cloud-native architectures, mobile CI/CD, and event-driven backends with a UX culture nurtured by Europe’s accessibility and data-protection norms.

As Techtide Solutions, we’ve partnered with startups and multinationals across Iberia, and a consistent pattern emerges: winners operationalize discovery (continuous research, lean experiments), quality gates (automation-first testing, observability), and delivery (trunk-based development, release trains) so they can ship faster without betting the company on every release.

The 30 companies below reflect that spirit. For each, we give a concise overview, any externally verifiable awards, the sorts of services and public proofs we’ve seen, and where they tend to be a great fit. If you’re weighing nearshore options, thinking about a Spain-based build, or plotting a multi-market rollout, this snapshot will help you narrow to the few that match your stage, stack, and stakes.

1. Appinventiv

Appinventiv is a global digital engineering firm with a strong mobility backbone and enterprise product focus. Operating for ~10 years (founded mid‑2010s), it’s headquartered in Noida with delivery centers across APAC, MENA, Europe, and North America. Team size sits in the four-figure range, reflecting its mix of mobile, cloud, data, and AI practices that can staff multi-workstream programs.

Recent recognition includes consecutive Deloitte Technology Fast 50 India listings in 2023 and 2024, covered externally by Business Standard and Deloitte’s own release pages ( Deloitte Fast 50 press coverage; Deloitte program press info).

On services, we’ve seen Appinventiv pair native iOS/Android and Flutter teams with platform squads for cloud, data engineering, and MLOps. Public case studies highlight large consumer brands and marketplaces, including internationally known retailers and QSRs alongside fintech and public-sector deliveries. That blend matters in Spain when a mobile front needs tight SLAs, analytics, and marketing tech that live on EU-compliant cloud.

Best fit in our view: scaleups or enterprise units that need a battle-tested vendor for regulated workloads (payments, health, public), multi-country launches, or a hardening phase for high-traffic consumer apps. Expect structured governance (RACI, RAID), product analytics instrumentation from sprint one, and multi-pod staffing to compress timelines.

2. Apiumhub

Apiumhub is a Barcelona-based software engineering company known for software architecture, clean code, and product development spanning web and mobile. Founded around 2014, it has grown into a mid-sized team that mixes senior architects with delivery engineers. The firm’s footprint is Barcelona-first, with collaborations across Spain and Europe.

We associate Apiumhub with engagements that start from architecture-principled discovery—domain modeling, modularization, and fitness functions—before code generation ramps. Their references and talks often dive into maintainability (testing pyramids, CI discipline, observability) rather than just feature throughput, which tends to produce mobile apps that are easier to evolve and re-platform.

Ideal for scaleups and mid-market enterprises who’ve hit complexity walls: multiple mobile codebases, performance bottlenecks, or a need to codify architecture decisions. If you value measurable code health and long-term velocity more than a one-off launch, you’ll find their style aligned.

3. TechTide Solutions

We are TechTide Solutions, a product-minded software company delivering native and cross-platform mobile, web platforms, and AI-enhanced services across Spain and the EU. We operate as a compact, senior team with a distributed model centered on Spain. A decade-plus of shipping mobile-first products shapes our approach: get discovery right, then automate quality so delivery never stalls.

Our engagements pair mobile squads (Swift/SwiftUI, Kotlin/Compose, Flutter) with backend and data engineers to deliver end-to-end. We’ve led app modernization, greenfield MVPs, and revenue-critical platform rewrites where app performance, offline-first reliability, and telemetry matter more than vanity metrics. Public-facing wins include consumer subscription apps, B2B field apps, and event-driven loyalty experiences where we owned the roadmap and the runbook.

We’re an ideal fit for founders chasing product-market fit with disciplined experimentation, or for established brands that need a dependable mobile partner to ship on a cadence—security reviews, app-store compliance, analytics governance, the works. We favor transparent pricing, small pods, and shared dashboards over black-box delivery.

4. Lasting Dynamics

Lasting Dynamics runs a group model with its headquarters in Las Palmas de Gran Canaria and additional locations in Italy and Norway. Active for ~10 years, it has a boutique-to-mid-sized engineering staff that combines custom software development with a strong testing culture and, increasingly, data/AI features embedded into mobile experiences.

We’ve seen their teams lean into native and cross-platform app builds tied to robust QA (manual plus automated) and a productized delivery cadence. For companies in Spain, Canary-Islands time zone alignment plus multilingual support can be a practical advantage on larger engagements with European stakeholders.

Good fit for organizations that want a long-term product partner, not just a project vendor—particularly those planning iterative releases, analytics-informed roadmaps, and a playbook for scaling a v1 mobile app to thousands of concurrent users without spiraling cloud costs.

5. Dribba

Dribba is a Barcelona studio specialized in mobile app development—native iOS/Android and Flutter—backed by a lean engineering team that emphasizes communication and delivery agility. Operating for more than a decade, they keep a clear Catalonia footprint with international projects sprinkled in.

Public write-ups on their site include mobile apps for labor unions, valuation firms, and UK sports-booking startups, suggesting comfort with transactional flows, location-based features, and refactors of inherited code. In our experience, shops like Dribba do well when asked to turn around a performant MVP and then harden it against real-world usage.

We’d recommend them to founders and product leaders who prefer a close-knit team, short feedback cycles, and a collaborative stance on UI polish. If your risk is time-to-first-release rather than organizational politics, this kind of specialist partner pays off.

6. FuGenX

FuGenX is a seasoned mobile and software company with origins in India and a global delivery model spanning the US, UAE, and Europe. Founded in 2008, it has grown to a few hundred employees with a long track record of enterprise and consumer app deliveries. While not Spain-native, we see them engaged in Spain via nearshore/remote structures.

Historical awards include ranking in the Deloitte Technology Fast 50 India list, referenced in third-party coverage ( Deloitte Fast 50 India 2016 listing coverage).

Service-wise, FuGenX spans native/hybrid apps, gaming, IoT, and AR/VR. Their published case mix includes retail, energy, and education—useful signals for Spain’s consumer brands and utilities exploring mobile-first field ops. We’ve found global veterans like FuGenX to be effective when the need is cost-predictable delivery across multiple SKUs.

Best fit: companies that want a broad tech menu (apps plus web plus integrations) with predictable staffing at scale—especially if you’re balancing cost, speed, and a backlog with varied skill requirements.

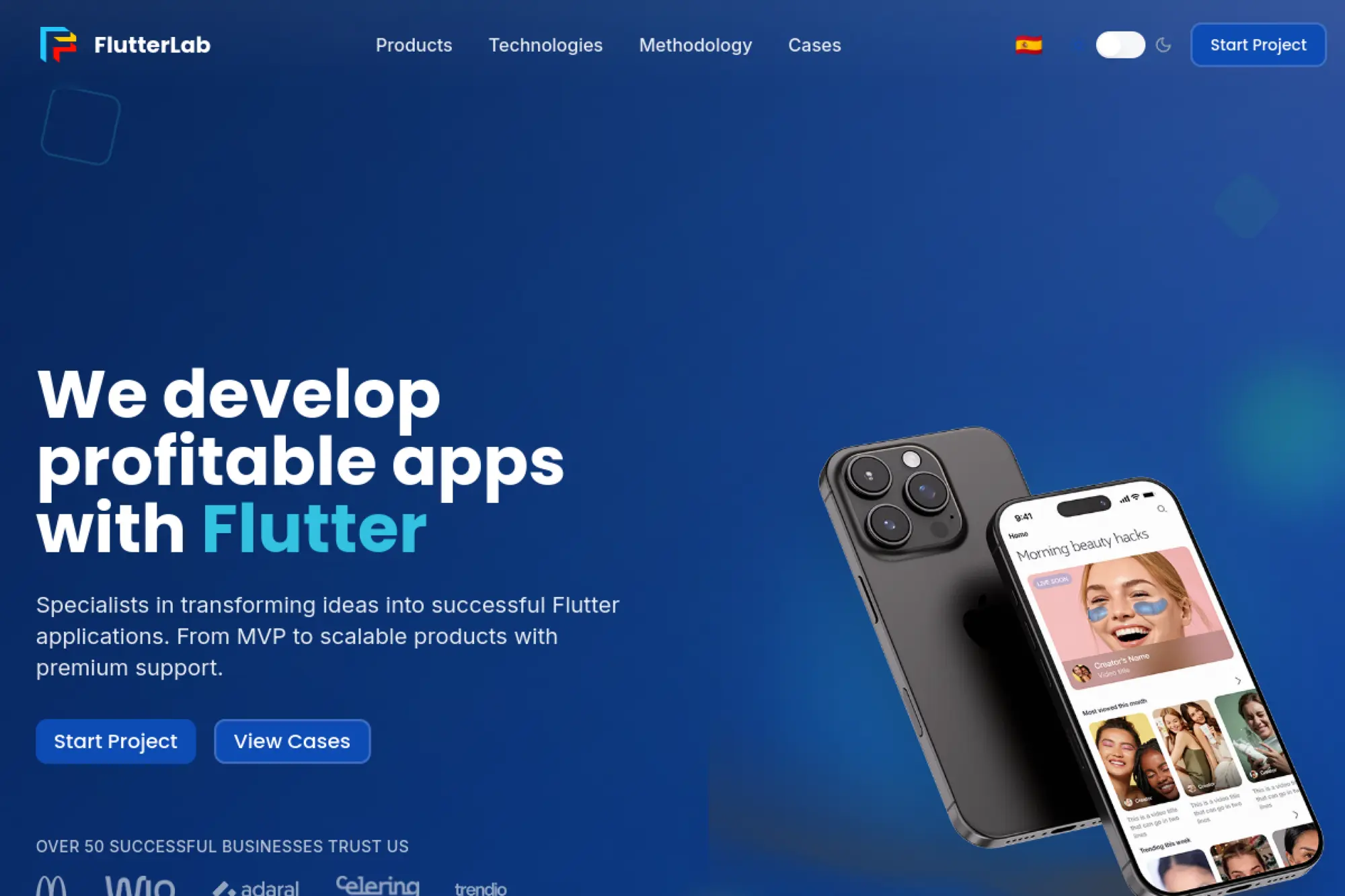

7. FlutterLab

FlutterLab is a Valencia-based boutique focused on Flutter, FlutterFlow, and Dart backends for multi-platform apps. Founded in the early 2020s, the team is compact and senior-leaning, aiming squarely at startup velocity and shared codebases that reduce maintenance for iOS, Android, and web.

From the public footprint, their portfolio includes MVP acceleration, migration from hybrid stacks to Flutter, and coaching on code quality. In Spanish projects, we’ve seen Flutter-first designs shine for content-heavy apps and operational tools where consistent UX and single-team ownership carry the day.

Ideal for founders who want to “ship one stack” and keep headcount lean, or product teams refactoring from older cross-platform toolkits. If you’re sprinting to 4YFN or need a demoable app for fundraising, this specialization makes a difference.

8. DIGIZONELabs S.L.

DIGIZONELabs is a Spain-based studio with offices in Barcelona and Cartagena, covering mobile apps (React Native), web apps, AI solutions, and UX/UI. It operates as a small, full-cycle team with an emphasis on custom builds and close collaboration across discovery, delivery, and maintenance.

We associate DIGIZONELabs with pragmatic implementations—streamlined flows, sensible cloud choices, and a cadence that prioritizes business outcomes over shiny tech. For organizations needing an app plus the operating model to maintain it, this is a valuable combination.

Ideal for SMEs and funded startups that want a Spanish partner for a first build, with hands-on product guidance and the ability to extend into AI agents and automation when usage grows.

9. Whale Tech Solutions

Whale Tech Solutions builds mobile and web apps with a focus on process automation, MVPs, and multi-city service in Spain (Valencia, Alicante, Orihuela, and beyond). It’s a boutique shop with a modern stack stance and a delivery playbook tailored to time-to-market and lean budgets.

Public narratives emphasize launching MVPs in weeks and scaling into production-grade systems with transparent cost/time baselines. In Spain, we’ve seen this approach work well for logistics, services marketplaces, and SMEs digitizing back-office processes via mobile.

Best for owners and product leads who want a strategic MVP, clarity on costs, and a team comfortable pivoting from prototype to durable app—without throwing away the initial code.

10. Apps Design

Apps Design (App Design) is a Spain-based agency offering native and cross-platform app development alongside web, eCommerce, and marketing capabilities. With 15+ years claimed experience and hundreds of projects, it operates as a mid-sized team serving startups, SMEs, and larger brands that want a one-stop shop.

We’ve seen shops like this succeed when mobile needs a tightly coupled web and CMS layer—think transactional flows, content ops, and SEO/ASO alignment. Their technology catalog spans React Native, Flutter, Swift/Kotlin, and common web frameworks, suitable for typical Spanish digital stacks.

Ideal for buyers who prefer consolidating app and web under one vendor, or those who need an MVP with immediate eCommerce or content integrations and measurable acquisition levers from launch.

11. Appcinking

Appcinking is a Spanish developer with a presence in Barcelona and Madrid, focused on native and hybrid mobile apps plus web design for a wide range of local businesses. Operating for more than a decade, team size appears small-to-mid range, with steady experience across commercial sites and apps.

Public traces include consumer-facing mobile applications and a variety of web builds, suggesting a versatile bench for SMEs. In our experience, teams like Appcinking handle cost-sensitive work efficiently, particularly where performance and SEO basics intersect with simple app features.

Best fit: small businesses and regional brands seeking a fair, local partner for practical mobile builds; also useful as a dedicated team for incremental enhancements to an existing app.

12. VMAD

VMAD (Value Mind Applications and Devices) is a Spain-centered software company focused on custom mobile apps, enterprise software, and AI-enablement with a training component around iOS/Swift. The team is compact and hands-on, operating across Spain with a startuplike bias toward velocity and iteration.

Published materials show emphasis on scalable mobile architectures, app performance tuning, and developer education—helpful for organizations that want a partner to build and upskill simultaneously. That dual track can pay off when internal teams will inherit the app.

Good fit for product owners who value ownership transfer: clean repos, clear documentation, and knowledge-sharing so the internal team can run the roadmap after launch.

13. Goo Apps

Goo Apps is a specialist Spanish agency with offices in Barcelona, Madrid, and Gijón, focused on mobile apps for health, sport, and well-being, plus corporate apps. Operating for several years with a mid-sized team, Goo leans into regulated mobile UX, device integrations, and evidence-led product decisions.

We’ve noticed its recurring footprint at industry gatherings (e.g., MWC/4YFN) and an emphasis on verticalization—GooMedical—suggesting domain expertise that reduces time-to-compliance and accelerates integrations with medical devices or fitness tooling. That’s meaningful in Spain’s health-tech ecosystem.

Ideal for health and fitness innovators needing app builds that pass medical-grade scrutiny, or enterprises that need corporate mobile UX refined for adoption and accessibility from day one.

14. Apps Barcelona

Apps Barcelona is a Barcelona/Sabadell-based developer focused on native and hybrid app builds plus supporting web work. Operating for years as a compact team, it serves local institutions and businesses with productized app delivery and publication support to the major stores.

Public examples include a destination app for a parcel/logistics brand with geolocation, rate calculators, and push notifications, alongside publication and ASO support. We’ve seen this sort of team work best when the brief is practical and the integration surface is limited.

Fit for SMEs and municipalities that need a straightforward mobile presence, quick time-to-store, and basic analytics—projects where value comes from dependable execution rather than sophisticated R&D.

15. We Are Crudo

We Are Crudo is a Spanish digital product studio spanning branding, UX/UI, and software development, with a punchy product voice and clear delivery ethos. It operates as a small-to-mid team and works across Spain, including with well-known organizations and startups.

Public client mentions include global pharma, provincial government bodies, and early-stage tech startups—signals of versatility across mobile, web, and data-backed product decisions. That cross-functional mix can simplify stakeholder management in complex app programs.

Best for leaders who want a “design plus code” partner with pricing clarity and measurable outcomes—especially when brand expression and mobile usability are primary levers for growth.

16. Techpanda

Techpanda operates as a mobile/web provider with a presence in the Canary Islands and UK-facing references, delivering native and cross-platform apps alongside web technologies. It appears to function with a small, flexible bench capable of typical SME and scaleup needs.

We’ve seen these hybrid-location teams thrive on bread-and-butter mobile builds—commerce, booking, line-of-business apps—especially when budgets are tight and the product scope is crisp. Spanish clients often value the combination of local responsiveness and global time-zone coverage.

Ideal for small businesses and growth-stage founders who want pragmatic mobile delivery with access to broader web capabilities and modern frontend stacks.

17. Indicus Software

Indicus Software is a Madrid-based consultancy and developer focused on custom software, mobile apps, and systems integration for SMEs and mid-market firms. The company has been active well over five years, with a compact team and headquarters in Rivas Vaciamadrid.

Public stories mention mobile and web systems for repair tracking, ERP/CRM integration (e.g., Dynamics 365), and document-heavy workflows—patterns we see frequently in Spain’s industrial and services sectors going mobile. Their tone is consultative: scope precisely, then build.

Suited to operationally intensive businesses seeking mobile apps that plug into existing ERPs and handle the paper-to-digital transition. If you need a Spanish partner that can live in your processes and speak in business outcomes, they’re a match.

18. Planet Media

Planet Media is a Madrid-centered digital player combining mobile development, web, and digital marketing. With decades of operation under the broader Planet Media banner, its headcount ranges from mid-sized to large depending on service line, and projects cut across consumer and enterprise categories.

We associate Planet with full-funnel thinking—apps designed in parallel with growth levers (SEO/ASO, CRM, paid) and data loops that feed product iteration. That’s useful when an app’s success leans as much on distribution as it does on features.

Works well for established brands that want a mobile product within a cohesive digital strategy, as well as for organizations consolidating vendors to manage app build, marketing activation, and analytics under a single roof.

19. BeMobile

BeMobile is a Spanish digital product and growth company, now part of Linkroad, with capabilities spanning strategy, mobile development (native and hybrid), and performance marketing. Operating for more than a decade, it keeps a mid-sized multidisciplinary team.

Its public showcase references national champions across logistics, banking, automotive, media, and pharma—useful when your mobile app must coordinate with brand, comms, and CRM machinery. We’ve seen such teams excel at turning sporadic app usage into habit.

Best for enterprises and scaleups that want both the app and the operating engine for growth—activation, retention, and cross-channel orchestration. If you’re chasing outcomes rather than outputs, that alignment pays off.

20. Glue Digital

Glue Digital is a user-centered product agency with offices in Vigo, Madrid, and further European outposts. Years in market: well over five; team size: boutique but multi-disciplinary. Its project list spans mHealth frameworks, industry tools, and consumer activations, reflecting equal comfort in B2B and B2C mobile.

Public references include KFC mobile initiatives, advertising-tech platforms, and healthcare tooling—signals that mobile UX is paired with robust backend and data layers. That balance is practical for Spain’s regulated industries and franchise models.

Fit for product owners who want a design-forward partner that still ships robust code and handles the non-glamorous realities of scale—role-based access, offline modes, and observability baked into the app from the start.

21. Quadram

Quadram is a Madrid-based mobile specialist delivering native iOS/Android, React Native, backend, and design systems. Operating for more than a decade, they’ve evolved from app builders to product partners who can own the lifecycle—from discovery to publishing to analytics.

Public highlights note first-in-market e-commerce plays, insurance utilities, health information systems, and safety R&D—useful breadth when your Spanish app must line up with legacy systems and consumer-grade polish. Their “no office is the new office” stance dovetails with distributed clients.

Best for teams seeking a dependable app factory that still sweats UX and release hygiene. If you need a partner that can build apps and a design system to keep them coherent, Quadram’s a strong contender.

22. SetUp Media

SetUp Media is a Barcelona-based consultancy and digital builder covering strategy, app and web development, and marketing. Operating for a decade-plus, team size is boutique-to-mid with experience in educational platforms, consumer apps, and ASO/SEO activation.

Public cases include collaboration with a national foundation’s educational program (device, content, and parental controls stack) and nightlife social apps—indicating familiarity with child safety requirements and consumer virality mechanics. For Spain’s public and private sectors alike, that duality has value.

Ideal for organizations wanting a single partner for product definition, mobile build, and growth activation—particularly where content ops and app-store visibility are as critical as the code.

23. Binaria

Binaria is a Barcelona digital agency focused on product design and advanced web/app development. With years in operation and a small-to-mid team, they emphasize people-centered design, web apps with app-like UX, and scalable codebases that play well with modern backends.

Public work includes collaboration with global consumer brands and social platforms for athletes, showing the ability to translate brand identity into performant, discoverable digital products. When a mobile web approach suffices, they push far with PWAs and responsive app UX.

Best fit for product leaders who want strong UX governance and a roadmap to evolve from mobile web to native only if/when the ROI is clear. If your needs are cross-platform with limited device APIs, Binaria’s approach keeps options open.

24. xatcom

xatcom is a Valencia-area digital agency with a specialty in tourism apps: native iOS/Android guides, offline navigation, proximity alerts, and content-driven experiences. Years in operation exceed a decade, and the team sits in the boutique range, pairing design with a solid engineering pattern.

Its destination guide for Xàtiva won a national category at FITUR’s AppTourism Awards, organized by SEGITTUR in collaboration with FITUR, as detailed by the organizers ( AppTourism Awards winners (SEGITTUR)).

On service scope, xatcom’s apps combine GPS guidance, offline content sync, QR interactions, and accessibility considerations—key in Spain’s cultural tourism. If your economic impact depends on wayfinding and storytelling, this specialization matters.

Best for city councils, DMOs, museums, and hospitality groups seeking a polished, low-friction mobile companion that functions well with spotty connectivity and diverse visitors.

25. Cloud Group

Cloud Group is an Alicante-based development company focused on mobile enterprise apps, custom web applications, and integrations. Operating for several years with a compact team, it targets productivity, workflow optimization, and secure data access on mobile.

We’ve seen Cloud Group’s materials emphasize integration with corporate systems (ERP/CRM), security controls (identity, access), and multi-platform delivery—bread-and-butter needs for Spanish SMEs modernizing operations via mobile endpoints.

Fit for leaders who want business apps that “just work”: role-aware, device-adaptive, and mindful of data residency. If your ROI comes from minutes saved in the field, not from consumer marketing, this orientation is spot on.

26. AlamedaDev

AlamedaDev is a Barcelona-based engineering studio delivering AI-first software, mobile apps, and web platforms. It operates as a senior-heavy boutique with projects spanning hospitality, fintech-like platforms, and operational tooling—often with applied AI (LLMs, RAG, multimodal) under the hood.

Public project write-ups include mobile/web platforms for hospitality ticketing and loyalty, knowledge-automation tools, and field-support assistants—signals that they’re comfortable weaving app UX with AI pipelines and scalable cloud architectures.

Ideal for product teams looking to infuse mobile apps with AI-native workflows (personalization, summarization, retrieval) and needing a partner that treats model selection, telemetry, and guardrails as first-class design decisions.

27. Vanadis

Vanadis is a Madrid-headquartered consultancy and one of Spain’s pioneers in mobile app development (mid‑2000s origin). In 2021 it integrated with Baufest, expanding its geographic and service reach while keeping a focus on native apps, gamification, and enterprise mobile solutions. Team size has historically been mid-sized, scaling with Baufest’s network.

We’ve seen Vanadis’ public history include national recognition for mobile development and government innovation support, and its integration into Baufest is documented externally. That combination—pioneer status plus a larger international backbone—can be valuable for complex Spanish programs.

Best for enterprises and public entities seeking a long-term partner with Spanish roots, strong app delivery history, and access to broader consulting capacity. If you want a mature delivery muscle with Spain-specific experience, shortlist them.

28. 4andGo

4andGo is a Madrid developer active for more than a decade, with a small team that focuses on mobile apps and supporting web work. Its model is straightforward: pragmatic builds, clear pricing, and iterative releases tailored to SME needs.

We rate teams like this for operational apps where a clean backlog and solid delivery hygiene beat exotic tech. If your app scope is focused—a booking flow, an internal tool, a location-centric customer app—velocity and predictability matter more than fancy architectures.

Good fit for budget-conscious businesses seeking dependable native or hybrid apps without the overhead of large-agency process, particularly when the mobile surface area is well understood.

29. Mobile Dreams

Mobile Dreams (often known as Mobile Dreams Factory) is a Spanish agency with deep roots in mobile creativity and engineering for brands and platforms. Active for well over a decade and mid-sized, it has worked with major Spanish advertisers on award-winning mobile activations.

Among external recognitions, its geolocation-based “Which colour is Madrid?” activation for Mahou won a Smarties Award from the Mobile Marketing Association, as covered by Mahou’s newsroom ( Smarties recognition coverage).

Mobile Dreams is best when you need the “big idea” and the execution—app builds that hook into campaigns, loyalty mechanics, and real-time data to create measurable brand outcomes. In Spain’s advertising ecosystem, that track record still counts.

Ideal for marketing-led app initiatives, festival/event experiences, and brand utilities where creative, engineering, and analytics must cohere—and do so under campaign deadlines.

30. NexTret

NexTret is a Barcelona- and Madrid-based IT partner with 30+ years in the market and hundreds of engineers across cloud, data/AI, security, and application development. While broader than mobile only, its application development practice is relevant for enterprises that need governance-heavy delivery and Spanish nationwide coverage.

Public references include modernizing data platforms and user-experience monitoring for high-profile apps—useful when your mobile initiative depends on platform reliability, security posture, and integration with enterprise tooling (ITSM, SSO, observability stacks).

Best for enterprise buyers, especially those who want an application team seated next to infrastructure, security, and data capabilities. If your organization values managed services and lifecycle stewardship as much as code, NexTret fits the bill.

Curious which three from this list best match your scope, budget, and timeline? Share your stage (MVP, scale-up, enterprise modernization), tech stack, and target users, and we’ll suggest a short list—and a practical starting sprint—to get your app moving.

Pricing, budgets, and engagement models for app development in spain

Budget confidence rises with ecosystem maturity. Spain’s startup landscape has doubled in valuation since early in the decade, with total startup value crossing €110 billion, which signals a deepening pool of builders, operators, and reviewers who ground estimates in shipped work rather than pitch decks.

1. Hourly or milestone-based billing options are widely available

We see three dominant patterns. First, time‑and‑materials with a cap when scope is fuzzy but speed matters. Second, fixed fee by milestone when scope is stable and risks are known. Third, retained squads when you want steady throughput and evolving scope under product direction. We default to retained squads for core development and layer fixed milestones for integrations, audits, and compliance gates. That hybrid keeps runway predictable while protecting dates on critical paths.

2. Visible rate bands in Spain: under $25/hr, $25–$49/hr, $50–$99/hr, and higher tiers

Directories publish rate bands to guide early filtering. In practice, delivered cost depends on seniority mix, release automation, and rework avoided by good architecture. We recommend comparing end‑to‑end economics rather than raw hourly figures. A seasoned architect who prevents a brittle navigation layer can save many cycles later compared with a cheaper rate today.

3. Directories often show project minimums starting from $5,000+ to $25,000+ for complex scopes

Minimums reflect context switching, onboarding investments, and the overhead of proper quality assurance. We coach founders to size the first slice carefully. A functional prototype with a reliable core beats broad but shallow features. That choice limits waste and sets up a clean runway to grow toward payments, growth loops, and integrations later.

4. Marketplace hiring flow: post a job, shortlist talent, interview, hire

Marketplaces work best when you write a crystal‑clear brief. Include platform targets, device constraints, analytics needs, success metrics, and security expectations. Shortlist talent by portfolio depth rather than keyword matching. In interviews, ask for a recent incident and how the engineer handled it. Practical stories reveal more than generic enthusiasm.

5. Secure payments and escrow protect work and approvals

Escrow reduces risk in transactional engagements. Tie releases to demoable increments and acceptance criteria that map to user journeys. We like checklists that include UX, accessibility, performance, and logging. When a feature fails any of those standards, the acceptance gate blocks release until it is fixed, which preserves quality without arguments later.

6. Dedicated teams and team extension models support long-term roadmaps

Dedicated teams align with roadmaps where market learning guides scope. Team extension suits cases where you already have a strong core and need specific skills, like low‑level camera control or compliance hardening. For either model, preserve a single backlog and a single product owner to avoid priority ping‑pong. Shared rituals anchor culture and keep coordination costs low.

7. Maintenance and optimization retain app quality post‑launch

Post‑launch work matters as much as the build. Security patches, SDK updates, and OS migrations never stop. We plan a recurring maintenance lane that covers dependencies, crash analytics, and performance budgets, and we track feature health against activation and retention cohorts. That prevents slide into entropy while keeping room for experiments.

Services and tech stacks shaping Spain’s app development market

Network foundations shape app possibilities. Across Europe, 5G represented 30% at the end of 2024, which unlocks richer video, tighter edge loops, and better reliability for real‑time features. Spanish vendors design to those performance envelopes with graceful fallbacks for mixed coverage in rural zones.

1. iOS app development (Swift) for performance and native UX

We advocate native iOS when your product needs on‑device intelligence, media processing, or polished motion. SwiftUI accelerates the design‑system handshake, while Combine or async patterns simplify state. For large teams, we define module boundaries early and enforce shared lint rules. That keeps new contributors from introducing fragile code in core flows.

2. Android app development (Kotlin) with scalable architectures

Android’s ecosystem demands deep device testing and observability. We build with Kotlin, coroutines, and Jetpack libraries for clear state management. Compose helps unify UI decisions and reduces boilerplate for theming and accessibility. We calibrate build times, isolate flaky tests, and set up hermetic environments for reliable CI. Those moves defend cadence when the codebase grows.

3. Cross-platform app development with Flutter

Flutter shines for pixel‑perfect interfaces that target both platforms without heavy native hooks. It compresses time to market for marketing‑driven products and back‑office tools. We keep platform channels thin, document any native bridge, and budget for design tokens that sync across web and mobile. That discipline lowers divergence risk as brand systems evolve.

4. Cross-platform app development with React Native

React Native fits teams with existing React expertise and web‑to‑mobile design systems. We reduce runtime surprises by limiting deep native extensions, upgrading dependencies promptly, and testing critical flows on low‑end devices. For growth loops, we wire deep links, universal links, and campaign analytics from the outset, so data stays trustworthy.

5. Wearable app development and device integrations

Wearables reward clarity. Surface only the interactions that benefit from glanceable context or quick input. Keep sync logic resilient and battery friendly. Health and fitness features need strong privacy patterns and risk reviews. Spanish health systems value auditability, which we support through event streams that separate personally identifiable data from behavioral telemetry.

6. Progressive Web Apps and web applications to complement mobile

PWAs extend reach and reduce friction in discovery. For marketplaces and media, they provide a low‑cost channel for testing features before rolling into native. We standardize performance budgets and prefetch strategies. If you need offline catalogs or kiosk flows, we design cache rules that minimize staleness without starving bandwidth elsewhere.

7. Backend and cloud stacks: Go, ElasticSearch, Google Cloud Platform, AWS

Modern apps ride on resilient services. We favor typed APIs, explicit contracts, and scalable storage for audit logs and events. Go works well for constrained, high‑throughput services. ElasticSearch helps with search and observability. We deploy on cloud platforms with managed secrets, regional failover, and blue‑green releases. The Spanish market demands data residency options, which we implement with regional buckets and clear data‑processing agreements.

8. QA automation and DevOps embedded in delivery

Automation is insurance. We aim for layered tests: unit, contract, and UI. Flaky tests get quarantined fast. Feature flags and staged rollouts reduce risk, and canary feedback drives confident releases. DevOps pipelines enforce quality gates, and dashboards display crash‑free sessions and performance against agreed budgets. Those habits keep teams shipping calmly.

9. AI, IoT, Blockchain, and AR/VR capabilities for modern use cases

On‑device models now power transcription, personalization, and moderation without round‑trips. IoT demands robust provisioning and secure updates. Blockchain shows up in credentialing, verifiable tickets, and supply chain proofs. AR unlocks try‑before‑you‑buy and guided maintenance, especially in retail and industrial settings. We tie these to measurable outcomes rather than novelty, so investment tracks value.

10. UI/UX design and ASO to drive adoption and retention

Design systems reduce friction across platforms. We test accessibility early and often, using screen readers, contrast checks, and motion settings. ASO work aligns metadata, creative, and performance with audience intent. Post‑install loops matter more. We instrument activation, habit formation, and referral mechanics so growth becomes structural, not episodic.

How to choose the right partner for app development in spain

Device cycles may drive near‑term roadmaps. Analysts expect phone shipments to grow, with features that embed on‑device intelligence rising, and a meaningful share including generative capabilities, as predicted by Deloitte with growth of 7% in 2025. Choose partners who treat these capabilities as accelerants, not crutches, and who can quantify gains without bloating complexity.

1. Evaluate case studies and real-world portfolios

Ask for code excerpts, not only gloss. Seek architecture diagrams, threat models, and rollout plans. Strong teams describe trade‑offs clearly and show how telemetry informed a pivot. When a case study includes post‑mortems, learn how the team handled failures. That humility often predicts future success.

2. Ensure tech stack alignment with your product needs

Do not chase logos. Start with user value and constraints. For media‑heavy apps, prioritize native performance and offline caching. For internal tools, prioritize velocity and operability. If you expect frequent experiments, choose stacks with shallow learning curves and mature testing tools. Your partner should explain why the stack suits your roadmap and how you can staff it sustainably.

3. Prioritize scalable architecture and code quality from day one

Architecture debt compounds silently. We insist on modular boundaries, idiomatic patterns, and dependency hygiene. That makes future platform migrations far less painful. You also gain confidence that a new team member can become productive quickly without breaking core flows.

4. Favor agile communication and predictable sprint cadence

Cadence builds trust. Short sprints, clear demos, and honest retros cut surprises. As product owners, you should see burn‑up charts, error budgets, and definition‑of‑done checklists. Those artifacts create shared understanding and enable data‑driven changes when priorities shift.

5. Require post-launch support, optimization, and roadmap ownership

Support is not an afterthought. Insist on playbooks for incident response, maintenance windows, and dependency upgrades. Your partner should own a shared roadmap that includes performance budgets and A/B test backlogs. When teams plan those rhythms, they ship faster and sleep better.

6. Use research-backed matrices and directories to validate shortlists

Shortlists benefit from independent validation. Review sites and buyer guides help, but weigh qualitative depth over badge count. Cross‑reference client references against shipped releases on the stores. If claims do not match public artifacts, keep looking.

7. Follow a clear process: post, hire, collaborate, pay

Process clarity protects momentum. Write precise briefs. Run structured interviews with coding conversations and scenario problems. Align on rituals and tools. Use escrow or milestone payments if the engagement is transactional. For longer relationships, retain a core squad and govern with outcomes, not output.

How TechTide Solutions helps you build custom solutions

We treat mobile as your growth engine, not a vanity channel. Our architecture‑first method aligns with leaders reshaping workflows to capture AI and automation gains, an opportunity McKinsey sizes at $4.4 trillion. That context guides our backlog, our telemetry, and our bias toward features that move the needle.

1. Discovery and solution architecture tailored to your business goals

We begin with discovery. Researchers surface user jobs and constraints. Architects translate those into domain models, API contracts, and observability. Designers codify a design system aligned to brand and accessibility. Product managers write outcome‑based roadmaps that balance learning and delivery. You get a blueprint that teams can execute and evolve.

2. Agile delivery across web and mobile with transparent sprints

We run sprints with clean rituals and visible metrics. Demos showcase features and telemetry. Retros drive improvements. CI/CD pipelines protect quality and allow safe, frequent releases. When priorities shift, we replan with impact estimates, not hand‑waving. That predictability lets you coordinate marketing, sales, and support without last‑minute chaos.

3. Post-launch support, scaling, and team extension to fit evolving needs

After launch, we stay. Maintenance windows keep dependencies healthy. Observability flags regressions early. As adoption grows, we add capacity, harden infra, and optimize costs. If you need to build an internal guild, we help hire, onboard, and document so the capability lives inside your company, not only inside ours.

Conclusion: key takeaways for app development in spain

1. Spain offers deep talent, mature processes, and modern stacks for ambitious apps

Spain combines creative product cultures with disciplined engineering. That mix is ideal for companies that want delightful experiences on top of robust, observable systems. Regional variety across hubs lets you tailor squads for scope, sector, and speed.

2. Align budget, tech, and engagement model to your scope and timeline

Strategy should drive structure. Decide where you must be native, where cross‑platform suffices, and where web complements the experience. Then fit the hiring model, cadence, and governance to those choices. Your partner should make trade‑offs explicit and reversible when new information arrives.

3. Start lean, iterate quickly, and leverage Spain’s hubs for long-term success

Start with a crisp slice that proves value, then iterate with telemetry. Use Spain’s talent hubs to compose squads that balance design, engineering, and operations. If you want a sounding board, we are ready to review your scope, challenge assumptions, and shape a delivery plan that matches your goals. Shall we explore your first release cut together?